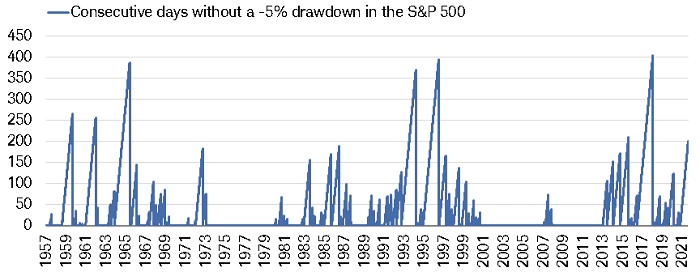

The market has shown great resilience in 2021; it has been more than 200 days without at least a 5% drawdown for the S&P 500. (The maximum drawdown this year has been 4.2%.) There have been only three years since 1928 with smaller maximum drawdowns. We believe several factors are contributing to the market’s resilience: buying during the dips continues to work effectively, the Fed’s policies are supportive to the markets, a new infrastructure deal is in the works, and corporate earnings continue to be strong.

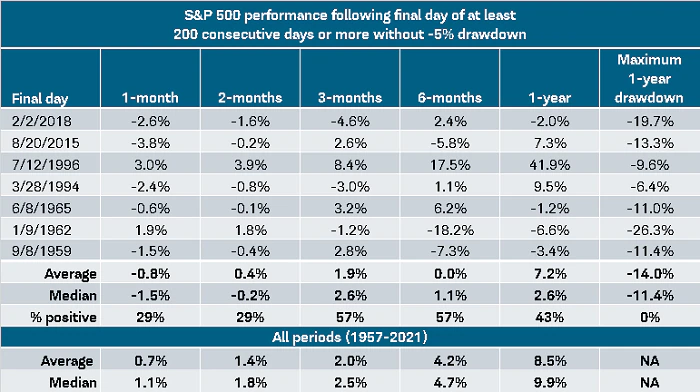

Dating back to 1957, there have been seven similar instances of going more than 200 consecutive trading days without a 5% drawdown — not necessarily enough instances to be considered statistically significant. However, as the chart below shows, the market on average has had positive returns at 3 months, 6 months and 1 year after those periods. In each of the prior seven instances, the markets have seen a greater than 5% pullback.

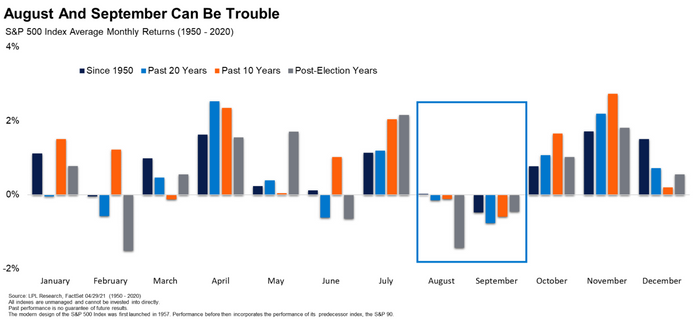

We are nearing the end of the summer and heading into September, historically the worst month of the year in terms of average performance, as seen in the chart below. August — also typically one of the worst performing months — has seen a record number of new highs in the S&P 500, the most since 1929.

The market still faces several risks:

* This week, the House of Representatives begins debate on two infrastructure packages. If Congress is unable to pass the trillion-dollar package that the markets are expecting, we could see some market sell-off.

* If the Federal Reserve increases the rapidity of its tapering and buys fewer assets, as we discussed last week, the flow of cash into the economy would decrease, possibly leading to a further economic slowdown.

* COVID variants continue to have an impact on economic growth, both domestically and around the world.

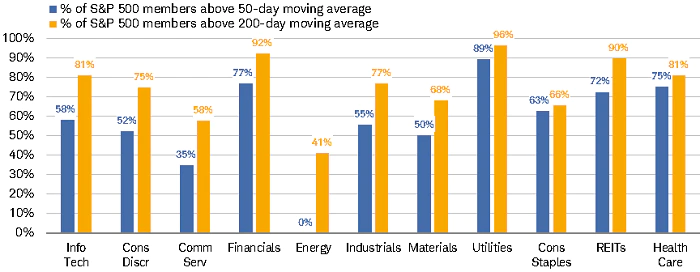

* Market valuations are not inexpensive. A majority of stocks in the S&P 500 across all sectors are trading above both their 50- and 200-day moving averages.

It remains important to stay disciplined in the current economic environment. Investors should stay focused on the long term, not on when to get in and when to get out of the market; that approach is gambling, not investing. Investing is a disciplined process done over time, staying committed during the ups and downs of the market.

So, what can we learn from all this? We believe it is not a matter of “if” but “when” the market will have a drawdown of more than 5%. However, trying to time when that may happen is gambling and not investing. Investors should not overreact to market headlines by making sudden and significant changes to portfolios. We continue to watch economic data closely and monitor the COVID variant’s effect on the global economy, as well as Federal Reserve policy and China’s increased regulations and restrictions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Fact Set, LPL, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures