It has been a year since a historic health crisis swept the world, and we remain truly thankful for the healthcare professionals who have continually risked their lives to care for the rest of us. We also mourn the more than 500,000 lives lost in the U.S. — and the 2.75 million deaths worldwide.

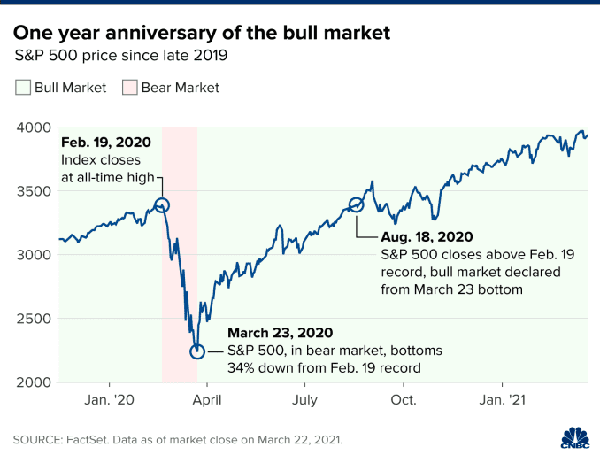

While we are glad to be on the path toward reopening venues and working toward a sense of normalcy, we also are aware that this week marks the anniversary of the S&P 500 reaching its bottom. On March 23, 2020, it had experienced a 30% decline in only 22 days, the biggest decline on record in such a short period of time.

Among our investment takeaways:

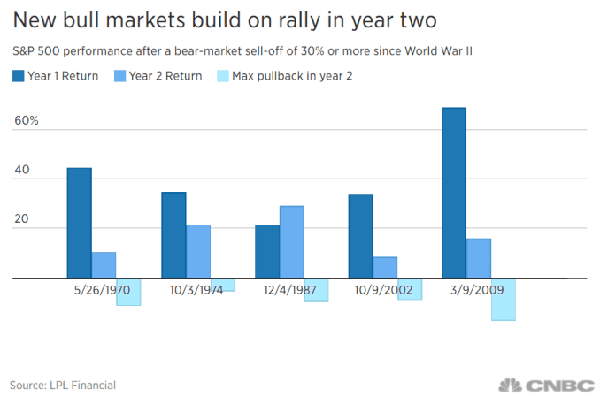

1. Stay invested and diversified. The market sell-off in February and March saw investments in both stocks and bonds tumble by double digits. However, as we discuss in every weekly letter, staying the course proved to be the prudent course of action. Since its low point in March 2020, the S&P 500 has risen more than 65%. Investors who sold their holdings in the midst of the decline and stayed on the sidelines missed the recovery and the upside gains, potentially altering their long-term financial plans in a negative way. Historically, strong bull markets usually follow big bear market declines, with gains carrying into a second year.

2. Look for opportunities along the way. Not only is it critical to stay the course, but it also is important to be both strategic and tactical with investment allocations. Last year, the world experienced a technological advancement due to the pandemic, and a group of stay-at-home stocks in the technology and healthcare sector performed very well. Technological and macro-economic trends accelerated due to COVID-19, presenting long-term investment opportunities. When the vaccines were announced in November and the world anticipated the reopening of the economy, small-cap stocks became more attractive, along with service and hospitality stocks. This doesn’t mean that technology and healthcare stocks are less favorable, but we continue to invest where we believe the market is moving, not where it currently sits.

3. There is a movement toward sustainable investing, such as worker health and safety, climate change and fossil fuel reductions — and not just with younger investors. More and more companies will focus on ESG (environmental, social and governance) as part of their corporate operations.

4. Tax Loss Harvesting. When markets experience large declines, selling current holdings and capturing realized losses will help offset future taxable gains. This does not mean investors should sell and get out of the market. Instead, swap one holding for a similar holding to maintain market exposure, and create a taxable loss. Then, in the future, when you sell the holding for a hopeful gain, you have a realized loss that may reduce the amount of tax that you owe on the gain. This is prudent investment strategy.

So, what can we learn from all this? Markets go up and down over time. The key is to stay invested and stick with the financial plan. Market downturns present opportunities to purchase stocks that were previously viewed as overvalued. In a down market, you are “buying low,” one of the fundamental tenets of investing.

We are not trying to time the market. We continue to view more risk being out of the market than in the market. Riding out future market volatility in addition to having a diversified portfolio means staying the course. From an investment perspective, we use trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next 5-7 years with short-term adjustments along the way.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, LPL

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures