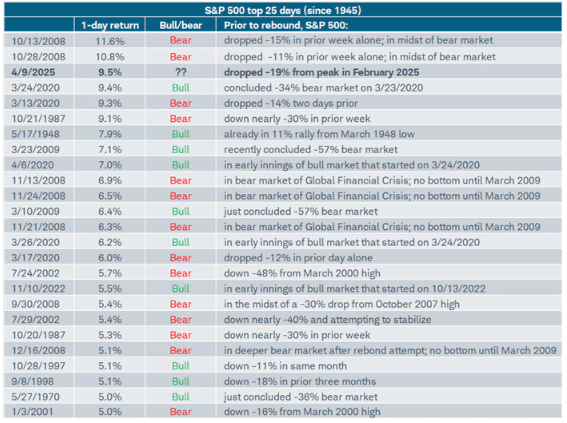

Last week was a memorable one in the equity markets. The S&P 500 fell more than 10% for the first two days of the week — one of the worst two-day declines ever — only to be followed by a gain of more than 9.5% in one day, the third-best day since World War II.

Going back to 1945, the S&P has gained more than 5% in one day 25 times. As the table shows, more of those occurrences happened during a bear market (14) than in a bull market (10). Some of the largest daily gains in stocks came almost immediately after bear market lows and/or major corrections. This serves as a great reminder that when things feel bad in the stock market, a big day can happen quickly, so it is critical to stay invested.

Last week, the S&P 500 was very close to entering into a new bear market (more than a 20% drop from recent highs). Intraday, the S&P 500 did fall more than 20%, but by the close, it was down only 18.9% from the high. Both the NASDAQ and the Russell 2000 (small cap stock index) had fallen into bear market territory.

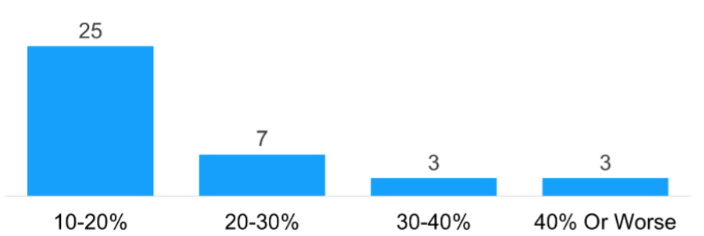

We have seen two bear markets in the S&P in the last five years — in 2020 and 2022 — and two close calls — one in 2018 and one this year. Only one of the last four big market declines led to a recession, and that was due to a global pandemic.

Here’s the important thing to keep in mind: The market goes down about a third of the time, and stocks always have gotten past the down markets. We don’t think that this time is any different.

Corrections and Bear Markets Since WWII

Man-made supply shocks caused by policy decisions (i.e., tariffs) are dominating the current environment. Here are some important takeaways to keep in mind during this period of volatility and uncertainty:

1. The stock market does not appear to like tariffs.

Tariffs are taxes that importers pay. These taxes either hit the company’s bottom line or they will be passed on in higher costs to the supplier and consumer. Businesses must adapt to tariffs — and the policy is changing on a seemingly daily basis. The market is concerned that the effective tariff rate could erase most of the economic and double-digit S&P earnings growth that was expected this year — as well as GDP growth.

2. Global investors are reducing their exposure to U.S. assets.

Fixed-income markets have been hit along with the U.S. stock market. Bond yields initially sank after the tariff announcement on April 2 and subsequently rose after higher tariff levels on some countries, such as China. The Federal Reserve continues to signal that it will keep its policy rate steady.

The trade war puts the Fed in a tight spot; a prolonged trade war could drive the economy into a recession, but inflation is holding higher than 2%. Treasury rates have surged to their highest level in over a month, while one of the main goals of additional tariffs is to reduce the long-term rates. It is more than likely that the rise in rates is due to hedge funds and institutions selling stocks and bonds to raise cash in the face of high market volatility.

3. Market volatility can affect policy decisions.

Both the stock and bond markets reached a fever pitch last week. Excess volatility in fixed-income and currency markets drove a policy pivot and led to a 90-day pause for most tariffs. Tariffs are not laws; the International Emergency Economic Powers Act gives the president the authority to levy them. There is some discussion that the Supreme Court will need to get involved, but legal clarity takes time, and potential further market volatility is expected. The latest tariffs may not persist at current levels. The good news is that tariffs can be removed with the stroke of a pen.

4. Volatility can create opportunities.

With stocks down and yields up, investors with excess cash can take advantage of both stocks and bonds. This could be an opportunity to convert a Roth IRA if the value of the Roth is down significantly from recent highs. As we previously discussed, missing the big gain last week is the equivalent of missing nearly a year and a half of market returns. Trying to time this (or any) market is very difficult. The S&P has never failed to make new all-time highs after selloffs or bear markets.

In the coming weeks and months, we are likely to see continued market volatility as the stock and bond markets digest the impact of ever-changing policy initiatives. Remember, long-term investment goals require long-term perspective, especially during times of heightened market volatility.

We fully understand it is hard to watch portfolio values fluctuate with the ups and downs of the market, but sticking with the long-term strategy will pay off over time. As always, we will be keeping a very close eye — and we will keep you apprised.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, JP Morgan, Schwab