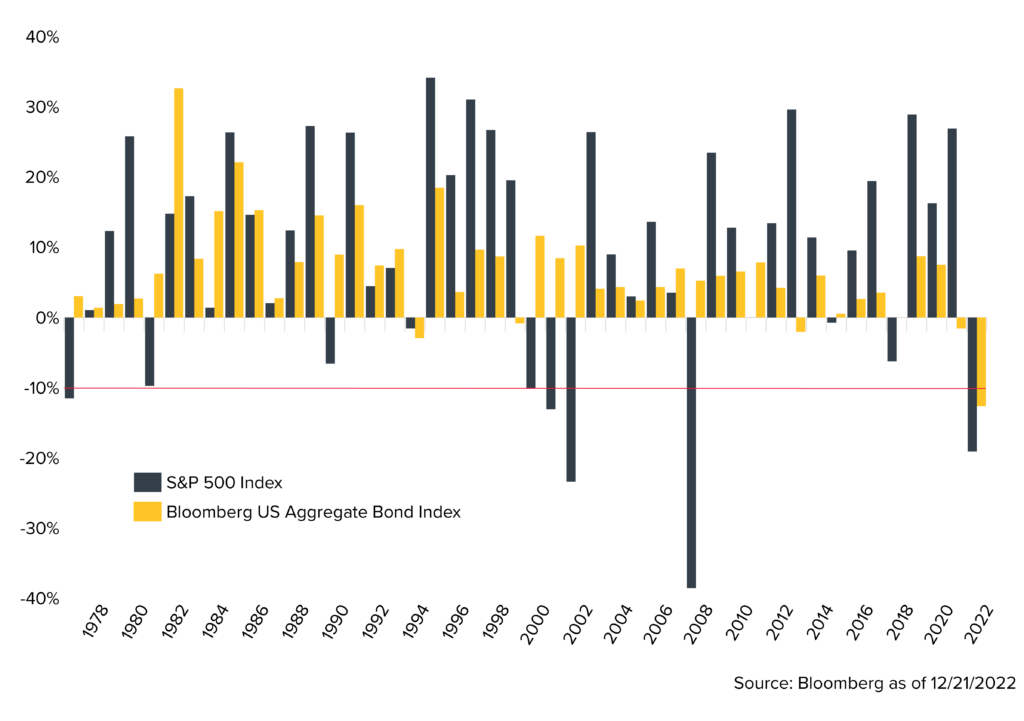

From a stock market perspective, we are glad to have put 2022 to bed. It’s rare to find a calendar year in which both equities and fixed income decline in tandem. The chart below shows annual returns over the past 45 years. In 1994, both stocks and bonds suffered small losses, and it nearly happened again in 2018. However, last year really takes the cake. We have never seen both simultaneously decline as they did in 2022.

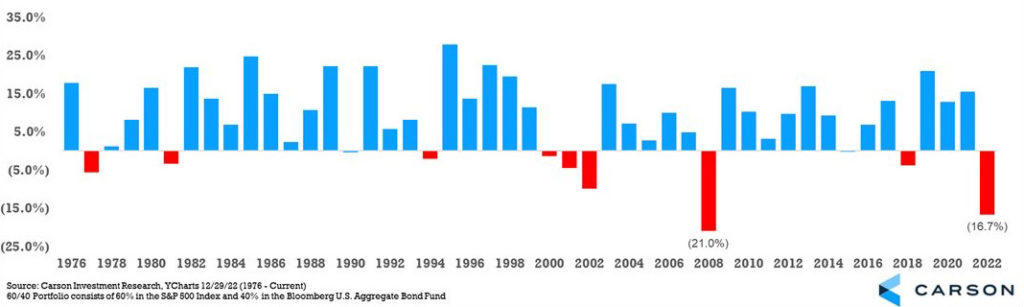

The rough waters in 2022 made many investors question whether the 60/40 portfolio was dead. The numbers are ugly: Last year will go down in history as one of the worst periods for bond returns on record. Normally when stocks go down, bonds help stabilize the portfolio, which is why the 60/40 portfolio has long been a good proxy for moderate growth portfolios. From 1980 through 2022, a 60/40 portfolio delivered positive returns 35 out of 43 years.

Making significant investment decisions based on one year’s unsatisfactory performance is never a good idea. If you were to have made that change following 2008, you would have missed out on 11 years of positive performance — with only 2018 being negative (and that was by just 3%). The average annual return of the period from 1980 through 2021 was 9.8% for a 60/40 portfolio.

Only 2008 Has Been Worse for a 60/40 Portfolio

Annual return for a 60/40 portfolio, 1976-present

Now, everyone wants to know when the next recession will start and how long it will last. No doubt each recession can be painful in its own way. The global economy appears headed in the direction of a recession. It is more than likely that Europe already is in a recession. China’s growth has decelerated essentially to zero, following strict COVID lockdowns.

The U.S. economy is stronger than most. When looking at the recessionary indicators below, the overall signal is that a recession is coming. Many factors can contribute to a recession, and the main causes often change. It is always helpful to look at many different indicators to better assess where the economy is at any point in time. These factors currently suggest that the U.S. is in a late part of the economic cycle and moving closer to a recession, even though the labor market remains resilient.

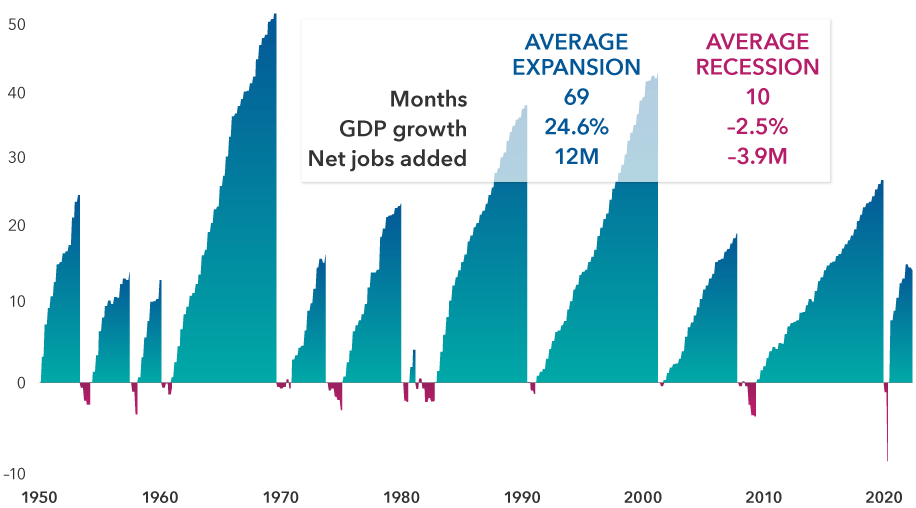

The good news is that recessions generally have not lasted very long in the U.S. The 11 recessions since 1950 have lasted between two months (COVID) and 18 months (the great financial crisis), with the average spanning 10 months.

Investors with a long-term horizon are better served looking at the bigger picture. Over the last 70 years, the U.S. has been in a recession less than 15% of all months. The net economic impact has been relatively small. The average expansion increased economic output by almost 25%, whereas the average recession reduced GDP by 2.5%.

The exact timing of a recession is hard to predict. Bear markets and recessions often overlap, with equities leading the economic cycle by six to seven months on the way down as well as the way up. Recessions have been relatively small blips in economic history.

Recessions Are Painful, but Expansions Have Been Powerful

Cumulative GDP growth

Remember, much of what we read and hear on the news is market predictions representing what economists and analysts think is going to happen in the year ahead. At the beginning of 2022, the top 15 Wall Street firms predicted on average that the S&P 500 would finish at 4,950 (from a high of 5,330 to a low of 4,400). The S&P 500 finished 2022 at 3,839, a far cry from the average prediction and much lower than anyone predicted to start the year. Those same analysts today predict on average that the S&P will finish 2023 at 4,100 (a high of 4,500 to a low of 3,725). At the end of the day, these are predictions. No one knows for sure how this year will play out. What we do know is that over time, markets tend to rise — and by not being invested when the market rebounds, you will miss out on the recovery.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Capital Group, Carson, CNBC, Factset, Horizon Asset Management

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.