Last week, the stock market pulled back in a very volatile week as investors grappled with the potential impact of the Omicron COVID variant and commentary from Fed Chair Jerome Powell that the risk of inflation has increased. Powell also said the Fed may consider speeding up its bond purchase tapering plans and hinted at potential earlier rate hikes in 2022.

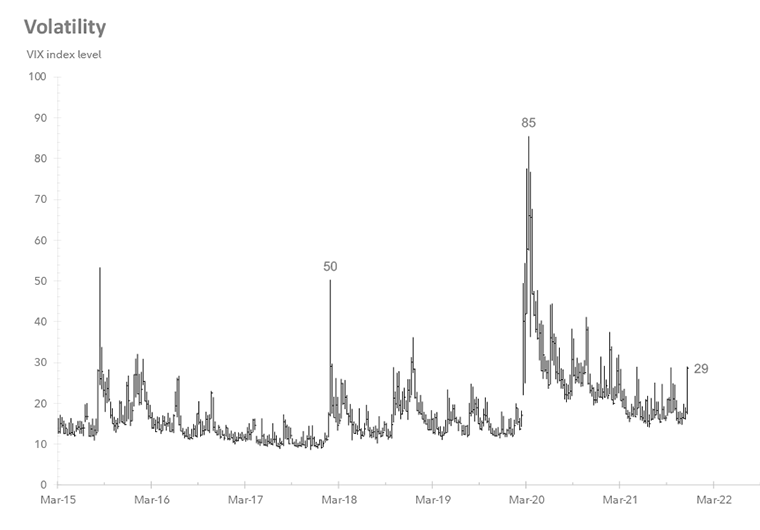

As a refresher, the VIX index is a measure of forward-looking stock market volatility for the next 30 days. The VIX is known as the fear gauge; it reflects the market’s short-term outlook for stock price volatility as derived from option prices on the S&P 500. On Monday, the VIX topped out at 35, after having traded at below 20 for most of October and November — that’s a 75% increase in the volatility index in a very short period. As the chart below shows, we have had many short-lived, volatile market movements over the past 20 months. In hindsight, the spikes in volatility have allowed investors to continue to “buy the dip” in the accompanying market sell-offs. As volatility then wanes, the market recovers.

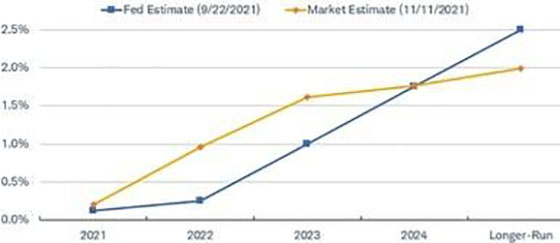

One of the primary causes of the recent increase in volatility is inflation. The Fed belatedly acknowledged inflation risks, and we expect it to start raising rates next year. What matters is not that they are going to raise rates, but the rate trajectory and where they end up next year and going forward. The chart below shows the Fed estimate as well as the market estimate for interest rates. Both the market and the Fed predict that short-term rates will be around 1.75% in 2024, which would be a slow, steady increase from where they are now: 0-0.25%.

The Fed’s view of the path of rate hikes vs. the market’s view

Note: The 12/15/2027 eurodollar futures rate was used for the Longer-Run market rate. Source: Bloomberg. Fed estimate as of 9/22/2021. The market estimate of the federal funds rate using eurodollar futures (EDSF). As of 11/10/2021.

Also weighing on the markets and causing increased volatility is the work Congress still has to do before the end of the year, with several large issues to resolve:

* Defense spending bill: Congress is near agreement to authorize $770 billion in military spending.

* Keeping government open: President Biden signed a stopgap spending bill that will keep the Federal Government running through Feb. 18.

* Social spending bill: The Build Back Better Plan could also drag into next year as negotiations on how to fund the bill continue.

* Raising the debt ceiling: The estimated deadline is Dec. 15. Raising the debt ceiling does not allocate new spending; it only authorizes the Treasury to make good on current obligations.

This year’s series of events has no historical parallel: a growth surge from a global pandemic, a supply-driven spike in inflation and a change in Federal Reserve monetary policy that is being tested in real time.

The COVID shock was more like a natural disaster than the economic restart from a global financial crisis. Economic activity surged, and corporate profits rebounded at a rapid pace.

Demand for goods — rather than services — along with supply-chain bottlenecks have driven prices higher. We expect that prices eventually will be higher than pre-COVID levels, but supply and demand ultimately will determine where they settle. As supply-chain bottlenecks open and more goods are available to the public, prices will come down as demand decreases. At the same time, the service industry also will begin to see increased demand, which may reduce the demand for goods, in turn reducing prices as well.

So, what can we learn from all this? COVID is still taking a terrible toll on the U.S. and the world. Even with the new Omicron variant, the U.S. economy looks solid and supply-chain bottlenecks may be easing. We think investors need to be ready to ride the COVID rollercoaster for years to come. Panic is not a strategy when dips occur. When the market falls and volatility rises, the plan is to stay the course and consider those opportunities as buying chances, not as a time to panic and sell.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Bloomberg, Blackstone, Fidelity

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures