In recent weeks, the markets have reacted to a myriad of economic data and geopolitical events. On the economic front, recent reports show weaker consumer spending with inflation levels last seen in 1982. On the other hand, the reports show strong job numbers with low unemployment rates. The Fed’s firm stance on controlling inflation has contributed to market volatility, and the picture is further clouded by uncertainty about the Fed’s plans to raise rates this year.

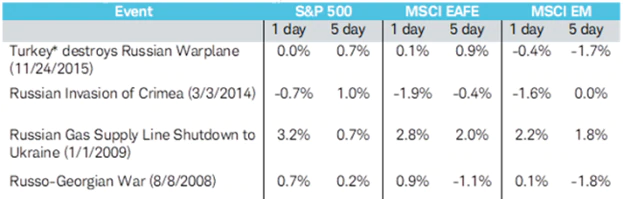

Over the last week, the markets also have reacted strongly to the buildup of forces along the Ukraine border. As seen in the chart below, previous incidents involving Russia have had little impact on the global financial markets. We do not believe that diversified investors need to take stock market actions related to the potential invasion of Ukraine by Russia.

Historical geopolitical events involving Russia

Source: Charles Schwab & Co., Inc. and FactSet. Data retrieved 1/28/2022. All price performance is in USD. Past performance is no guarantee of future results.

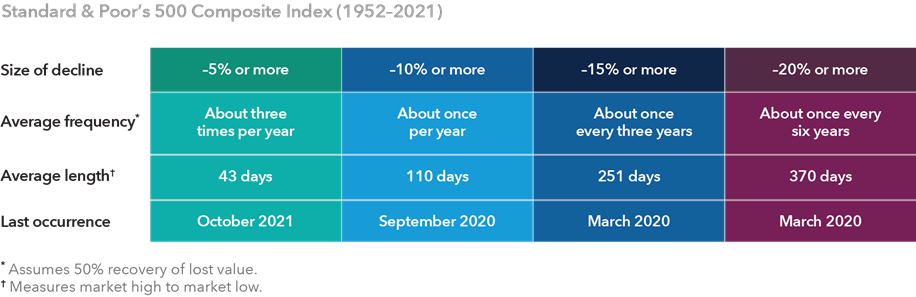

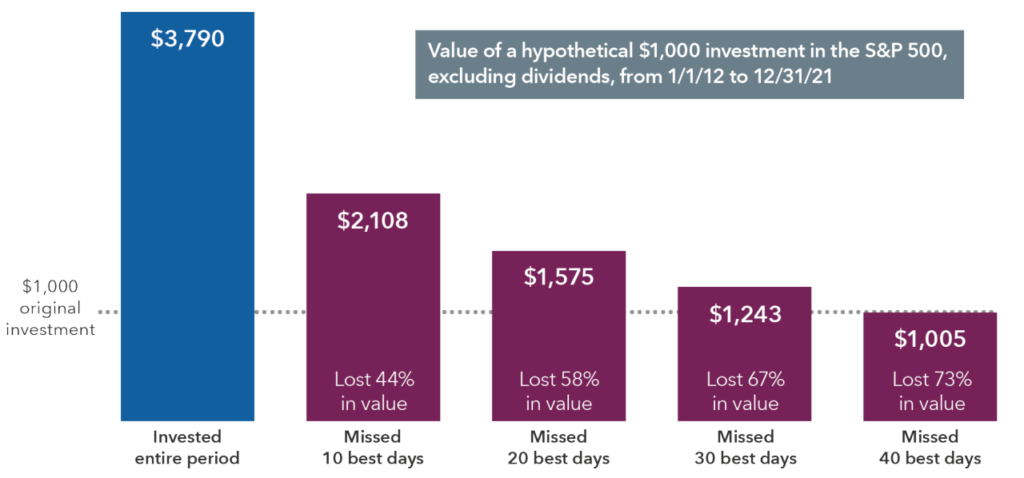

Loss Aversion Theory demonstrates that the pain people feel when losing money is greater than the joy they feel from making money. The market’s decline to start the year tests this theory for many investors. The instinct to flee stocks when the market starts to fall can have a major negative impact on the long-term health of the portfolio. Stock market declines are an inevitable part of investing, but over long periods of time, stocks have tended to move higher. The S&P 500 has typically dropped at least 10% about once per year — and 20% or more about every six years — according to data from 1952 to 2021. Each historical downturn has been followed by a recovery and a new market high.

Investors who sit on the sidelines risk losing out on periods of market appreciation that follow the downturns. From 1929 through 2020, every decline of 15% or more in the S&P 500 has been followed by a strong recovery. The chart below shows how just missing a few of the market’s best days can hurt long-term investment return. The takeaway for investors is to remain invested during volatile times so that when the market starts to recover, one does not miss out on the returns to recover the unrealized losses.

Missing just a few of the market’s best days can hurt investment returns

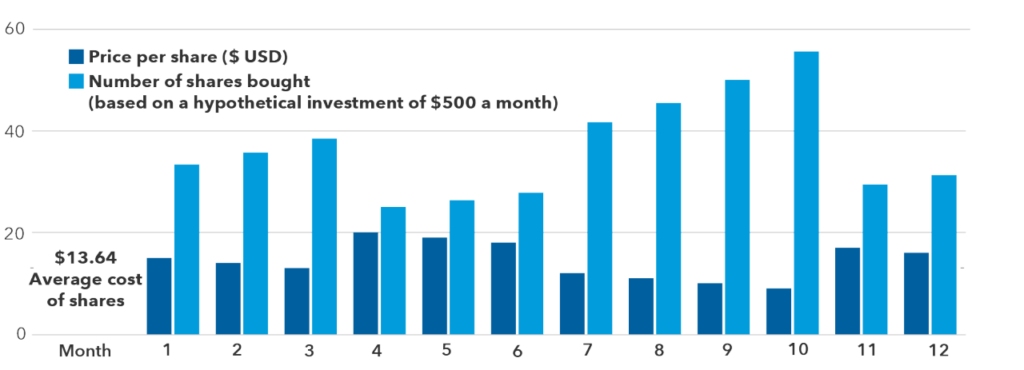

As we write each week, we believe in sticking with the plan to avoid making decisions based on emotions — particularly when the market goes lower. We regularly practice dollar-cost averaging, investing an amount of money into the portfolio at regular intervals, regardless of whether the market moves up or down. Most people do this every two weeks with their 401(k) plans without even realizing that they are dollar-cost averaging. People who follow this strategy purchase additional shares at lower prices and fewer shares at higher prices. Over time, though, investors pay less per share.

As seen in the chart below, the dark blue line represents stock price, and the lighter blue is number of shares owned. As the price drops in months 7 through 10, the number of shares purchased each month increases. This does not necessarily ensure a profit or protect against losses, but it keeps investors in the market and helps to take advantage of market downturns.

When stock prices fall, you can get more shares for the same amount of money and lower your average cost per share

Behavioral economics tells us recent events carry a larger influence on our perceptions and decisions. It is always important to maintain a long-term perspective, as markets tend to reward those who invest over longer periods of time. Those who can ignore the short-term worries and the noise — and focus instead on long-term goals — are better positioned to be rewarded for the future.

So, what can we learn from all this? Investors will be well-served to remove emotion from their investment decisions and remember that over the long-term, markets tend to rise. Market corrections are normal; nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It’s important to remember that panic is not an investing strategy. Neither are “get in” or “get out” — those sentiments are just gambling on moments. Investing is a disciplined process, done over time.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: American Funds, JP Morgan, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures