The S&P 500 officially entered bull market territory last week, closing more than 20% higher than its low on Oct. 12, 2022. For now, the 2022 bear market is over.

The stock market has inched higher as the economy continued to surprise while inflation has cooled. Inflation, measured by Consumer Price Index (CPI), has slowed for 11 consecutive months. In May, prices rose at the slowest annual pace since March 2021.

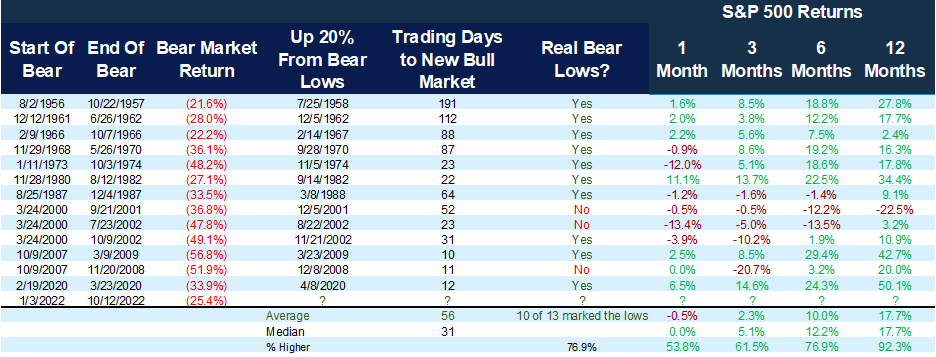

New lows have happened just two times after stocks gained 20% off the bottom: the global financial crisis of 2007-2009 and the tech bubble of 2000-2002. The average return 12 months after the end of a bear market was 17.7%, as seen in the chart below.

A New Bull Market Should Have Bulls Smiling Very Soon

New bull markets start (20% off bear lows) and what happened next for the S&P 500

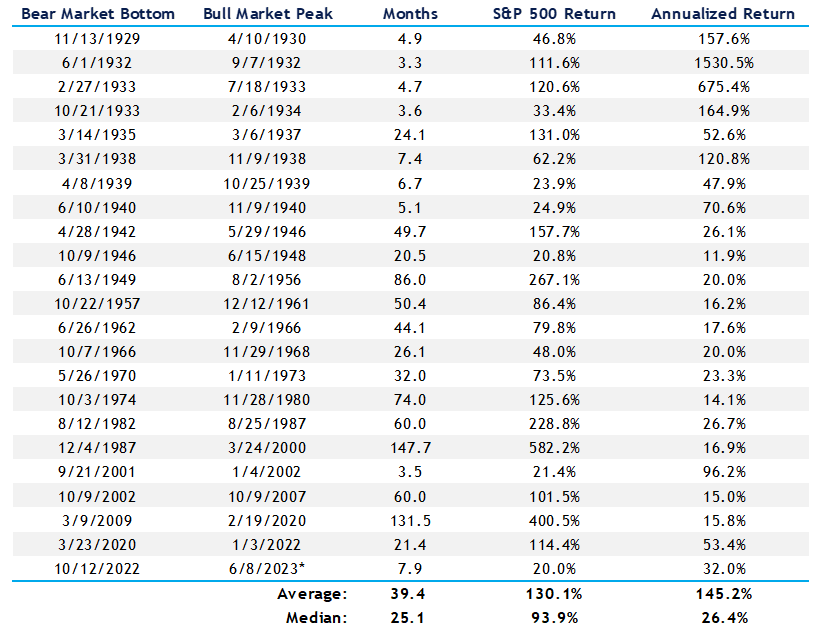

The duration of a bull market has varied significantly. Historically, bull markets have averaged 39.4 months and have produced an average gain of 130.1%. If you exclude the Great Depression, the average bull market has lasted 51 months and produced an average gain of 147%. We are now eight months into the current bull market, starting at the October low.

S&P 500 | Duration & Performance of Bull Markets (1929-YTD)

* Ongoing

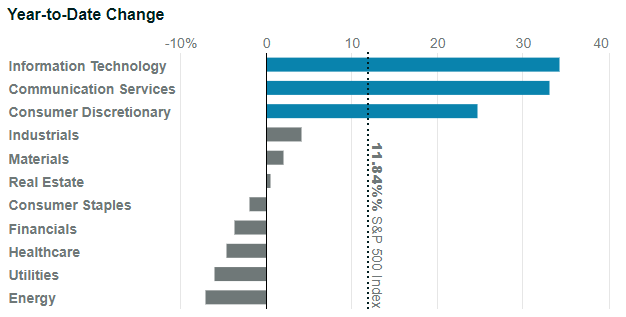

We still would like to see more breadth in the market, meaning more sectors other than technology participating in the rally. Big Tech gains have been driven in part by investor enthusiasm for the rise of artificial intelligence. ChatGPT has become the fastest-growing consumer app in history. Last week, we started to see other sectors gain momentum, as small-cap and international stocks also began to rally. The seven biggest stocks (Apple, Amazon, Google, Meta, Microsoft, Nvidia and Tesla) gained 77% this year through the end of May, while the average stock in the index is down 1.2% over the same time.

In or Out?

Three sectors have generated most of the S&P 500’s returns this year.

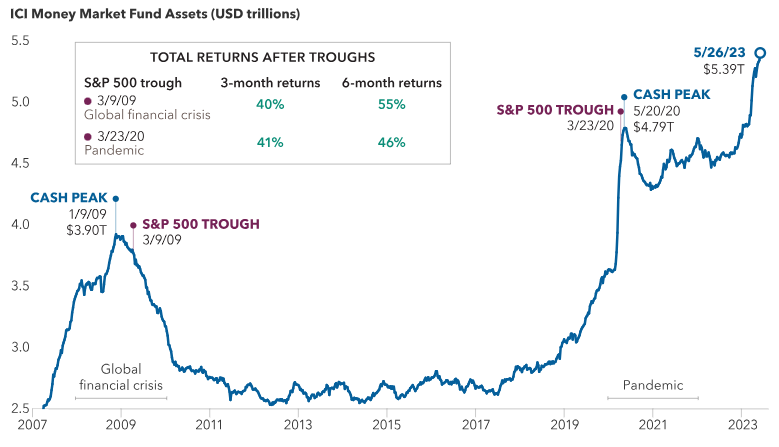

The declining dollar has helped international companies, as other currencies have gained compared to the dollar. Since October, the dollar has declined 6% as measured by the J.P. Morgan USD Real Effective Exchange Rate Index. At the same time, investors have continued to shift assets from stocks and bonds into money market funds. Money markets reached a record level at over $5.39 trillion in late May. This flight to cash has been understandable following last year’s decline of both stocks and bonds as well as higher interest rates.

Many investors moved monies from banks to money markets among higher yields on cash alternatives. When cash starts to unwind and move back into stocks and bonds, as it did after the global recession and pandemic, markets may be able to move even higher.

Investors’ Flight to Cash Has Been Followed by Strong Returns

This doesn’t mean a recession is out of the equation. The Fed has raised rates from 0% to 5% over the last 15 months. These rate hikes are being felt throughout the economy, and we will continue to feel them. It typically takes 12 to 18 months for rate hikes to work their way through the system.

A possible recession doesn’t mean that the market must collapse. Remember, markets are forward-looking, and investors are still positioned for the worst. The biggest risk to the market remains the Fed. Even if the Fed pauses rate hikes in June, it still could resume raising rates in July, possibly by as much as another 50 basis points. The hope is that such a move would ultimately be the last rate hike, but we will continue to follow this closely, as persistent inflation could upend the Fed strategy and the market rally.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Barron’s, Carson, Capital Group, U.S. News

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.