The Santa Claus stock market rally came a little early this year. Last week, the Federal Reserve left interest rates unchanged and signaled the end of the hike cycle. The Fed acknowledged that inflation is easing faster than expected and that several Fed members favor cutting interest rates in the first half of 2024. The Fed’s statement also acknowledged that the pace of economic activity is slowing.

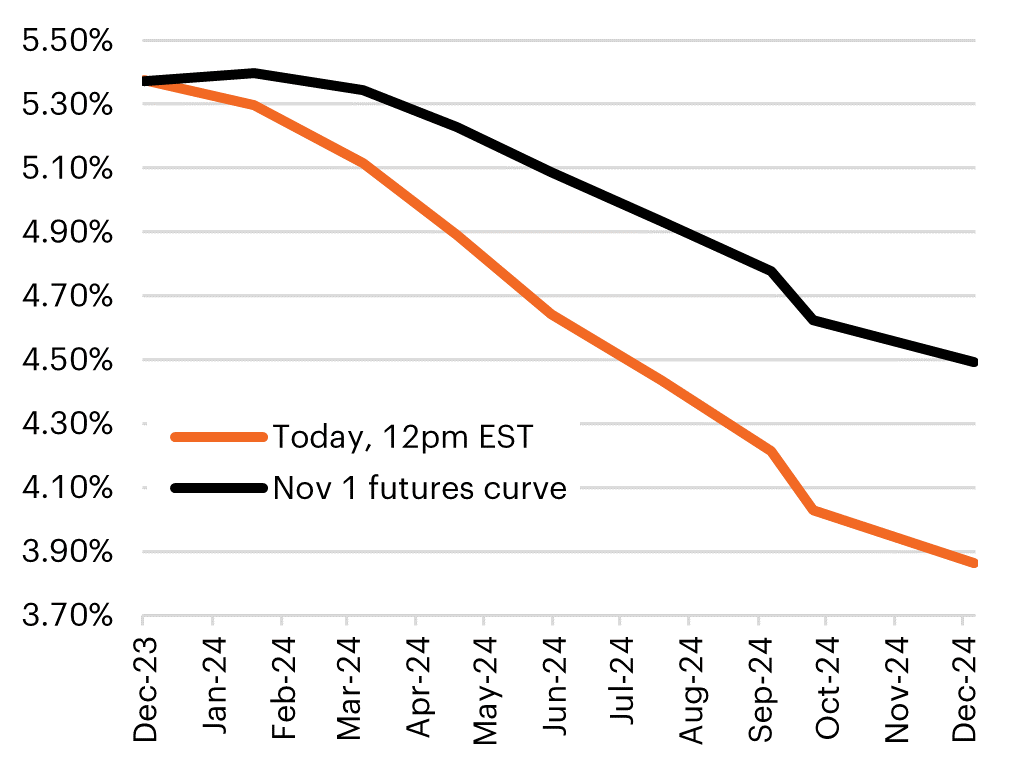

Bond yields fell on the news, and the stock market rallied. Fed Chairman Jerome Powell emphasized that the risk of not doing enough to curb inflation is now balanced with the risk of holding rates too high for too long and in turn, potentially breaking the economy in the process. As seen in the chart below, before the Fed announcement, the market wasn’t expecting an interest rate cut before the third quarter of 2024 — and now, following last week’s Fed meeting, as many as six rate cuts are being priced in next year.

Markets Expect 6 Rate Cuts in 2024

There are plenty of reasons we believe in being bullish as we head into 2024:

1. Inflation continues to show signs of moderating to the Fed’s target of 2%.

2. Interest rates are normalizing. We expect bond yields to decline in line with falling inflation and slower economic growth. This year, we saw the 10-year Treasury span a huge range from as low as 3.25% in April to as high as 5.02% in October.

3. Consumers appear to have plenty of disposable money in their pockets. Consumer spending should grow more slowly as job gains diminish, but on aggregate, financial conditions are nowhere near levels before the great financial crisis.

4. Household wealth and liquidity remain robust.

5. The U.S. government has committed more than $1.4 trillion for capital projects. This has the potential to reshape U.S. manufacturing and energy — and boost the semiconductor industry.

6. Economists are expecting corporate earnings for companies in the S&P 500 to grow by double digits in 2024. Increased earnings could provide a runway for stocks to head higher.

7. Almost $6 trillion of cash remains on the sidelines. Soaring yields in 2023 pulled cash into money market funds and other short-term instruments, such as Treasury bills and CDs. Lower rates in 2024 could force investors to move money into equities and longer-duration bonds to earn a higher rate of return as cash yields fall.

8. Artificial intelligence captured investors’ hearts this year and contributed to the outperformance of stocks led by the Magnificent Seven stocks. AI applications are spawning innovation across many industries, not just in technology companies.

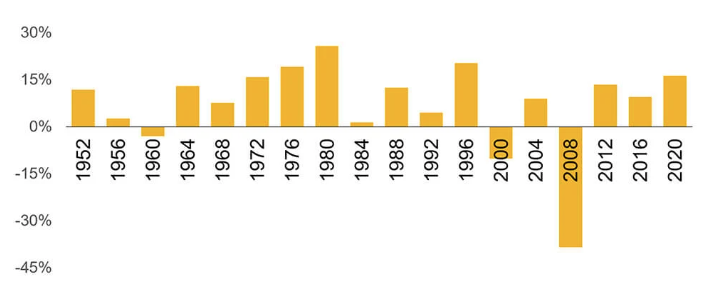

9. Presidential election years have been very good for stocks. There is a tendency among investors to worry about elections — especially now. But going back to 1952, the stock market has declined only three times in a presidential election year. In re-election years, the S&P 500 has not declined since 1948.

S&P 500 Performance Has Been Positive in Most Presidential Election Years Since 1952

Markets do not go up in a straight line, and we expect volatility to continue in 2024. Over the last five years, we have experienced two bear markets, a worldwide pandemic, high inflation and surging interest rates. All the while, the S&P 500 has doubled during this time.

The market hit an all-time high in early 2022, only to see equities and bonds fall precipitously, with both asset classes ending 2022 down big. In 2023, we saw a sharp reversal, led by the Magnificent Seven: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla. The S&P 500 is closing in on a new all-time high as we near the end of 2023.

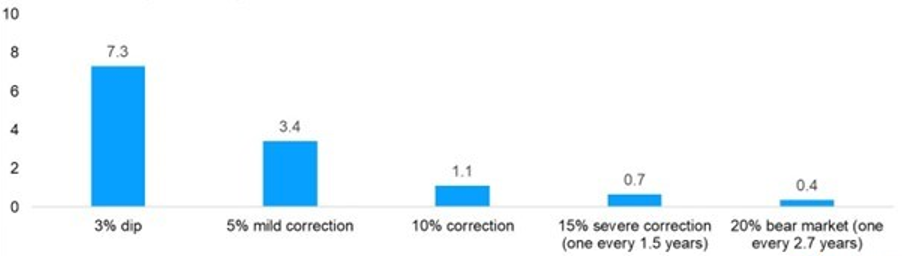

We have referred to the below chart before: On average, there has been at least one 10% market correction each year since 1950, and there is no reason to think that 2024 will be any different.

Volatility Is the Toll We Pay to Invest

S&P 500 per year (1950-2022)

Inflation, Fed policy, artificial intelligence and the Magnificent Seven dominated the market headlines in 2023. Those same topics, along with the upcoming presidential election, will be top of mind as we head into 2024. But over the long term, returns are driven by fundamentals and not the latest noise.

There will be lots of noise from candidates about potential policy changes that could affect retirement, estate or tax planning. It can be tempting to react in anticipation of what may happen, but you must be careful not to overreact to the news.

In the year ahead, it will be critical to remember that there are things in your control and things out of your control. Spending time and energy on the things you can control will make it easier to withstand any potential headwinds that may occur.

We look forward to the challenges and opportunities that lie ahead, and we look forward to guiding you through the upcoming year.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, Carson, FS Investments, JP Morgan, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.