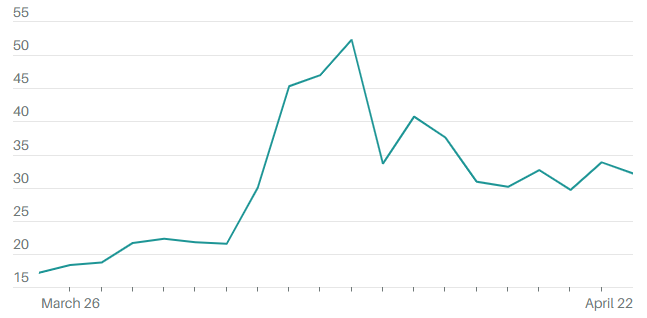

Another week, another roller-coaster ride in the stock market. Volatility has stayed high since “Liberation Day” and the announcement of tariffs on multiple countries. The chart below shows the volatility index for the last month; it does not look that different from the pandemic, when we saw big market swings daily.

Big Swings

Volatility because of tariffs nearly matches what it was during the financial crisis and the COVID-induced recession.

The most recent culprit of market weakness was President Trump’s push against Federal Reserve Chairman Jerome Powell. Trump has repeatedly criticized Powell for not cutting interest rates fast enough and has made overtures about possibly firing him. On Tuesday, Trump said he had no intention to fire Powell, and the market responded positively Wednesday.

The Fed’s independence — specifically the ability to carry out its duties without interference from elected officials — is foundational to achieving economic stability. It is unlikely that the Fed will come to the market’s rescue (like it did in 2018 and 2020) because of worries that tariffs will be inflationary.

Understanding Market Volatility

Volatility reflects the amount of risk related to fluctuations in a security’s value. A highly volatile security can see its price change dramatically in either direction in a short period of time. A security with low volatility will tend to hold its value over time and not move much.

The Volatility Index

One of the preferred measures to gauge market volatility is the Volatility Index (VIX), a measure of forward-looking volatility for the next 30 days. Also known as the fear gauge, the VIX reflects the market’s short-term outlook for stock price volatility, as derived from option prices on the S&P 500. This index is not something that can be purchased like a stock or bond.

The higher the VIX, the more volatility in the market and the larger the market swings. The VIX is a good indicator of fear in the market. Less than a month ago, the VIX was trading at less than 20; the long-term average of the CBOE Volatility Index is around 19.5. After April 2, however, the VIX index surged to over 50, a level not seen since the height of the pandemic.

For reference, here is how the VIX often translates:

• 0-15: A certain amount of optimism in the market, as well as low volatility

• 15-25: More volatility in the market, but nothing too extreme

• 25-30: More market turbulence, and volatility is increasing looking forward

• 30+: The market is highly volatile and extreme market swings are likely to occur

We find that when the VIX spikes, investors often want to sell or get out of the market. The market then experiences more wild swings like we are seeing today, and the fear gauge rises.

Instead of thinking about timing the market or selling out of equities, we want our clients to do the following:

1. Revisit your investment objectives and your financial plan. Longer-term objectives are made possible when taking an appropriate level of risk.

2. Maintain a longer-term mindset. Do not let market volatility or your emotions convince you to abandon your prudently designed, long-term investment plan. Short-term, reactive decisions can derail your plan.

3. Continue to contribute. Maintain your savings of cash according to your periodic investment plans, such as your 401K or dollar-cost averaging into your portfolio.

Volatile times in the market also present opportunities, such as tax-loss harvesting, dollar-cost averaging, increasing contributions to take advantage of lower prices, and potential Roth IRA conversions. The stock market seems to be one of the few markets where investors don’t want to buy at sale prices and would rather pay full price.

Resist the urge to time the market and look for a good sale!

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, JP Morgan, Schwab