Investors often get excited when they learn that a private company they’re following is planning an initial public offering, and last year’s IPO momentum carried over into 2021. Nasdaq saw 91 IPOs in January alone, and more than two-thirds were special-purpose acquisition companies (SPACs), one of Wall Street’s hottest trends.

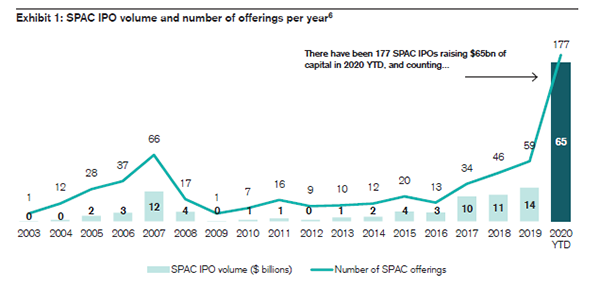

What exactly is a SPAC — and how does it work? A SPAC is set up with no commercial operations of its own; it is formed only to raise capital for the purpose of acquiring an existing private company. SPACs have been around for decades, as seen in the chart below, but they have recently gained popularity as a medium for smaller, private companies to go public. Examples of companies recently going through a SPAC merger are DraftKings, Virgin Galactic, Opendoor and Nikola, to name a few.

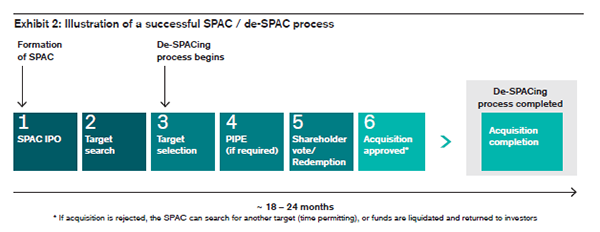

SPACs make no products and do not sell anything. The only asset a SPAC has is the money it raises through an IPO. Institutional investors (or very wealthy investors) typically create SPACs, which often are referred to as “blank check companies” because when they raise money, investors do not know what the eventual acquisition target will be. By design, SPACs have a specific period of time — normally two years — to identify a suitable company to acquire.

SPACs are not allowed to prescreen investments or sign letters of intent prior to going public or raising monies. The money raised in the IPO is placed in an interest-bearing trust account, and funds cannot be dispersed except to complete an acquisition or to be returned to investors if the SPAC is liquidated because it could not close a deal quickly enough.

If a company agrees to be acquired by a SPAC, it will forgo the IPO process during the two-year open period. Investors, therefore, receive immediate liquidity and equity exposure via the SPAC. Assuming SPAC shareholders approve the merger, the SPAC’s name changes to the name of the acquired company when the purchase is complete.

What can go wrong with investing in a SPAC? Not every SPAC completes all the phases in the chart above within the two-year window. Target companies run the risk of having their acquisition rejected by SPAC shareholders. SPAC investors are putting money blindly into an investment vehicle, not knowing what company may be acquired with their investment. The due diligence process of the SPAC is not as thorough as that of the IPO process, and therefore, can be riskier.

There are no guarantees that SPAC returns will not fall short of the average post-market return. Most SPAC investors are not buying at the SPAC’s IPO price, usually $10 per share. Instead, they often buy shares on the open market, with a considerable premium added. If the SPAC is unable to close a merger, it returns $10 per share to the investor, possibly far less than what the investor paid.

So, what can we learn from all this? SPACs can be a good investment vehicle. However, investors need to understand the risks involved and the hidden danger of paying a premium price while not knowing what company they may end up acquiring. Investors should invest only as much as they are willing to lose, and if one does invest, it should be part of a well-diversified portfolio.

From an investment perspective, we use the above insights to help with the strategic and tactical asset allocation based on where we see the portfolio heading over the next five to seven years, with short-term adjustments along the way. We are not trying to time the market, but we will try to take advantage when we see where the market is heading. Having a well-balanced, diversified, liquid portfolio and a financial plan are keys to successful investing. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, Wealthmanagement.com, Credit Suisse

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The Dow Jones Industrial Average is a popular indicator of the stock market based on the average closing prices of 30 active U.S. stocks representative of the overall economy.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It is not possible to invest directly in an index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.