The markets have been volatile in the second half of February and the beginning of March as worries over the economy,tariffs and technology stock weakness have dominated the headlines. The positive returns we saw in January have all but vanished.

February historically has been a weak month, so in many ways, what we are seeing is normal and not a reason to panic. It’s easy to forget that we are coming off back-to-back gains of 20% in the S&P 500 the past two years, and maybe a break is due. Just two weeks ago, we saw market highs in the S&P 500, but today, that feels like a long time ago.

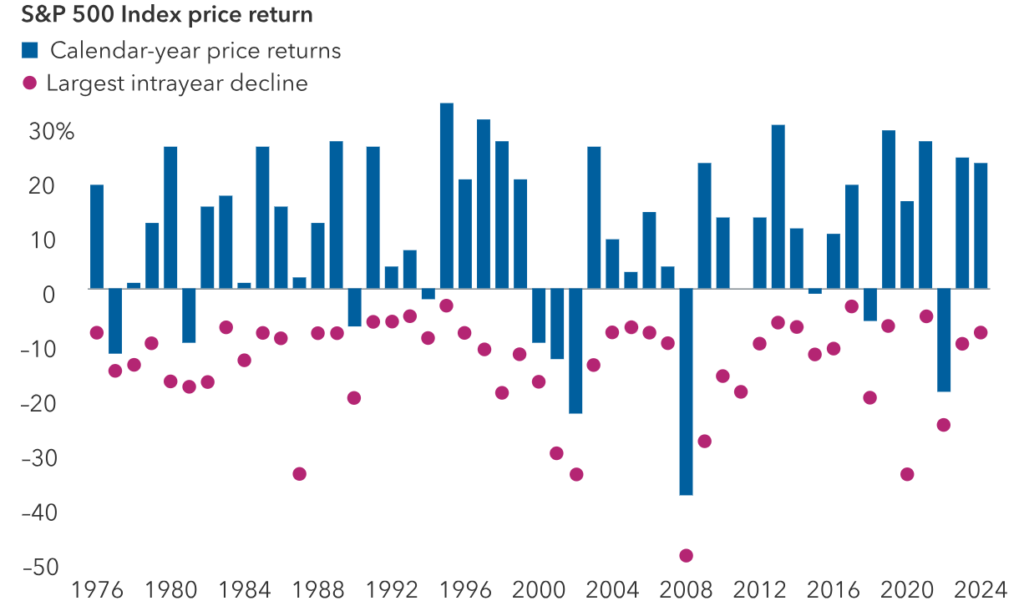

Over the past two decades, March and April historically have been two of the better months, while February has been one of the weakest. The chart below illustrates that markets have declines and pullbacks in every year. It’s a good reminder that downturns are regular and that we should learn to expect a few market surprises.

Market Declines Have Happened Every Year

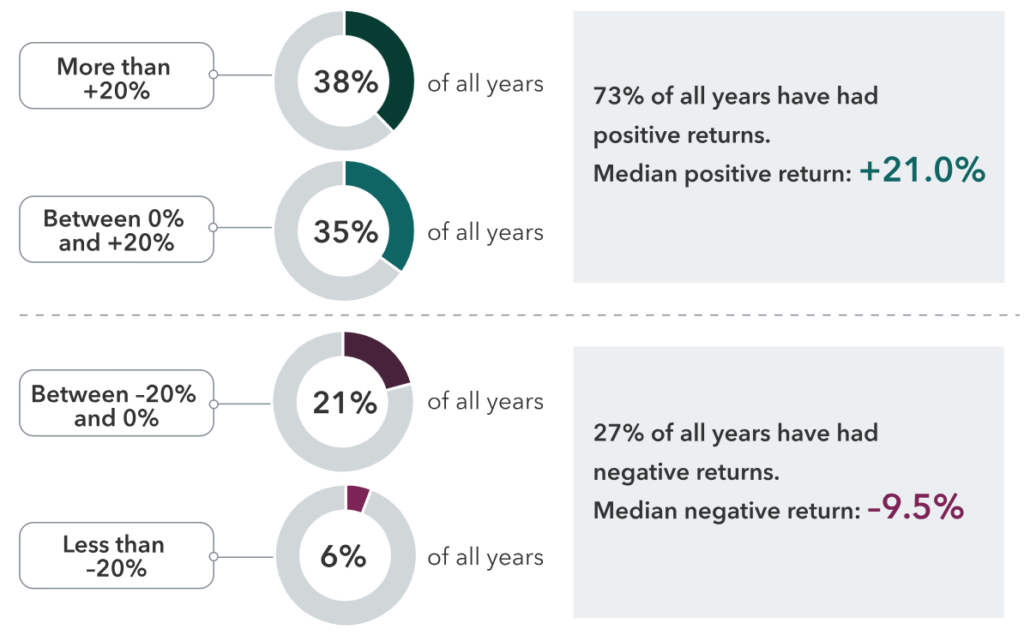

Going back to 1928, S&P 500 returns show that the market has been positive almost 75% of the time — three out of every four years on average! Stocks were negative only one in every four years on average.

The economic backdrop remains positive, bolstered by strong wage growth, steady rates and potential new policy designed to foster growth in America. These high expectations have led to valuations that may be elevated, but that doesn’t mean that everyone should abandon stocks.

S&P 500 Annual Total Returns, 1928-2024

Uncertainty around tariffs, federal layoffs and a weakening economy contributed to the markets’ performance in February. To put the layoffs into perspective, federal employees account for only about 1.5% of the workforce, and economists project that the job losses could account for less than .5% of current non-farm jobs in the U.S.

The Atlanta Fed recently estimated that the first-quarter GDP would be negative, dropping from +2.3% to -1.3%, based largely on the effect of tariffs on imports from Mexico, Canada and China. The tariffs have prompted retaliatory measures from those countries, along with concerns about economic growth and consumer prices.

There is no doubt GDP growth is likely to slow from the 3% annual pace we have seen the last few years, but the Atlanta Fed’s estimate does not take imports into account. While the headline number drew attention and cause for concern about potential recession, numbers alone don’t tell the whole story, as is often the case.

From a portfolio management perspective, we continue to look ahead — just as the markets are forward-looking, often telling us what may happen. With an eye on the future, we are making the following portfolio changes as we end the first quarter:

1. Diversifying Beyond the Magnificent Seven

Over the last two years, the markets have been dominated by the Magnificent Seven stocks – Apple, Amazon, Google, Meta, Microsoft, Nvidia and Tesla. Last year, we saw some early movement towards the other 493 stocks in the S&P 500. This year, we have really started to see the broadening out of the market, as the current leaders so far are some of the stocks that led the markets years ago.

That isn’t to say that the technology trade is dead — far from it, as investment in artificial intelligence is still in its infancy. From an equity perspective, we are maintaining our allocation to large-cap stocks as well as technology stocks. We are adding some additional exposure to value stocks as the market continues to move back toward a sense of normalcy regarding market breadth.

We also are tweaking our mid-cap exposure to make sure we maintain true exposure to the asset class. As is often the case with mid- and small-cap stocks, they tend to move either up or down in market cap as they grow or get acquired. Sometimes, they shrink due to market struggles or economic situations. Rebalancing the portfolio is important to capture and redistribute some of the winnings.

2. Rebalancing Fixed-Income Allocations

With the yield curve continuing to normalize and remaining un-inverted, we want to make sure the duration of the portfolio remains in line with the aggregate index. The longer-dated maturities at the end of the yield curve are more volatile than the short-end of the yield curve.

We have seen more volatility this year in the Treasury market as the markets try to understand which direction the Fed may be headed with interest rates and inflation. Like our equity allocation, it is important to rebalance our fixed-income allocations. From time to time, they need to be shifted to rightsize the positions and put them in position for where we see the markets heading.

We believe that when rates fall, we will be able to capture nice income, along with capital appreciation from rising bond prices.

Market sentiment has soured due to uncertainty. Talk of recession is starting to loom — and one of the biggest threats to your portfolio could be you.

Staying invested in the face of market turmoil is easier said than done. While your gut may compel you to sell to curb the downturn, getting out of the market — even for a short time — can be devastating to the portfolio.

We continue to maneuver the portfolio in response to where we think the puck is moving. We are not accustomed to a world where interest rates and inflation are higher. Financial markets, both stocks and bonds, are more volatile in response, which we have seen in the first two months of the year.

Staying in a diversified portfolio still is the key to navigating volatility. We will continue to monitor the portfolio and make changes to go to the puck, not wait for the puck to come to us.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, Fidelity, Schwab