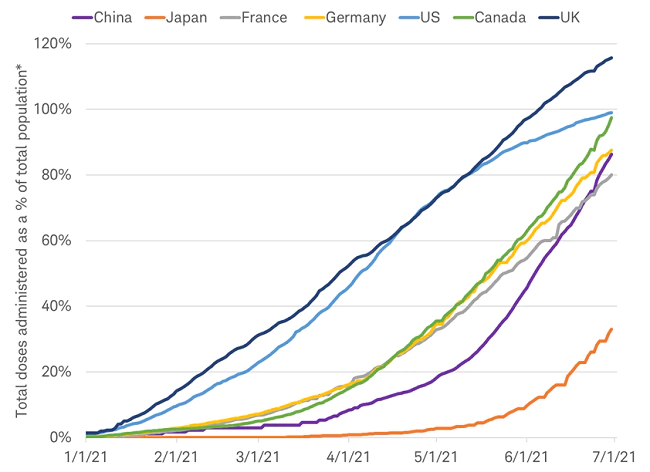

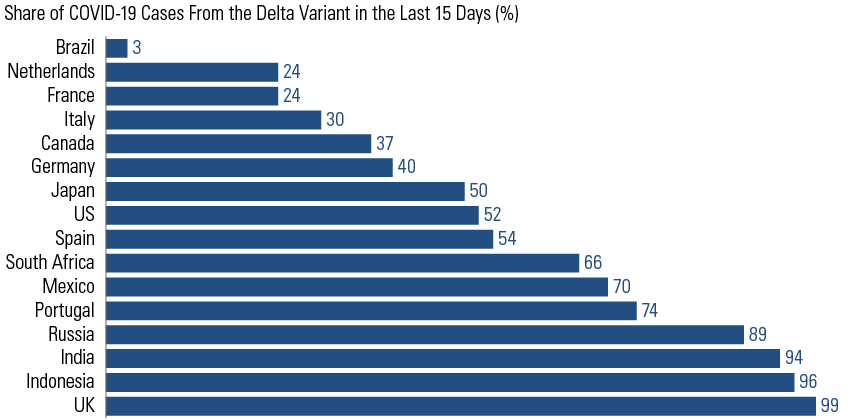

In our client letter last week, we wrote that one of the factors to watch in the second half of the year is the effect of COVID variants. Late last week, the Olympics announced it was banning fan attendance after Tokyo declared its fourth state of emergency. While Japan still has not reached the level of having 50% of its population vaccinated, it is encouraging that many major countries (including China) are beyond that threshold. We may see additional restrictions and lockdowns in other parts of the world with the continuing transmission of the Delta variant. For example, Israel has delayed reopening its borders, and Europe has tightened curbs on U.K. visitors.

The Delta variant, first identified in India, already is a dominant factor in the U.K. and is growing in many other countries. The World Health Organization said the variant has been detected in more than 96 countries, and the U.S. Centers for Disease Control and Prevention said it accounts for 20% of all cases. The pickup in variant cases has renewed some investor concerns about global growth, but high vaccine efficacy and faster-than-expected vaccine rollout should help offset the variant’s economic impact.

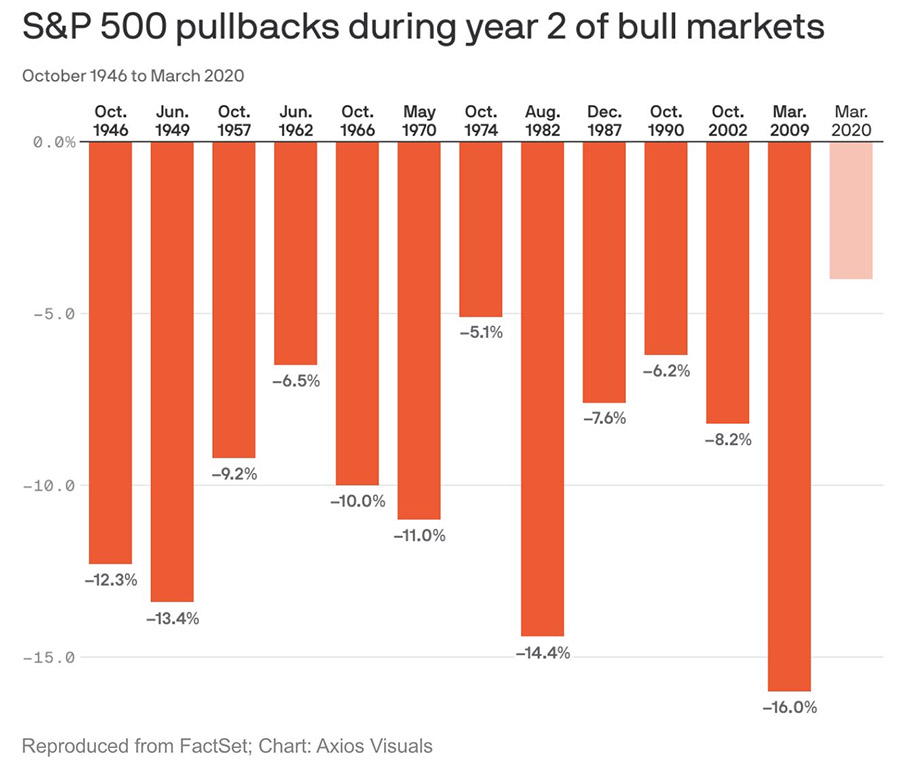

Despite recent concerns about the Delta variant and the potential reduction of fiscal and monetary stimulus, stocks have continued to climb to all-time highs. The S&P 500 and Dow Jones Index have gone almost eight months without a pullback of more than 5%. Earlier this year, the NASDAQ had a brief correction of more than 10%, but it recovered quickly and now is trading at an all-time high as well.

The chart above highlights that during past bull markets dating back to 1946, the second year of the bull market’s run — which we are now in — has seen various degrees of market pullbacks. If the S&P 500 has a pullback and/or a correction — whether in 2021 or 2022 — we will continue to stay the course and make necessary adjustments to the portfolios.

So, what can we learn from all this? We are closely watching economic reports such as Consumer Price Index (CPI) and employment data. We also are monitoring the COVID variants’ effect on the global economy and Federal Reserve policy, as well as its effect on China and its increased regulations and restrictions. Strong market fundamentals remain intact as the economy continues to reopen. Market volatility remains at a low level and may pick up as we near the end of the summer, headed into the fall.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: MarketWatch, Goldman Sachs, Charles Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures