After another rough start to the month of September, stocks have rallied and have remained positive for the last three weeks. The S&P 500 has been up 10 out of the last 11 months, and all three major U.S. stock market indexes are near all-time highs.

The big story last month was the Fed’s decision to cut interest rates for the first time since March 2020, when Covid-19 shuttered most of the world’s economy. The Fed reduced interest rates by 50 basis points on Sept. 18. Although it was widely expected that the Fed would cut rates, questions remained about the size and timing.

Did the Fed’s decision have anything to do with the election?

The Fed made the cut in its final meeting before the election in November; its next meeting will be Nov. 7, two days after the election. The Fed has consistently and repeatedly stressed that political considerations do not factor into its decision-making, regardless of what some media reports may say.

“We never use our tools to support or oppose a political party, a politician, or any political outcome,” Chairman Jerome Powell said at the Fed’s July press conference. “Anything that we do before, during or after the election will be based on the data, the outlook, and the balance of risks, and not on anything else.”

The Fed has shifted its focus from the fight against inflation to the health of the job market. For much of the past few years, unemployment has been so low and inflation so high that the Fed could focus predominantly on reigning in inflation. Now, unemployment has risen above to 4.2% from a low of 3.4%, and the pace of new jobs being added each month has slowed.

Are rate cuts near all-time market highs normal?

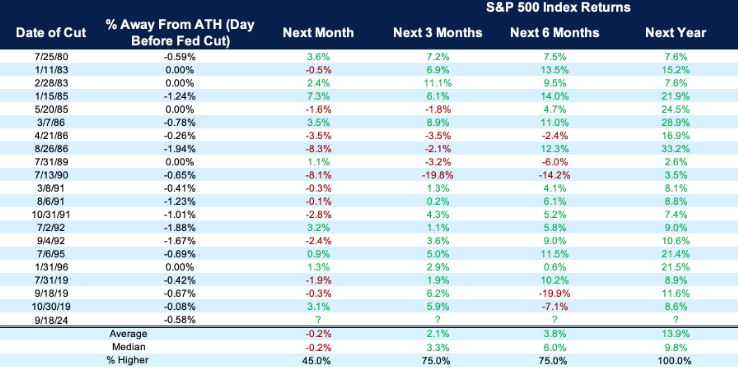

This is not the first time that the Fed has cut rates with the market at or near all-time highs. In fact, this most recently occurred in 2019. There have been 20 times that the Fed cut rates when the market was within 2% of all-time highs, and in each instance, stocks were higher a year later. Remember the adage: Don’t fight the Fed!

Fed Cuts Near All-Time Highs

S&P 500 returns after Fed cuts within 2% of an all-time high

Does this mean that the Fed thinks the economy is in trouble?

The economy continues to surprise to the upside. While the labor market has been cooling, it is important to remember that it is coming down from unusually high levels from the global pandemic. GDP growth for the last five years was revised from 9.4% to 10.7% and grew at 3% for the last quarter. Disposable income for households also was revised higher and as a result, the savings rate was revised up from 3.3% to 5.2% in the previous quarter.

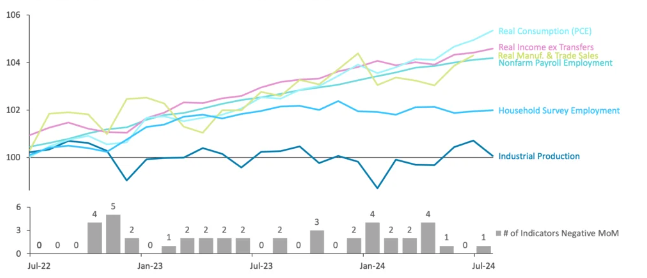

Corporate earnings are expected to grow at double digits for the year and are expected to grow 15% for 2025. Looking at the chart below, only one of the six indicators used by the National Bureau of Economic Research for recession tracking reflects a potential recession.

Recessionary Indicators

National Bureau of Economic Research recession indicators for the United States (normalized to July 2022)

What do rate cuts mean for consumers and investors?

It is important to remember that the Fed controls very short-term rates only. The Fed does not set interest rates for mortgages, CDs, or bonds. However, it can influence these rates through its actions. Consumers may feel the impact most immediately with lower interest payments on debt that is tied to the prime rate, like credit cards or auto loans.

Interest rates on longer-term debt, like mortgages, have already been falling in anticipation of lower rates coming. It is important to note that mortgage rates won’t keep pace with Fed rate cuts, and the days of 3% mortgages are a long way off — if they ever come again.

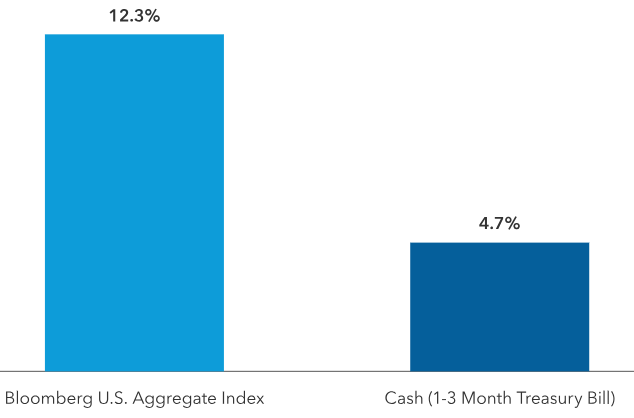

Investors have been anxious for the Fed to begin cutting rates. There have been 13 rate-cut cycles since World War II, with an average S&P 500 return after the first rate cut of 14%. It is not just stocks that stand to benefit from lower rates. As the Fed lowers rates, cash yields will drop in tandem. Investors faced with lower rates on cash have been moving into stocks and bonds to replace the lost yield.

Historically, bonds have been at their strongest in periods of rate cuts since bond prices rise as yields fall. Average returns for the U.S. Aggregate Bond Index have outpaced cash proxies in rate-cutting periods over the last 40 years.

Falling Rates Have Supported Bond Returns

Average annualized monthly returns during rate-cutting cycles

Where do we go from here?

The market is pricing in that by this time next year, the Fed will have cut interest rates eight to 10 times, and the benchmark rate will be at 3%. That would be much lower than today’s rates but still higher than any time from 2009 to 2021.

October typically has been the worst month during an election year, and we wouldn’t be surprised to see some volatility during the month. However, the good news is that November and December do quite well in election years as the uncertainty of the election is removed. Investors have been rewarded for staying invested amid the constant negative sentiment and worry.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing; we are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, Fidelity, NBER