Last week, we saw the biggest one-day rally in the stock market in more than two years as Wall Street reacted to better-than-expected inflation data for the month of October. Loosening restrictions in China also contributed to market confidence that inflation may have peaked in the world’s largest economy. The market is hopeful that the Fed will react to the most recent data with smaller interest rate hikes in December. (While the inflation data that was reported in October is backward-looking, the stock market is looking ahead.) The Fed needs to see continued confirmation that inflation has cooled and will not decide on interest rates based on a single data point. Instead, it needs to see a trend of several months of data that shows inflation slowing down.

Meanwhile, cryptocurrency investors have had a year to forget, capped off with the seismic disruption from FTX, the fourth-largest crypto exchange in the world. In a week’s time, the company went from operating as one of the biggest players in the industry to filing for bankruptcy. The unraveling of FTX is sending shockwaves through the industry. We have seen this story play out before with Enron, Madoff, Stanford Financial and more recently, Theranos. Many smart investors, analysts and auditors were duped by FTX, as it seems billions of dollars was stolen from traders and investors.

What was FTX?

FTX was a centralized cryptocurrency exchange that specialized in derivatives and leveraged products, options and leveraged tokens. It also provided a spot market (immediate exchange versus a futures market that would be delivered in the future) in more than 300 cryptocurrency trading pairs. This exchange allowed traders to speculate and make bets on various forms of cryptocurrency.

FTX promoted the ability for liquidity and transacting in coins and tokens. FTX allowed users to connect their “wallets,” place trades, exchange currencies, and buy and sell NFTs. U.S. residents were not permitted to trade on its platform due to regulations. FTX represented itself as being protected from hackers and as a safe place to store cryptocurrency.

What went wrong?

In recent months, as inflation has soared and interest rates have been lifted, the easy money cash from the days of the pandemic has dried up. That is bad news for digital assets, which are considered sponges for excess money. Less money in the money supply means more risk aversion in the market. When money is easy, investors are willing to take on more risk, such as speculating in cryptocurrency. As the year progressed, investors have continued to sell speculative assets, including crypto.

Sam Bankman-Fried was the founder of FTX and the quantitative trading firm Alameda Research. FTX created its own in-house cryptocurrency, FTT, and used customer funds from FTX in a way that flew under the radar of auditors, employees and investors. FTX used customers’ funds without their knowledge and drastically underestimated the amount of currency it needed to keep on hand if investors wanted to cash out on the trading platform.

Bankman-Fried’s trading firm, Alameda, was borrowing from FTX, using FTT tokens (their own cryptocurrency) to back the loans. In early November, rumors spread about liquidity concerns and allegations of misused funds, and investors began withdrawing funds rapidly. The price of FTT fell 75% in one day, making the collateral insufficient to cover the trade. Early last week, rival Binance had agreed to purchase FTX, but the deal fell through after Binance reviewed FTX’s balance sheet. FTX crashed from a $32 billion powerhouse into bankruptcy in less than one week. At the same time, there was a suspected hack of $477 million of cryptocurrency from the exchange hours after FTX declared bankruptcy.

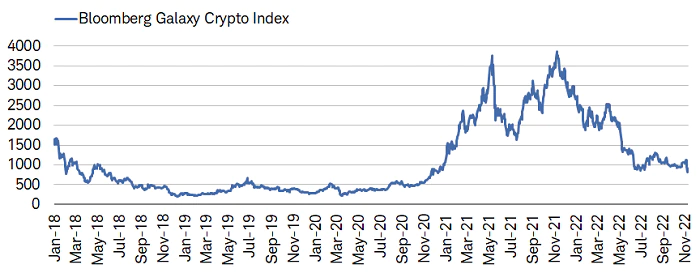

The damage was not isolated to FTT cryptocurrency. Bitcoin, Ethereum and many other cryptocurrencies experienced sharp declines. The Bloomberg Galaxy Crypto Index fell 23% last week, and as shown below, it has fallen 79% from its all-time high a year ago.

What is the potential fallout?

Crypto investors are questioning if their bitcoin or Ethereum is safe. FTX and other exchanges are a type of “crypto-casino gambling websites,” said Cory Klippsten, CEO of the financial services firm Swan Bitcoin. “Any exchange is a security risk. With bitcoin, you have the option to take self-custody and take your coins off that exchange.” If investors keep their cryptocurrency off an exchange, it should mitigate the risk of hacking.

While the financial impact is yet to be determined from the FTX collapse, the effect appears to be isolated to the world of cryptocurrency and does not appear on the larger global markets. It is more than likely that big banks will continue to be wary of letting customers trade crypto through margin or loans. We should expect a continued emphasis on regulation in the cryptocurrency world and continued volatility in the price of cryptocurrencies.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: CNBC, Investopedia, Schwab, Yahoo Finance

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.