After just one month, 2025 already is feeling much different than 2024. The past two Mondays have started off with a bang: Last week, news out of China about an artificial intelligence startup made waves, and this week, top headlines focused on how potential tariffs may affect the markets.

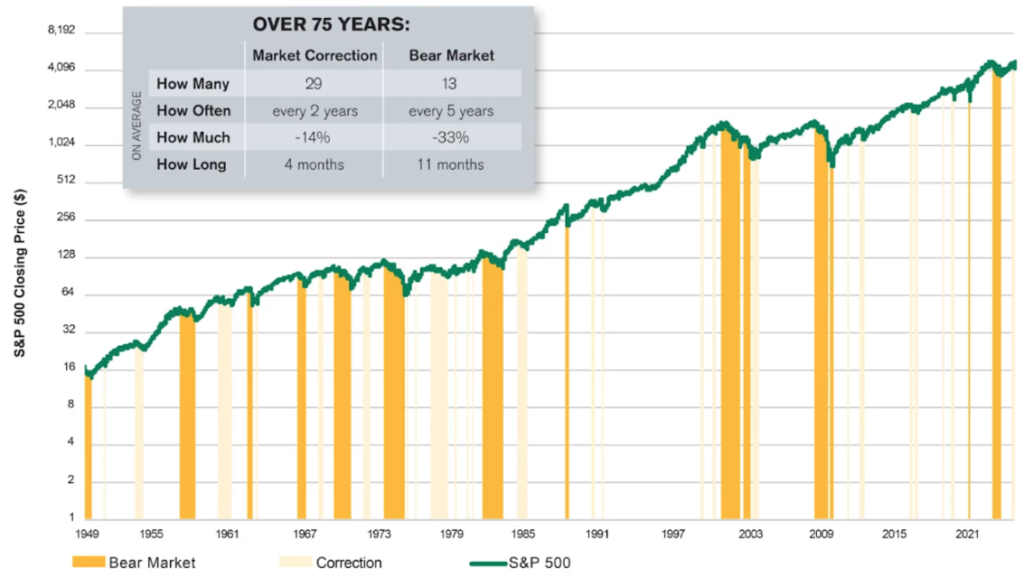

Last year was unusually quiet for volatility in stocks; the biggest pullback was 8.5%, well below the market’s average drawdown of 13%. For investors, it is important to remember that the market typically doesn’t move smoothly — or only in one direction. The market clearly shows an upward trend over time, but as seen in the chart below, there have been bumps in the road.

In the past 75 years, there have been 29 market corrections (when the market drops 10% from its peak). Bear markets occur much less frequently; there have been just 13 bear markets in the past 75 years, and two of those have been within the last five years. A key stat for investors: It takes an average of just four months for the market to recover a loss after a decline of 10%!

Average Length of Bear Markets and Market Corrections

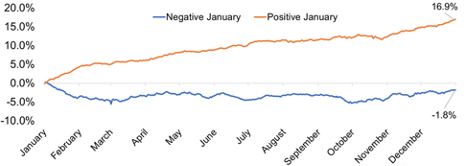

Even with the volatility we saw last week, the S&P 500 finished in the positive for the month of January. Historically, when January has been positive for the S&P, the rest of the year has been up an average of 16.9% and positive more than 86% of the time. This is a good sign for the rest of the year.

The Effect of a Positive January

In the last few years, the Magnificent Seven stocks (Apple, Amazon, Alphabet, Microsoft, META, Nvidia and Tesla) and the development of AI have driven the market. Last week’s news of a new development in AI introduced new uncertainty into the market — along with new potential. A company out of China, DeepSeek, released an AI model that appears to be as powerful as existing ones, such as ChatGPT, but trained at a fraction of the computing cost. The accuracy of the reports has yet to be fully verified.

Founded in China in 2023, DeepSeek apparently used 10,000 Nvidia chips that it acquired in 2021, before export controls were imposed by the United States. Two weeks ago, DeepSeek released DeepSeek R-1, a more advanced reasoning model with innovative methods that reduced the training cost. The release sent the tech world into a brief frenzy, as DeepSeek took over the No. 1 spot for most downloaded free app in the U.S. Apple store, dethroning ChatGPT.

Until now, it looked like only a few of the largest tech companies had the financial and technological resources to compete and dominate the AI arena: Microsoft (ChatGPT), Google (Gemini) and Amazon (Claude). After the DeepSeek release, the AI sector is now awash with questions around the legitimacy of the cost, what it took to develop the application and the future implications of this development.

There is an economic theory called the Jevons paradox, which states that increased efficiency in the use of a resource can lead to an increased demand for the resource.

For AI, this could lead to a lower cost of chips, increasing demand of the chips and in turn causing resource use to increase. In turn, that could lead to additional capital spending — not less, as early news reports feared. Last week’s earnings calls from Meta and Microsoft indicated a full-steam-ahead approach on spending plans for AI, not a slowdown.

Ultimately, the market will reveal the AI battle’s winners and losers. The big-picture view is that AI will permeate the economy faster if the cost to access it is lower. Companies will ramp up their spending even more, which will be good for the growth of the economy and productivity of companies. In the interim, market pullbacks like we have seen the last two Mondays are par for the course.

The cause of the declines is always different, and the headlines can be scary. However, the key is to remain invested, stay diversified, and avoid making irrational decisions based on the headlines of the day.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Fidelity, JP Morgan, American Century, Carson, Goldman Sachs