There is a popular Wall Street maxim: “Sell in May and go away.” This suggests investors should sell their equity holdings this month and then reenter the equity market in November, based on the historical tendency of stocks to underperform between May and October (compared to November through April). This may be especially true for some investors after the month of April, where all three major indexes — S&P 500, Dow and NASDAQ — all were lower.

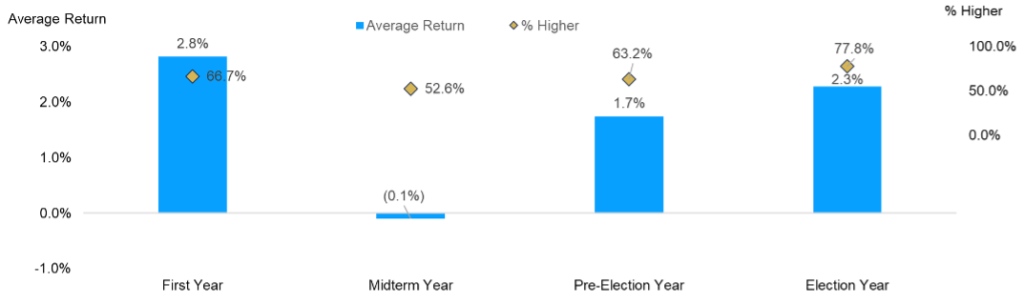

Those who regularly read our commentary know that we would never espouse this theory, but it is good to look at these “trends” to see if they hold water. We clearly do not advocate selling based on the calendar. Dating back to 1950, the S&P 500 has averaged only 1.7% from May to November, and the market was higher less than 65% of the time in pre-election years.

However, during election years, the average has increased to 2.3% and has been higher almost 80% of the time. While this is not a huge return for a six-month period, it is still a positive return.

What About Sell in May in an Election Year?

S&P 500 performance (May-October), broken down by presidential cycle (1950-current)

Earlier this year, many economists and investors were thinking that the Federal Reserve would reduce interest rates as many as six times in 2024. As the year has progressed, the economic data reflects that while we have made progress on inflation, it remains higher than expected.

As seen in the chart below, the market now is projecting one or two rate cuts instead of a possible six by the end of 2024. Recent market volatility and trends have been dependent on economic data and how the market interprets what the Fed may do based on inflation reading, job numbers or GDP estimates, for example.

Market Expectations for Fed Rate Cuts This Year Have Declined

It is worth thinking about what would happen to the market if the Fed were to cut rates only one or two times this year — or not at all — instead of six times. If the Fed were to stand pat, it may not necessarily result in a bad outcome.

Below are three reasons the Fed may not reduce rates — and how it may still be a good year in the market:

1. The U.S. economy is in good shape. The economy continues to grow at a healthy pace; its resilience in the face of higher rates has been a nice surprise over the last two years. In 2022, most economists thought that we would be in a recession by now. American consumers continue to spend, the labor market remains strong with unemployment below 4%, and manufacturers continue to invest in capital expenditures — especially related to artificial intelligence.

2. Progress on inflation is stalling. Inflation has come down considerably from 2022, when we saw CPI over 9%. But the battle is not over, and inflation remains above the Fed’s 2% target. Fed officials have stated that the last mile, from 3% to 2%, will be the hardest and may take a while. If the Fed doesn’t cut rates this year, it will be because inflation isn’t falling fast enough. (The Fed doesn’t want to repeat the 1980s.) The U.S. unemployment rate remains near 50-year lows, and inflation still is headed in the right direction.

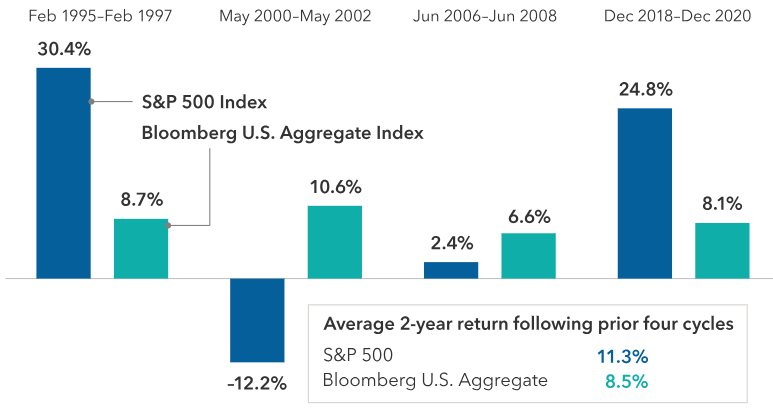

3. Financial markets are good with the status quo. The stock market hit a record high in the first quarter of 2024. Stocks have been able to overcome the fear that higher interest rates would bring the bear market to an end. Bond investors have benefited from higher yields, and investors continue to see a nice return on cash while rates remain elevated. A market rally with higher interest rates is not unusual. Stocks and bonds have done well in periods following a Fed rate-hike campaign.

Powering Through Rate Hikes

Two-year annualized returns (%) following the end of prior hiking cycles.

Over time, markets tend to adjust to the prevailing interest-rate environment. As long as rates remain stable, markets have been able to move higher, as they are strongly influenced by corporate earnings and economic growth more than monetary policy. The bond market continues to price in one or two rate cuts before the end of the year. However, if the Fed were to decide not to cut rates, that could be a factor of both sticky inflation and the economy humming along.

If that is the case, both stocks and bonds could produce nice returns without the Fed actively cutting rates.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, CNN

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.