Persistent worries about inflation and tightening monetary policy led to January’s market sell-off and NASDAQ’s worst month since the onset of the pandemic in March 2020. The average stock in the NASDAQ composite has experienced a decline of about 47% from its peak, according to a JP Morgan Report. Renewed geopolitical tensions, ranging from the Russia-Ukraine crisis to U.S.-China relations, also are fueling market volatility. And though market volatility is likely to persist, this does not mean that the stock markets will continue to experience similar downward pressure for the remainder of the year.

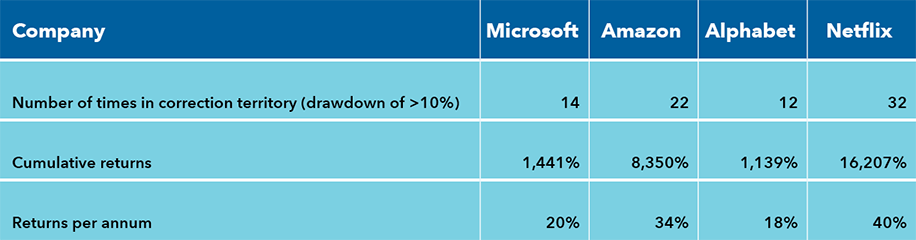

Volatility in growth companies is to be expected in any market environment. Over the past 15 years, some well-known, fast-growing companies experienced multiple corrections that were similar to the ones we encountered in January. Those who remained invested and weathered the market turbulence have realized attractive returns over the long term.

Many positives remain for the current economy. GDP, which was reported last week for 2021, grew at an annualized rate of 5.7% — the fastest growth since 1984. Most economists expect the GDP to grow at a much lower rate for 2022 as fiscal stimulus wanes and monetary policy tightens. The first-quarter GDP is expected to be .1% and around 2% to 3% for the year. While this prediction would mean slower growth this year — thanks to economic drag from COVID and supply-chain tightness — it does not mean a recession is likely. By definition, a recession happens when there are two consecutive quarters of negative GDP growth. Based on economists’ predictions that GDP will be positive and growing, we do not see the economy headed into a recession.

As we wrote last week, the market has tended to rise in periods following initial increases in interest rates. The Fed is intent on normalizing interest rates. The current levels of inflation are driven mainly by supply constraints following a huge shift in demand during the pandemic, not by an overheated economy.

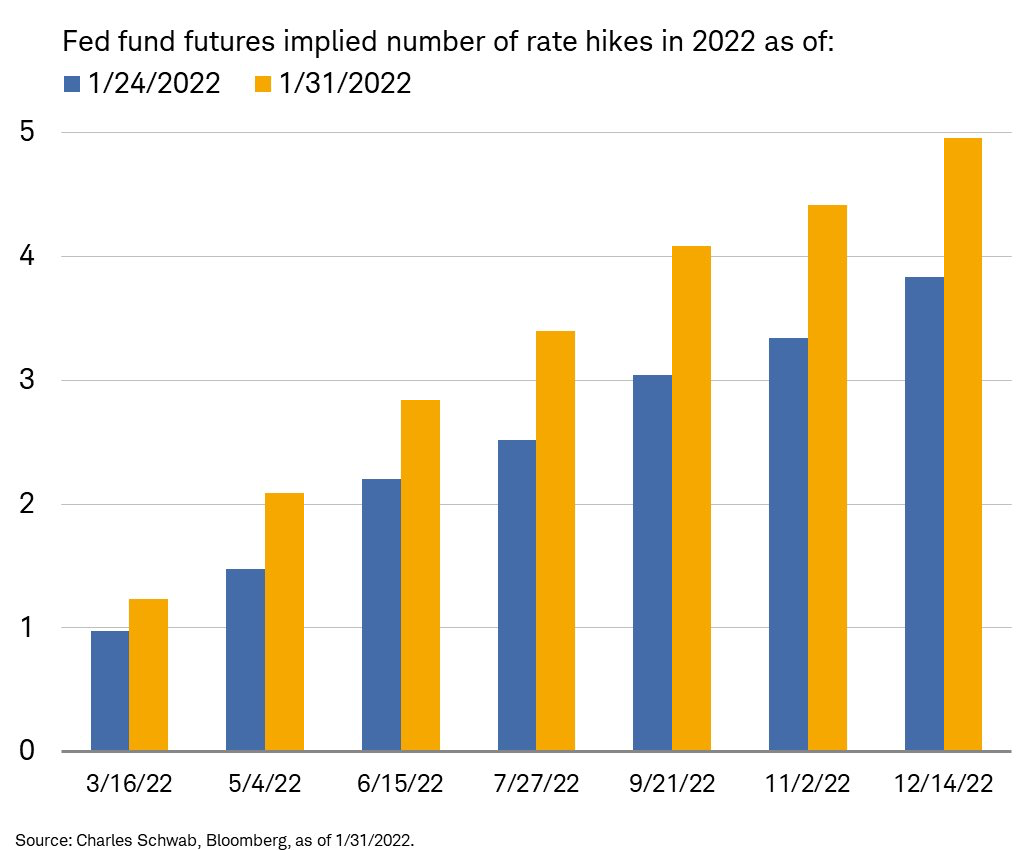

We continue to believe that the path toward monetary policy normalization will be bumpy as the Fed raises rates and tapers bond purchases, and we predict that volatility will continue to exist in the markets. Questions remain as to how many interest rate hikes the Fed will implement in 2022. As the chart below shows, even the change from one week differs on expectations for rate hikes in 2022.

The uncertainty around Fed policy in a highly fluid environment has been the main driver of recent market volatility. Until there is greater clarity from the Fed on inflation, we expect these choppy market conditions to continue.

So, what can we learn from all this? In markets and moments like these, it is essential to stick to the financial plan and not to panic. It’s important to remember that panic is not an investing strategy. Neither are “get in” or “get out” — those sentiments are just gambling on moments in time. Investing is a disciplined process, done over time.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: American Funds, JP Morgan, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures