The fall season is a great reminder to harvest. Not every investment will be a winner, but sometimes an investment that has lost money can still do some good.

With both stocks and bonds down in value last year, investors saw numerous opportunities to take advantage of tax-loss harvesting. Even in years where stocks and bonds are up in value, there may be opportunities to harvest losses — especially in a diversified portfolio, where not all asset classes move in the same direction.

What Is the Silver Lining of a Bad Investment?

You may be able to use your loss to lower your tax liability and better position your portfolio going forward. This strategy is called tax-loss harvesting. The principles behind tax-loss harvesting are straightforward, but there are potential dangers if not done properly.

Tax-loss harvesting allows you to sell investments that are down in value, replace them with similar investments and then offset realized investment gains with those losses. This helps reduce your tax burden and keeps more money to be invested in the hopes of making up for the losses.

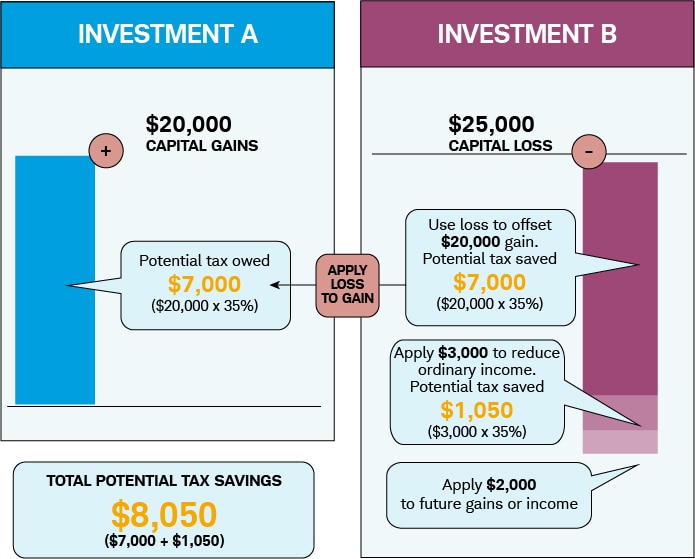

For example: If you had an investment with a short-term gain of $20,000 and you were to sell that investment, you potentially would owe $7,000 in taxes (assuming a 35% ordinary income tax bracket). However, if you had another investment with a $25,000 loss, you could sell that holding at a loss to offset the holding with the gain.

In this instance, as shown in the chart below, you would not owe the $7,000 gain and would save an additional $1,050 by using an extra $3,000 of losses to offset additional gains.

Capital gains are the profits you realize when you sell an investment for more than what you paid for it, while capital losses are the losses you realize when you sell an investment for less than what you paid. Short-term capital gains are taxed at an ordinary income rate, while long-term capital gains are taxed at a lower capital gains rate.

Long-term capital gains and losses are realized after selling investments that are held longer than one year. Short-term capital gains and losses are those realized from the sale of investments that owned for one year or less. The key difference between short- and long-term gains is the rate at which they are taxed.

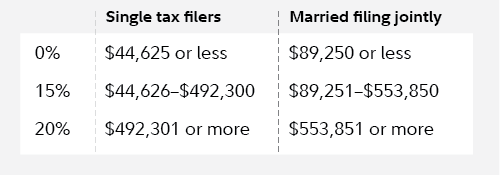

As seen in the chart below, those who have income of less than $89,250 (married filing jointly) may not pay capital gains tax at all. This can be a big benefit for tax planning as well.

Long-Term Capital Gains Rate for 2023

An investment loss can be used for different reasons:

1. The losses can be used to offset investment gains, either today or in the future. Short-term losses can be used to offset short-term gains, and long-term losses can be used to offset long-term gains. The least effective use of short-term losses is to apply them to long-term gains, but this may still be preferable to paying long-term capital gains tax.

2. The losses can help offset $3,000 of income on a joint tax return in one year. Unused losses can be carried forward indefinitely. Realizing a capital loss can be effective, even if you didn’t realize capital gains in that year with the carryover provision.

If you have mutual fund investments, your short- and long-term gains may be in the form of mutual fund distributions. Harvested losses can be used to offset these gains. Short-term capital gain distributions from mutual funds are treated as ordinary income for tax purposes. Unlike short term capital gains resulting from the sale of securities held directly, the investor cannot offset them with capital losses.

The Wash-Sale Rule

When performing tax-loss harvesting, one must be aware of the wash-sale rule. The wash-sale rule states that if you sell a security, fund or ETF for a loss and buy the same or substantially identical security within 30 days after the sale, the loss will be disallowed for tax purposes.

For example, if you own IVV, iShares Core S&P 500 ETF and sell it for a loss, and then purchase SPY, SPDR S&P 500 ETF with the proceeds, the IRS will most likely deem this to be a wash-sale violation, and you will not be able to take advantage of the realized loss. This applies across different accounts: You cannot sell an investment for a loss in one account and buy it back in another account, such as an IRA or spouse’s account.

As always, we recommend that you consult with a CPA if you have questions. If the IRS determines that you have violated the wash-sale rule, the loss is disallowed and added to the cost basis of the new investment.

While no one wants to see their portfolio value decrease, rebalancing the portfolio to create some tax losses can be beneficial to offset future gains or current income. Tax-loss harvesting and portfolio rebalancing are important investment principles that go hand in hand. If you choose to try tax-loss harvesting, be sure to keep in mind that tax savings should not undermine the investment goal.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Fidelity, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.