Investing in an Election Year

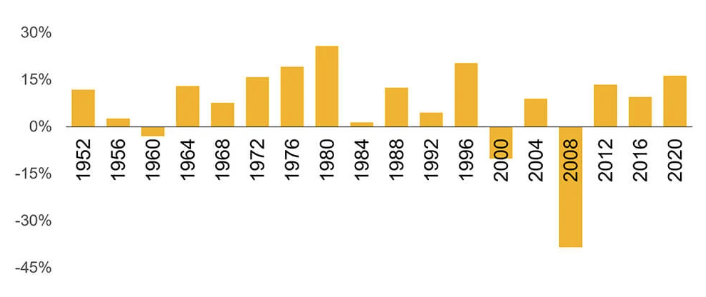

Political news will dominate the headlines for 2024, and we all know this can be contentious and anxiety-provoking. There is a tendency among investors to worry — especially now — but historically, presidential election years have been very good for stocks.

In the year ahead, it will be critical to remember that there are things in your control and things out of your control. Spending time and energy on the things you can control will make it easier to withstand any potential headwinds that may occur.

S&P 500 Performance in Presidential Election Years

There will be lots of noise from candidates about potential policy changes that could affect retirement, estate or tax planning. It can be tempting to react in anticipation of what may happen, but you must be careful not to overreact to the news.

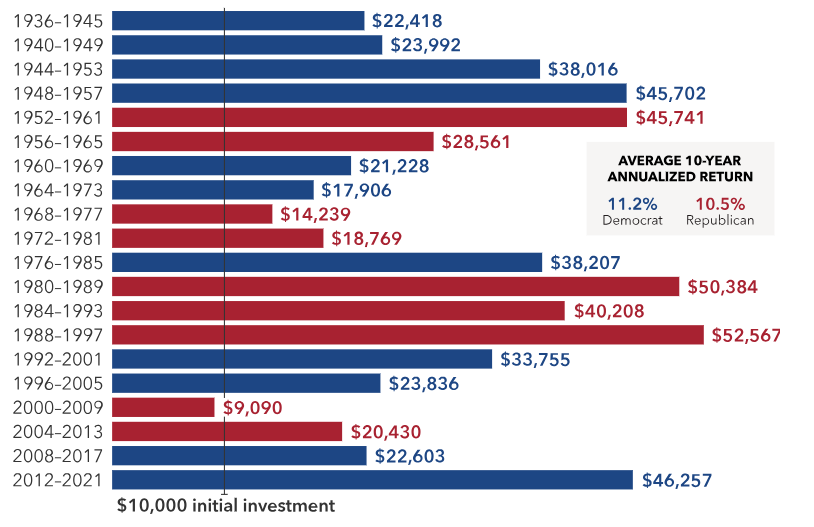

Politics Doesn’t Matter Much for Investors

Sources: Capital Group, Standard & Poor’s. Each 10-year period begins on January 1 of the first year shown and ends on December 31 of the 10th year. For example, the first period covers Jan. 1, 1936, through Dec. 31, 1945. Figures shown are past results and are predictive of results in future periods.

As measured by the S&P 500, the 10-year annualized return of stocks from the start of an election year is over 10% for both Republicans and Democrats. If volatility arises this year, it will provide opportunities for investors who stay focused on long-term investments.

The Bottom Line: Don’t Mix Politics with Your Portfolio

Market Insights & Connections

Want to get in touch?

Send us your contact information and one of our representatives will be reaching out soon!