You may have seen recent headlines about bitcoin and other cryptocurrencies getting a boost. Just last week, Tesla said it had purchased $1.5 billion worth of bitcoin and would accept it as payment, and Mastercard said it would open up its network to support certain cryptocurrencies. On Tuesday, the price of bitcoin — the original and best-known cryptocurrency — rose above $50,000 for the first time.

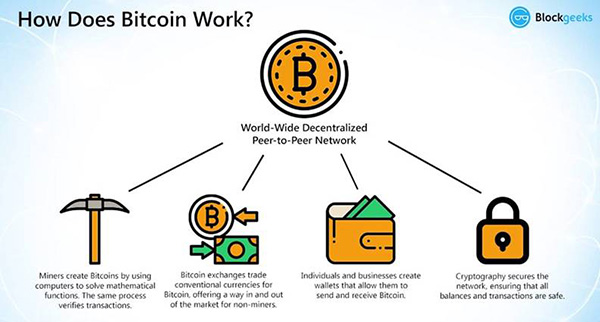

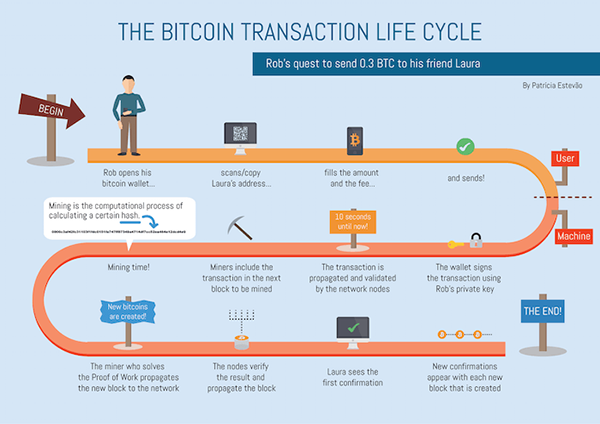

Cryptocurrencies are digital assets that work as a medium of exchange. Ownership records for an individual token (or coin) are stored on an exchange, known as blockchain; this ledger is a shared computer database that reflects who owns these tokens — and in what amounts. There is no single person or organization in charge of the record, so any two people, anywhere in the world, can send bitcoin to each other without the involvement of a bank, government or other institution. Every transaction involving bitcoin is tracked on the blockchain (ledger), which is distributed across the entire network.

Cryptocurrency provides a global method of payment through a computer network, available any time of day or night, anywhere in the world. Fractions of bitcoins may be used as payment, and each transaction is tracked on the blockchain ledger, which is open for all bitcoin holders to see.

One of the allures of cryptocurrencies such as bitcoin is that these digital monies are said to be safe from manipulation or inflation. Bitcoins are produced through “mining,” a process in which very powerful computers solve complex math problems on the bitcoin network, verifying transaction information to ensure the payment network is trustworthy. About 18 million bitcoins have been mined so far, and the supply will be capped at 21 million. As the remaining 3 million bitcoins are mined, the process will move more slowly, and the last blocks may not be mined until 2140.

Of the approximately 18 million bitcoins in existence, an estimated 4 million may have already been lost forever and another 2 million may have been stolen — meaning one-third of the existing supply could be gone already. Some bitcoins have been lost when people lose or forget the encrypted passcode that accompanies the currency as part of the blockchain, which can prove to be a very painful mistake. In fact, one man in England accidentally threw out his hard drive that was loaded with bitcoin and offered to donate more than $70 million to his home city if the council would let him scour the landfill to find it.

There are several ways to invest in cryptocurrency, such as bitcoin. Two more common mediums are through either the Grayscale Bitcoin Trust exchange traded fund (GBTC) or an online exchange, such as Coinbase. Coinbase allows individuals to buy, sell, send and receive bitcoin. The publicly traded option, GBTC, trades at a premium to the actual price of bitcoin and has higher costs than using Coinbase. The price of bitcoin varies substantially on a daily basis and remains unpredictable as an asset class.

Bitcoin is a new kind of money because of its global nature and its constant availability — even on weekends, when banks are closed. Bitcoin transactions are private and secure, as the network has yet to be hacked. Bitcoin remains a relatively immature, volatile asset whose price fluctuates wildly from day to day.

So, what can we learn from all this? Cryptocurrencies like bitcoin are still in their infant stages, as they have only been around for a little more than 10 years. They are still a risky investment that may or not pay off. Investors should invest only as much as they are willing to lose, and if one does invest, it should be part of a well-diversified portfolio.

From an investment perspective, we use the above insights to help with the strategic and tactical asset allocation based on where we see the portfolio heading over the next five to seven years, with short-term adjustments along the way. We are not trying to time the market, but we will try to take advantage when we see where the market is heading. Having a well-balanced, diversified, liquid portfolio and a financial plan are keys to successful investing. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Sources: Blockgeeks.com, Coinbase, Motley Fool

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The Dow Jones Industrial Average is a popular indicator of the stock market based on the average closing prices of 30 active U.S. stocks representative of the overall economy.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It is not possible to invest directly in an index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.