Fifteen years ago this week, the stock market bottomed after the vicious bear market crash from the global financial crisis. The S&P 500 fell almost 57% before hitting its low point on March 9, 2009. Like all bad markets have in the past, this one came to an end. The decade of the 2000s went down as one of the worst decades for stock investors.

We have experienced incredible gains since then. The S&P 500 is up more than 900% on a total basis return over the past 15 years. Don’t assume that this climb was in a straight line, either. Over the last 15 years, we’ve had two bear market close calls (2011 and 2018), a global pandemic bear market in 2020 and another bear market in 2022.

The key lesson to remember is that long-term investors were rewarded for remaining invested!

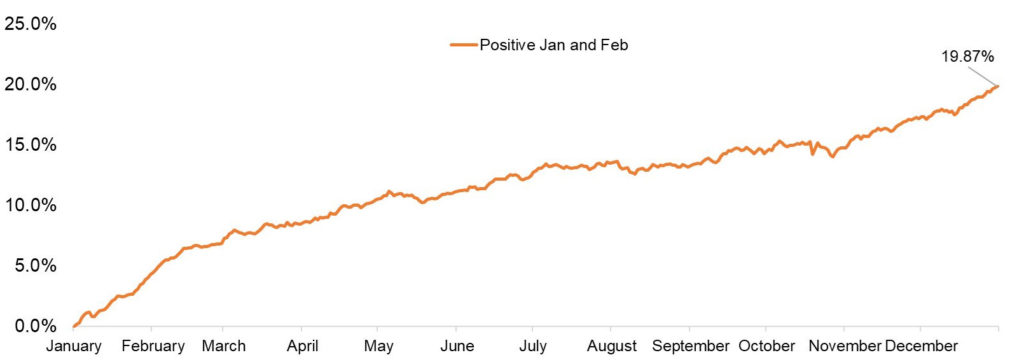

This year, the S&P 500 was positive in the first two months for the first time since 2019. Historically, gains during the first two months of the year have suggested above-average returns for the rest of the year. Going back to 1950, the following months have been higher 27 out of 28 times, with an average return of 14.8%. The S&P 500 was up 19.9% in years when both January and February were higher.

A Positive January and February Is a Good Thing for 2024

S&P 500 performance for the year, based on if January and February are higher

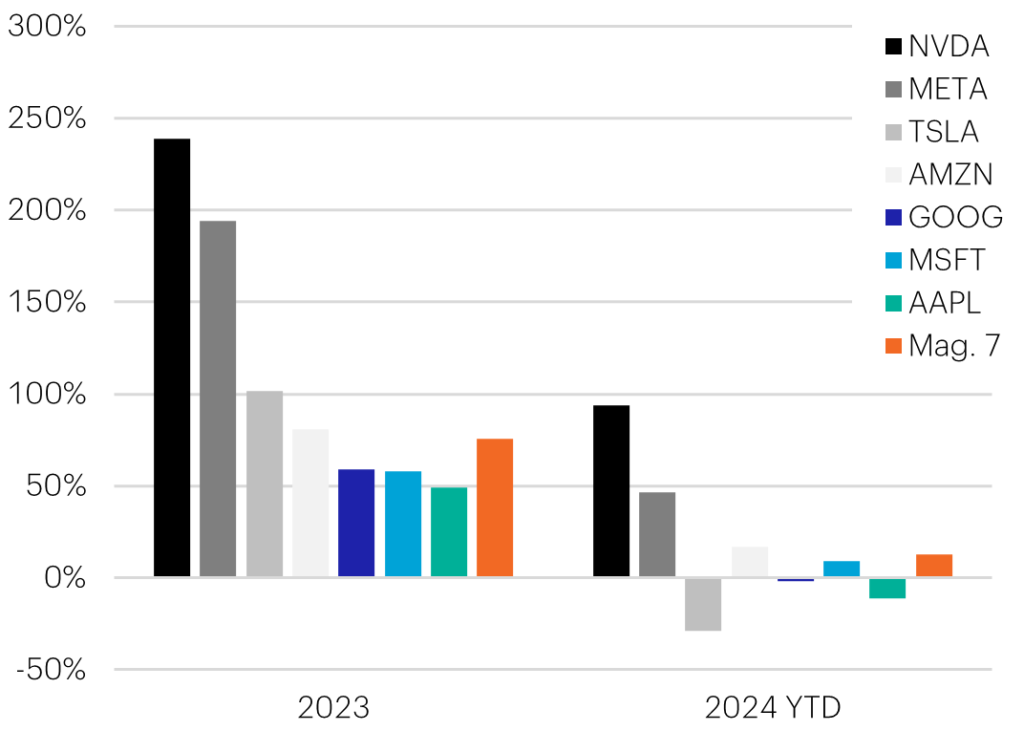

We are starting to see more breadth in this market compared to last year. The Magnificent Seven has not been nearly as magnificent as last year. Nvidia and Meta have started the year very strong, but the remaining five stocks have seen mixed results. As of this week, all 11 sectors of the S&P 500 are positive year-to-date. This is a sign of a much broader rally in the stock market, compared to last year being so heavily dominated by technology stocks.

Magnificent Seven Performance, 2023 vs. 2024

From a portfolio management perspective, we continue to look ahead. The markets are forward-looking, often telling us what may happen ahead of time. The market seems to have put recession talk in the rearview mirror and has moved on to Fed watch: When will the Fed begin cutting interest rates in 2024? Earlier in the year, the market was pricing in as many as six cuts of 25 basis points. That number now is down to three.

Inflation continues to show signs of weakening but remains persistently, stubbornly above the targeted 2% level. With an eye on the future, we are making the following portfolio changes as we end the first quarter:

1. We are beginning to see the broadening of the market away from the Magnificent Seven stocks. Technology stocks continue to be the leading sector in the S&P 500, led by the continued advancement of artificial intelligence. The key for investors is to distinguish between what is hype and what is real from an investment standpoint.

Artificial intelligence is no longer just a buzzword. Companies across all sectors are beginning to harness its potential to automate complex tasks, streamline workflow and accelerate technological advancements. This is not like the GameStop trade during the pandemic. From an equity perspective, we are maintaining our allocation to large-cap stocks as well as technology stocks.

Internationally, we added a position to maintain the overall overseas allocation but switched to a manager that allows for additional flexibility investing not only in developed markets but also in emerging markets. Rebalancing is important to capture some of the winnings and redistribute throughout the rest of the portfolio.

2. We continue to increase the duration of the fixed-income portfolio as we near the peak of interest rates. The longer-dated maturities at the end of the yield curve are more volatile than the short-end of the yield curve. Like with our equity allocation, it is important to rebalance our fixed-income allocations.

We like our fixed-income positions, but from time to time, they need to be shifted to the right size in the right position for where we see the markets heading. We believe that when rates fall, we will be able to capture nice income, along with capital appreciation from rising bond prices.

We continue to maneuver the portfolio in response to where we think the puck is moving.

The world in which interest rates stay higher for longer is not one we have been accustomed to for the last 15 years. Financial markets, both stocks and bonds, may be more volatile in response, and we have seen glimpses of this in the first quarter.

With higher yields for longer, investors are being compensated in cash through money markets and CDs. However, as soon as the Fed lowers the fed funds rate, we will see those yields fall rapidly. We think that much of the pain from rising interest rates is behind us and the key to navigating volatility remains being in a diversified portfolio. We will continue to monitor the portfolio and make changes to go to the puck, not wait for the puck to come to us.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, FS Investments, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.