Those of us with kids or grandkids are well aware of the crazy cost of college today. Between 1980 and 2020, the average price of tuition, fees and room and board for an undergraduate degree increased 169%. In 1980, the price to attend a four-year college full time was roughly $10,000, adjusted for inflation. By 2020, the total price had increased to roughly $29,000!

Why have the costs of college gone up over time? There are many reasons: growing demand, pressure to go to college, rising financial aid, lower state funding, cost of administration and increasing student amenity packages to keep up. Aside from tuition payments, public colleges depend on funding from state and local governments. Typically, state and local funding make up about 44% of public four-year college revenues. However, economic downturns like we saw in 2008 and 2020 can lead to funding cuts. To make up for the lost dollars, universities must turn to other sources to raise monies, with the most direct source being higher tuition.

For most people, the cost of college may not be manageable – let alone the cost of graduate school or medical school.

More than half of bachelor’s degree recipients from public or private four-year colleges graduated with debt in 2020, with the average debt load being $28,400.

For college graduates with $50,000 or more of debt, the idea of one day owning a home and being debt-free feels like it’s a world away.

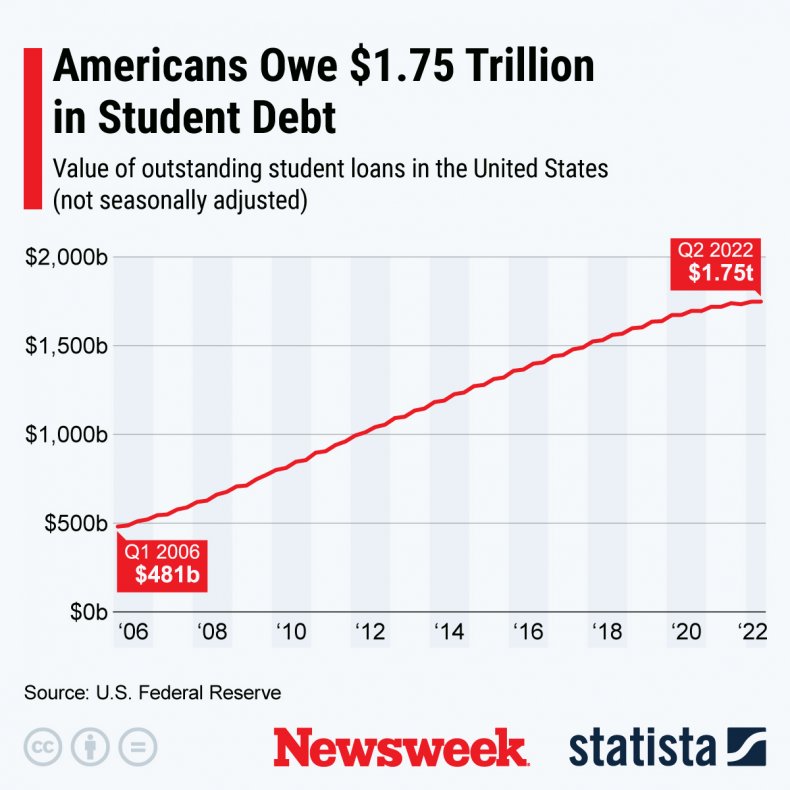

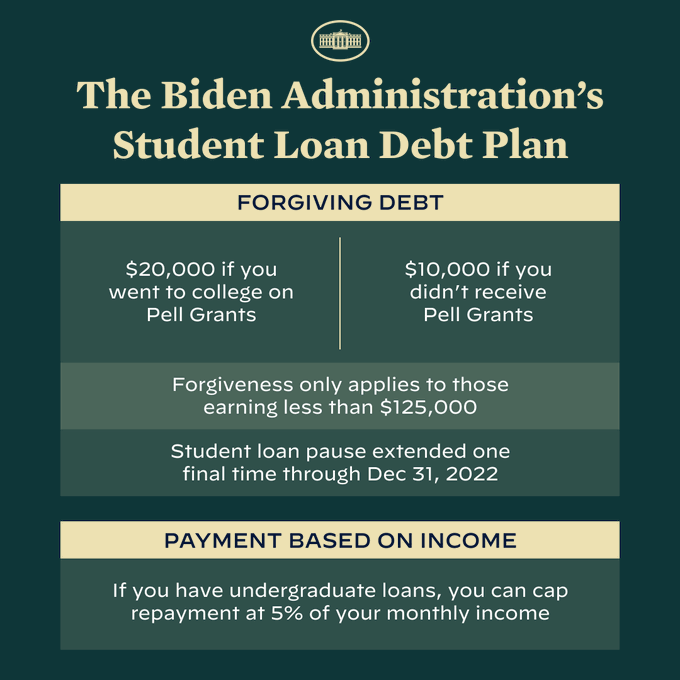

Even before President Biden was elected, one of his objectives was to provide student debt relief. Last week, he announced that the government will provide $20,000 in debt relief to Pell grant recipients and $10,000 for many other borrowers. Roughly 43 million Americans hold federal student loan debt, estimated at $1.75 trillion.

Borrowers eligible for loan forgiveness must make less than $125,000 per year individually or $250,000 if married for the 2020 or 2021 tax year. Private loans will not be forgiven as part of the debt relief act. At the same time, the president also announced an extension of the pandemic pause on student loan payments through the end of the year, with payments resuming in January 2023. The Education Department said nearly 8 million borrowers are likely to have their loans forgiven automatically, and the remaining borrowers will have to apply for loan forgiveness. Current students also are eligible for loan cancellation, provided their loans were obtained before July 1, 2022.

There also is a new income-based repayment plan. For undergraduate loans, the relief act caps monthly payments at 5% of a borrower’s discretionary income; currently, borrowers must pay 10%. For borrowers with original loan balances of $12,000 or less, the balance will be forgiven after 10 years of payments; currently, they have to repay their loans for 20 years.

The plan will provide relief for borrowers at a time when the cost of education continues to surge. Critics question the fairness of the plan and warn about the potential impact on inflation should students with forgiven loans increase their spending. The debt forgiveness plan will not be like the $1,200 relief checks that the government sent out during the global pandemic, however they will be relieved of making loan payments over many years. Critics also believe that this relief bill penalizes those who scrimped and saved for college and worked jobs while in college to pay off their loans.

The elephant in the room remains the exorbitant cost of college, and many fear that government debt relief might encourage future students to take on even more debt, allowing colleges and universities to raise prices even further.

Regardless of political beliefs, the affordability of higher education remains a larger issue. Between 2000 and 2021, the cost of college tuition increased at more than twice the pace of overall inflation, despite a slowdown in tuition hikes during the pandemic. As is most often the case with many bills passing Congress, only time will tell the full economic impact of the Student Relief Act.

While the form for forgiveness is not available yet, federal student loan borrower updates can be received by subscribing via the Department of Education’s website here.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Forbes, CNBC, Newsweek, USA Today

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.