Cryptocurrencies continue to generate a lot of interest among investors, yet they remain an enigma for most people. They also are a somewhat controversial asset class with a wide range of potential outcomes for investors.

What is the allure of cryptocurrencies?

For starters, cryptocurrencies are not associated with any government or any one financial institution. They can be transferred from one individual to another without the help of a central organization. The supply of bitcoin is fixed, whereas a central bank can manipulate the amount of currency in circulation to help control the economy. As we have written before, money supply is one of the main tools the Federal Reserve uses to speed up or slow down an economy.

More and more companies are accepting payment via bitcoin. There are an estimated 6,000-plus brands of cryptocurrency in existence today, and many investors think that if they invest in the smaller, newer cryptocurrencies, they might have a chance for the kind of big returns that early bitcoin investors have experienced.

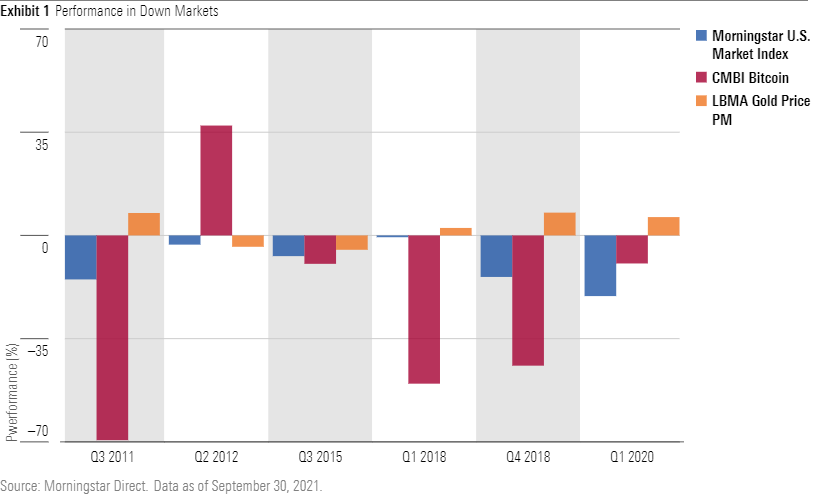

Historically, gold has been one of the go-to asset classes for investors who are worried about inflation or who want a hedge against a market downturn. As the chart below shows, gold has typically generated positive returns during periods of negative equity returns. Bitcoin, on the other hand, moved in the same direction as the market, and the losses were more severe.

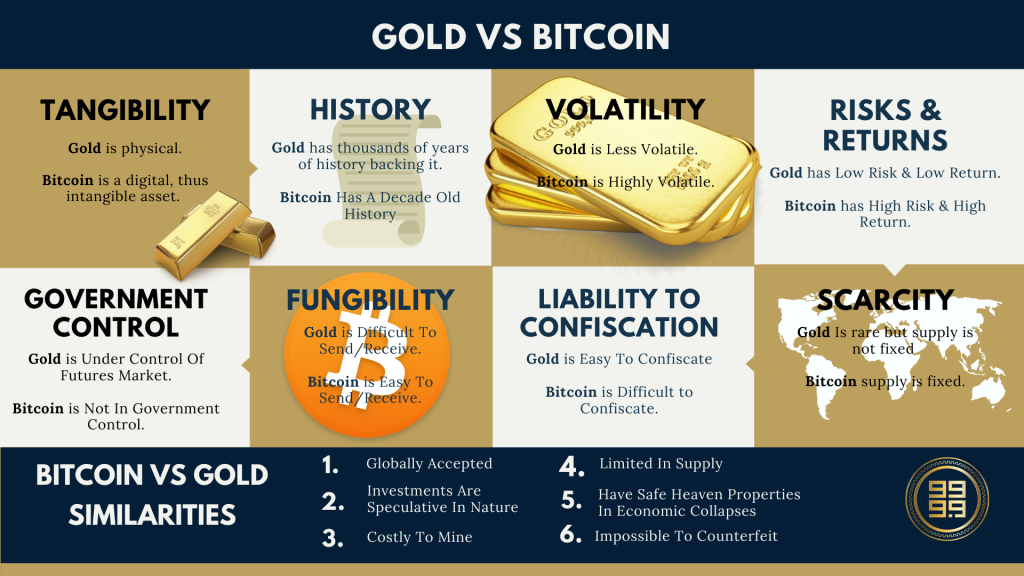

For investors who view bitcoin as a substitute for gold — as an inflation hedge or commodity replacement — the chart below outlines similarities and differences between the asset classes.

What are the risks of cryptocurrencies?

Cryptocurrencies do not provide steady, reliable cash flows — nor do they generate earnings through exposure to economic growth. The price of cryptocurrencies tends to be highly volatile. For example: The price of bitcoin was about $63,000 in mid-April, proceeded to lose more than half of its value by late July, and is back at record highs in mid-November. As a result, they have not offered consistent or reliable diversification in portfolios. In fact, bitcoin’s correlation to traditional asset classes has risen during recent periods, possibly because of increasing adoption in the marketplace. Also, cryptocurrencies are not regulated in the same manner and are not insured by the federal government. The SEC is expected to increase regulation and begin taxing cryptocurrencies.

How do you invest in bitcoin?

There are several ways to invest in cryptocurrency. The most popular mediums are through the online exchange, Coinbase, or through exchange traded funds (ETFs). Until recently, the main ETF on bitcoin was Grayscale Bitcoin Trust (ticker GBTC). A new ETF was launched as competition in October — The ProShares Bitcoin Strategy ETF (ticker BITO) — and has seen a large inflow of assets.

Is it wise to invest in bitcoin and other cryptocurrencies?

For many investors, the world of cryptocurrency remains difficult to understand. Many investors maintain a mantra not to invest in something you don’t understand. We wrote about the basics of cryptocurrency earlier this year and explained how bitcoin was created and how it works. There remains little consensus on the value and use of cryptocurrencies, and with the lack of consensus comes both opportunity and risk.

So, what can we learn from all this? It is important for investors not to confuse trading in ultra-risky assets like cryptocurrency with more traditional approaches to investing. For individuals with a long-term horizon and a high tolerance for risk, there can be a place for buying assets that have wild swings in value. Bitcoin and other cryptocurrencies remain a relatively new asset class and investment vehicle. They are still a risky investment that may or may not pay off. Investors should invest only as much as they are willing to lose, and if one does invest, it should be part of a well-diversified portfolio.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course and focus on the long-term goal — not on one specific data point or one indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Morningstar, Kestra

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures