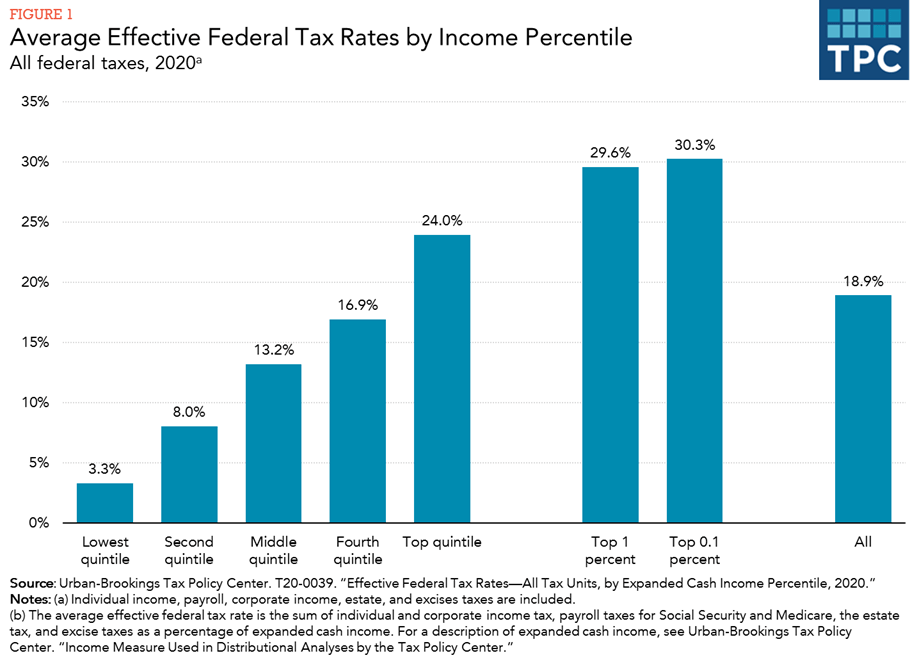

As we near the end of the third quarter, Congress continues to debate infrastructure packages. Many investors are wondering if Congress will pass tax reforms that alter the tax landscape to pay for the new bill. The Biden administration has consistently said it is targeting individuals whose income is greater than $400,000. Our current tax system is considered a progressive system, one in which the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, as seen in the chart below, which is why the current administration remains focused on increasing taxes for those individuals.

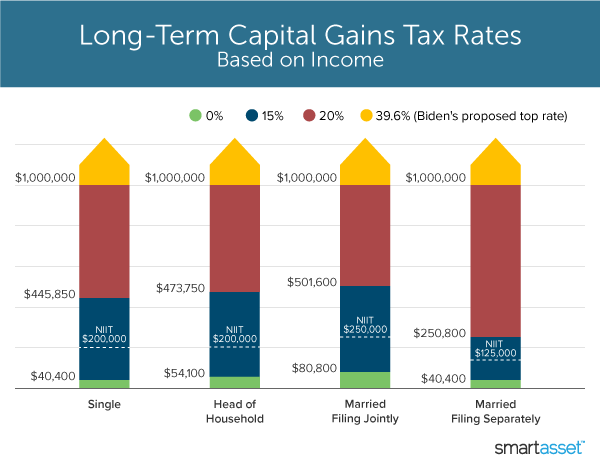

One of the proposals is to raise the long-term capital gains rates on those who make more than $1 million to pay for infrastructure. The current rate for those earners is 20%, and the new rate would be 39.6%, almost double the current rate. The chart below shows the proposed long-term capital gains rates if the new rates were to go into effect. We believe that the chance of any major tax changes passing is still remote, given the current makeup of Congress.

We continue to look for opportunities to bolster tax savings for our clients, regardless of whether the proposed tax changes pass in Congress, and we want to highlight three strategies below.

Strategy No. 1: Tax Loss Harvesting

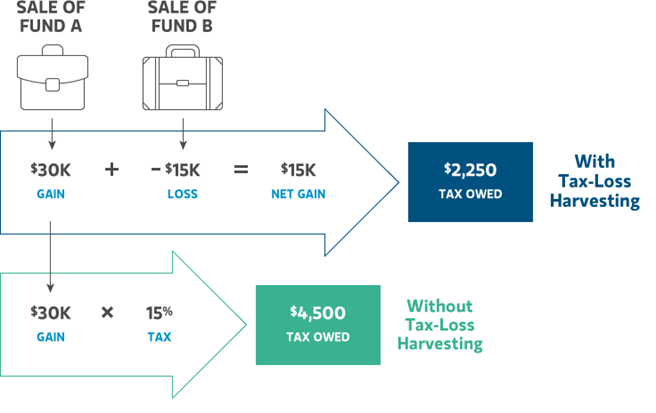

Under current tax law, it’s possible to offset current capital gains with capital losses you’ve incurred during the year or carried over from a prior tax return. Capital gains are the profits you realize when you sell an investment for more than paid for it, while capital losses are the losses you realize when you sell an investment for less than you paid for it.

Short-term capital gains are taxed at ordinary income rates, whereas long-term capital gains are taxed at a lower capital gains rate. Being able to reduce the tax on both short- and long-term capital gains by harvesting losses can help offset the gains one incurs from taking profits. Harvesting the loss has no effect on the portfolio value, as one can use the proceeds from the sale to buy a similar investment.

This allows the investor to maintain a similar asset allocation and reduce federal income taxes, as seen in the example below. Throughout the year, we continue to look for opportunities to harvest losses and take profits, all while maintaining the current risk tolerance.

Tax-loss harvesting and portfolio rebalancing can provide nice synergies as they play different roles in portfolio management. When we rebalance a portfolio, we are managing risk in the portfolio by selling holdings that have outsized their target holdings and adding those gains to positions that may have had losses or not grown as much. Often in rebalancing, the portfolio will experience sizeable capital gains. That’s where tax-loss harvesting helps reduce the gains and bring the risk of the portfolio back to its target allocation.

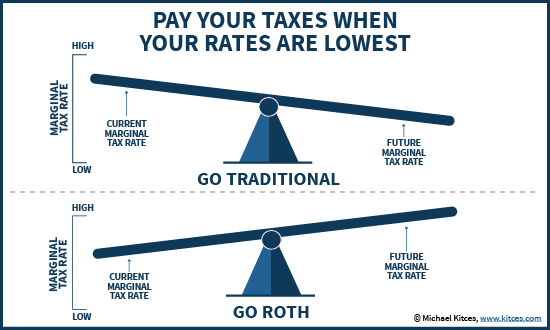

Strategy No. 2: Converting to a Roth IRA

A traditional IRA/401K is funded with pre-tax contributions. Future withdrawals from your IRA/401K are then taxed at ordinary income rates. A Roth IRA/401K is funded with after-tax dollars, and the withdrawals are tax-free, if the qualifications are satisfied. Individuals who have most of their retirement assets in a traditional IRA/401K might consider converting a portion of those assets to a Roth retirement account for tax diversification. With tax rates currently at historically favorable levels, now might be an opportune time to do a Roth conversion, since the IRS treats Roth IRA conversions as taxable income.

Strategy No. 3: Increasing Charitable Contributions

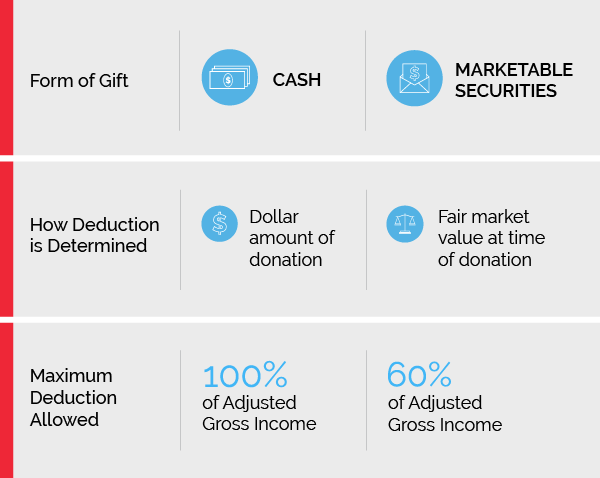

The CARES Act, along with additional stimulus at the end of 2020, provided tax relief to those individuals with charitable intent. For 2021, taxpayers can elect on their income tax return to deduct up to 100% of adjusted gross income for cash gifts made to public charities. Also, under the CARES Act, taxpayers can gift long-term appreciated securities to public charities (including donor advised funds) up to 30% of their adjusted gross income while also making cash gifts to public charities totaling up to 60% of adjusted gross income.

For those who are charitably inclined and over the age of 70½, this year offers an opportunity to donate more to your favorite charity and potentially reduce your taxable income by donating directly from your IRA to a qualified 501(c)3 organization. The maximum dollar amount for any individual from an IRA is limited to $100,000 per year. A married couple can each donate up to $100,000 from their respective IRA.

So, what can we learn from all this? We will continue to monitor the financial plan and the portfolios to look for opportunities to tax-loss harvest, discuss Roth IRA conversions and potentially donate appreciated stock to your favorite charities. We continue to watch economic data closely and monitor the COVID variants’ effect on the global economy, Federal Reserve policy and China’s increased regulations and restrictions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Fidelity, Cambridge Trust, Michael Kitces, Smart Asset, Tax Policy Center, https://www.taxpolicycenter.org/resources/income-measure-used-distributional-analyses-tax-policy-center

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures