The first half of the year marked the second-best six month start for the S&P 500 this century, beaten only by 2019. The market is treading water so far in July, which seems appropriate considering the heat wave that has enveloped the country.

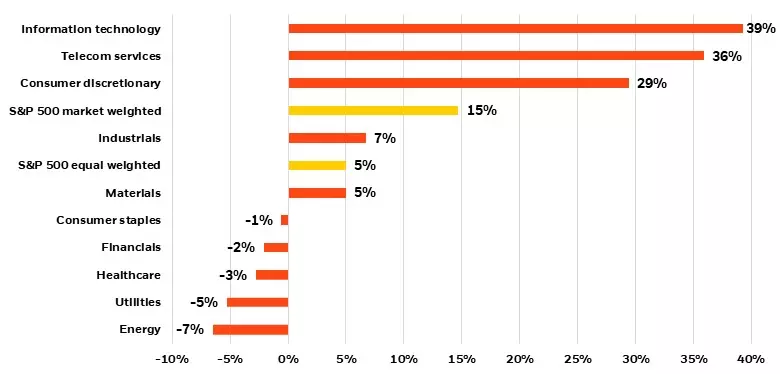

After cratering last year, technology shares carried the S&P 500 for the first half of 2023. Energy led the way for the S&P 500 last year, while technology brought up the rear, and the opposite has been true this year. The chart below shows a breakdown of the S&P 500 along with a comparison of market-weighted returns and equal-weighted returns.

The S&P 500 is a market-weighted index, with the largest stocks carrying the most weight. Apple, Microsoft and Amazon account for 17.62% of the S&P 500 Index. Due to the strength of returns for those three stocks in the first half, the return of the market-weighted S&P 500 index significantly outperformed an equal-weighted index.

In the equal-weighted index, each of the 500 holdings is roughly the same weight, with the largest holding being only .28% of the overall index. That’s a significant difference, compared to Apple being 7.66% of the overall market-weighted index. Since most of the return of the S&P during the first half of the year was from seven large-cap technology stocks, the equal-weighted index did not perform as well, with five sectors being negative.

A Tale of Two Markets

S&P 500 Performance by sector, year-to-date 2023

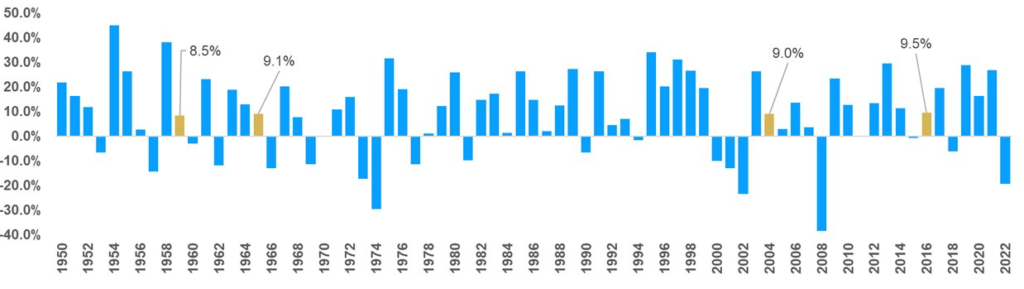

We often talk about average return, or what the market has averaged over a long period of time. As a reminder, the market is rarely average. Just look at the last three years, starting with 2020: a drastic drawdown to start the year with the global pandemic, followed by a steep recovery in the same year. Then 2021 was another strong year, only to see the bottom fall out in 2022 for both stocks and bonds. Over the last 72 years, the market has fallen in the “average range” only four times — a good reminder that the market seldom gains the average of 8-10% in a calendar year.

An Average Year Isn’t So Average

S&P 500 gains between 8-10% are quite rare (1950-current)

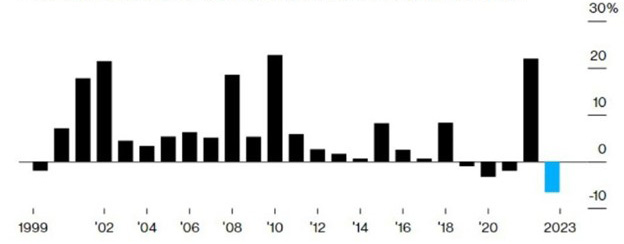

Wall Street strategists remain bearish on the market for a variety of reasons: stretched technology valuations, stubborn inflation, current money market and short-term bond yields, the commercial real estate recession and ongoing concern about regional and smaller banks. They are more bearish now than they have been anytime over the last 24 years for the final six months of the year.

In other years when they expected a negative return over the final six months, we have seen the following returns, with the average return for those four years being 12.2% over the final six months:

• 1999: +7%

• 2019: +9.8%

• 2020: +21.2%

• 2021: +10.9%

Wall Street Strategists Stick to Cautious Equity View

Their S&P 500 target points to the most bearish second-half outlook on record

• S&P 500’s second-half outlook implied by strategists’ average year-end target

Still, there is no guarantee of positive or negative returns for the rest of the year. Ample cash remains on the sidelines, waiting to be deployed. While investors have hunkered down in cash, this also suggests that this money could make its way into the economy and the markets. This can lead to paralysis and contentment with short-term cash returns, but it also can be detrimental to long-term financial goals.

Every cycle is different, which makes investing amid uncertainty a challenge but also highlights the importance of being invested in a diversified portfolio. Equities historically have been the highest-returning asset class over the long run, and we do not see anything to alter that precedent going forward. We will continue to monitor the markets closely and make changes as necessary.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Blackrock, Bloomberg, Carson, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor regarding your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS.

Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.