As we approach the second half of the year, it’s a good time to look back at the trends that have shaped our economy so far. Inflation continued to ease each month, and U.S. economic growth slowed. The Fed continued to raise rates while signaling that we are closer to the end of the rate-hike cycle, and the U.S. government debt-ceiling standoff was resolved without a default (thankfully).

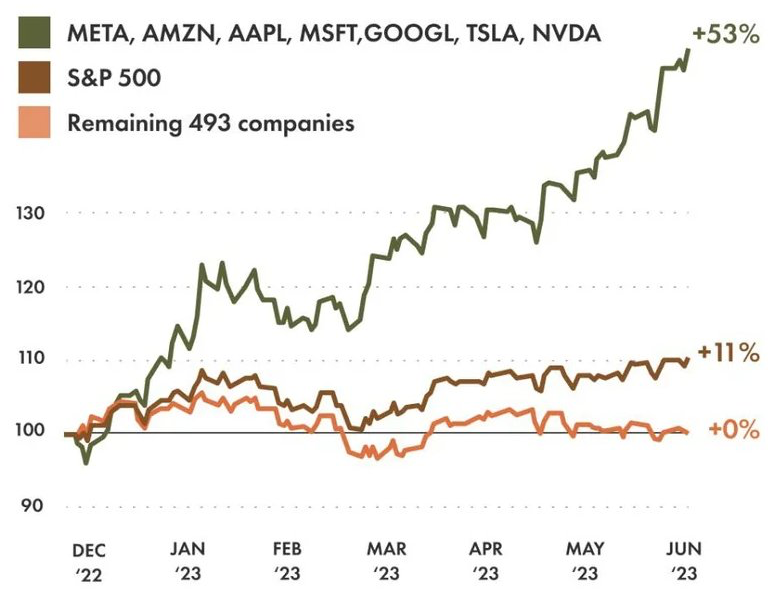

Artificial intelligence was the talk of the stock market for the first half of the year, and as we have written before, mega cap stocks led the market higher, with seven stocks accounting for most of the return of the S&P 500 through June.

Big Tech’s Performance vs. the Rest of the S&P 500

Through June 1

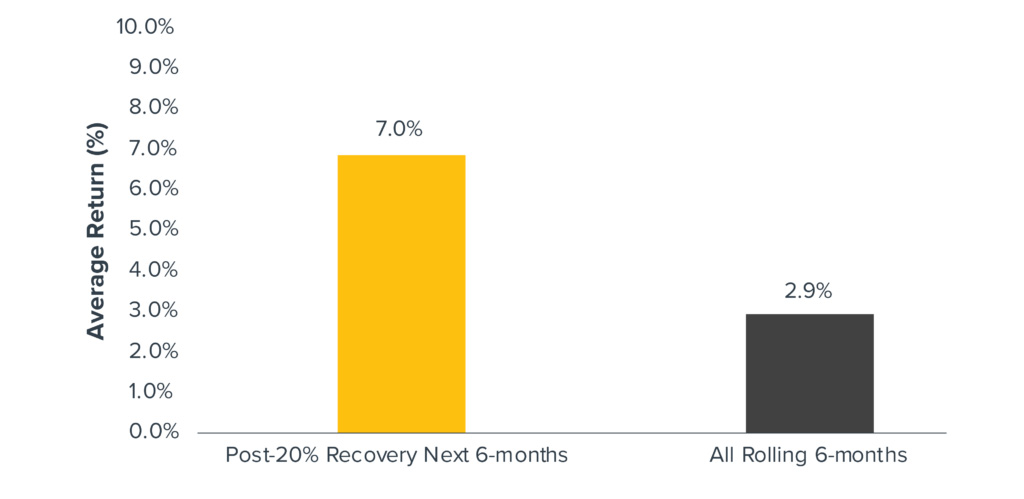

As we wrote last week, the stock market has rallied by more than 20% from the bottom in October 2022, and a new bull market has begun. Dating back to 1928, the S&P 500’s average return has been 7% over the six months after a rally of 20% follows a drawdown of 20% or more (like we saw during the first nine months of 2022). That is significantly higher than the average rolling six-month return of just 2.9%, as seen in the chart below. These findings suggest the possibility of further gains from here.

Drawdown Recoveries: What Happens Next?

Fixed income markets were positive for the first half of the year. Short-term yields, money markets, CDs and Treasury bills continued to offer attractive rates not seen for many years. Last week, the Fed kept the Fed Funds rate unchanged, ending a streak of 10 consecutive increases going back to March 2022. However, bank officials were quick to point out that the tightening cycle is not necessarily over.

“Allowing inflation to get entrenched in the U.S. economy is the thing we cannot allow to happen for the benefit of today’s workers and families and businesses, but also for the future,” Fed Chairman Jerome Powell said.

The Fed’s new summary of economic projections indicates that there still could be two more rate hikes to come. The question is whether the Fed is posturing and hedging its bets, as inflation fell again in May to 4%, still above the Fed’s target 2% level. It also is important to remember that it can take time for Fed rate hikes to work their way through the economy, often 12 to 18 months.

Here are some of the key indicators and trends we are watching for the second half of the year:

Leading Economic Index (LEI)

Used to predict the direction of global economic movements over the next few quarters, this index is comprised of 10 components whose changes tend to precede changes in the overall economy. There is still much discussion on a potential recession in the second half of the year — or whether one can be avoided altogether.

Labor market

The unemployment rate is 3.7%, remaining near its all-time low but up slightly from its recent measure of 3.4%. For inflation to fall to its 2% target, the Fed needs to see continued weakening in the labor market and slower payroll growth.

Credit crunch

Lending standards have tightened with higher interest rates and the effects of the Silicon Valley Bank failure. This may affect corporate earnings, which could lead to downside in the S&P forecast. There also is concern about the commercial real estate market, as a tremendous amount of debt needs to be refinanced this year. With interest rates still high, we could see a record level of default on commercial real estate property.

Market breadth

As we wrote last week, we have started to see sectors other than mega-cap tech names beginning to rally. Technology had been the only sector with positive returns, but in June, we are seeing other sectors turn positive. A continued improvement in other sectors would bode well for the market during the second half of the year.

Artificial intelligence

The first half of 2023 was all about ChatGPT and anything affiliated with artificial intelligence. Enthusiasm is elevated, and market valuations for some AI stocks are frothy as concerns about a repeat of the tech bubble of 2000 are starting to surface based on the first-half run of technology stocks.

+++

The second half of 2023 may hold the potential for fewer surprises with a debt-ceiling deal in place until 2025, global central banks moving towards a pause on rate hikes, signs of potential U.S. and China tensions cooling, and bank stress stabilizing. We will continue to closely monitor the markets and adjust the portfolios as necessary.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: FactSet, Goldman Sachs, Horizon

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.