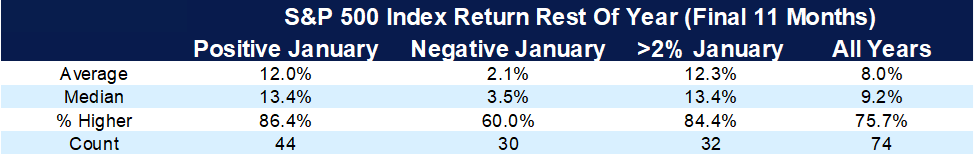

Stocks continued to move higher throughout January, as the S&P 500 has been positive 12 out of the last 13 weeks. The question is, does a good January mean much for the rest of the year?

It turns out that the “January Barometer” could be a good sign for investors. Historically, when the first month of the year is positive, the rest of the year is higher 86% of the time — up nearly 12% on average. When the first month of the year is lower, the market is higher 60% of the time — up only about 2% on average. Overall, a strong January is potentially a good sign.

So Goes January, Goes the Year

The January Barometer says a strong January for stocks is a good sign

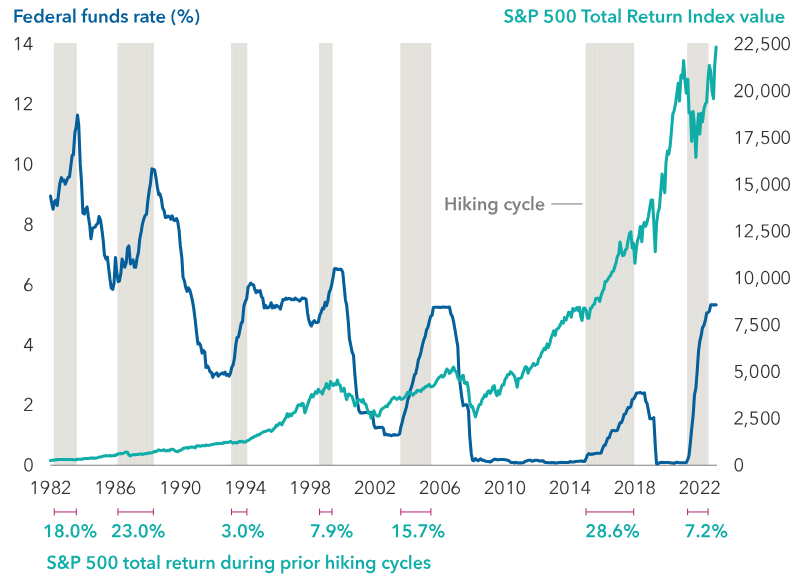

People tend to assume that higher rates are bad for stocks and lower rates are good. What we have seen since the beginning of 2023 is that markets have been strong not because of rates going up or down, but because the economy has been strong.

The assumption was that higher rates would force us into a recession, which would have been bad for corporate earnings, which ultimately is what the market cares about. Instead, we have seen stronger-than-expected earnings in many different companies and sectors, not just technology.

Market analysts continue to expect double-digit earnings growth in 2024. With rates as high as they are today, the assumption is that they will go back down soon. Some economists are aggressively calling for and predicting rate cuts this year.

The risk to the market remains that rates stay higher for longer. The Fed will need to continue to tread cautiously as it battles the possibility of lowering interest rates, but not at the expense of inflation rearing its ugly head again and repeating the mistakes of the 1980s.

Interest Rate Hikes Haven’t Necessarily Been Bad for Stocks

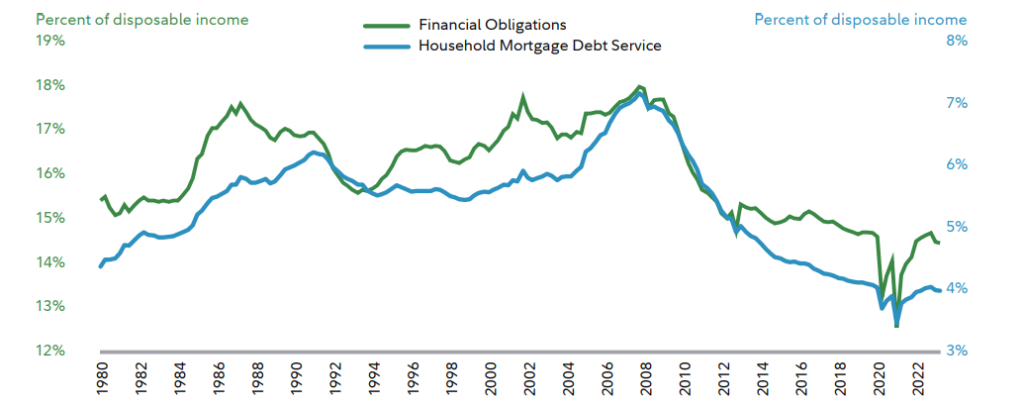

U.S. consumers have weathered the higher interest rate environment quite well. This has a lot to do with the fact that the debt profile of households with significant leverage is comprised of lower-rate, longer-term mortgage balances, compared to higher-rate, shorter-term credit card balances. Household incomes remain strong, especially with inflation easing. This continues to drive consumer consumption.

If you expect inflation to continue to ease, that means real income remains strong. Consumer spending has accelerated as we have seen real income growth from tight labor markets, ongoing spending from excess savings and rising household net worth.

Consumer Financial Obligations and Household Mortgage Debt Service

Each has risen since the 2021 lows, but are still low historically

Now that the market is back to all-time highs, what happens next? The economy continues to roll along. GDP expanded at an annual rate of 3.3%, adjusting for inflation. The economy continues to be underestimated.

It is very difficult to be in a recession with low unemployment, strong GDP, double-digit earnings growth and inflation easing. This does not mean that we don’t expect bumps in the road ahead during 2024. We still have plenty of uncertainty: market domination by a select few stocks, conflict in the Middle East and Ukraine and lofty valuations, not to mention a presidential election in November.

As always, a well-diversified portfolio can help to limit the impact of volatile markets and to maintain focus on long-term market results.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, FactSet, Fidelity, KIM, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.