Among the financial damage from the coronavirus pandemic has been the large increase in the federal budget. The pandemic has caused massive economic disruption, and the U.S. government deficit has soared, as COVID-related fiscal stimulus is still being required.

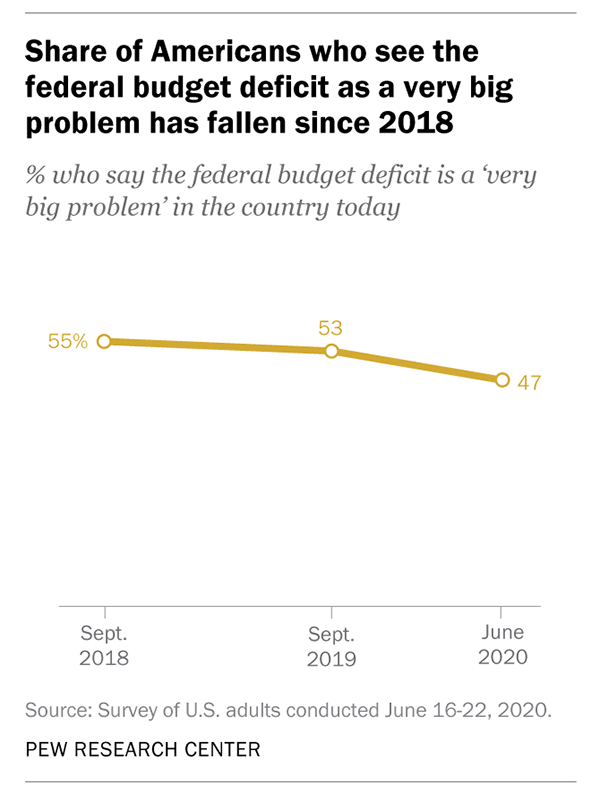

However, Americans appear to be less concerned about the deficit than in recent years. A recent Pew study reflects that in June 2020, only 47% of Americans viewed the deficit as a large problem, compared with 55% just two years ago. In fact, clients often ask us, “What should we do about the growing deficit — and with interest rates so low, do deficits really matter anymore?”

Federal Reserve policies, including low interest rates and quantitative easing (QE), have enabled the government to increase stimulus spending with little risk for now. With all of the challenges facing the economy, the Fed has allowed the government to issue new debt with interest rates at historically low levels. This is very similar to homeowners continually refinancing their home mortgages as rates continue moving lower. Often, homeowners will take equity out of their house when they refinance, increasing what they owe to the bank but lowering their overall payments since their new interest rate has decreased.

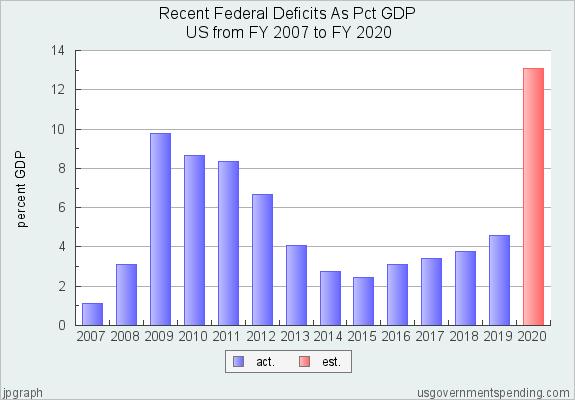

With interest rates having been on the decline for many years, and with the Fed’s recent statements pointing toward keeping them lower for years to come, servicing a higher deficit seems to cost relatively little. As seen in the chart below, the federal deficit has risen to almost 15% of GDP as fiscal stimulus was needed along with a plunge in GDP growth due to the economic shutdown. Congress is negotiating how much more stimulus will be needed to help businesses that are still affected by the global pandemic.

But with rates low, servicing a higher deficit level costs much less. In 1996, interest payments accounted for 15.4% of total federal spending. In 2019, the federal government paid out $375 billion of interest on its debt, accounting for 8.4% of total federal spending.

The bigger question remains with state and local government deficits, which have increased as well during the crisis. Tax revenues have decreased and unemployment insurance costs have risen as the unemployment rate currently sits at 7.9%. City and state spending have accounted for more of GDP spending than the federal government; local governments employ more workers than the federal government.

However, state and local governments must balance their operating budgets every year and can’t borrow to finance large deficits. To date, federal aid has exceeded projected revenue losses, but unless the federal government continues to support local economies, projected shortfalls are forecasted for years to come. If aid to the states and local governments is not in the upcoming stimulus package, states will cut back their spending and in turn will restrain the vigor of economic recovery.

Tax policy in the next four years remains uncertain with the looming election. Regardless of who occupies the White House, state and local taxes could rise in the coming years to fill the budget shortfalls created by the pandemic. These shortfalls could hinder economic recovery in the near term, just as after the great recession of 2007-2009, local governments’ spending didn’t support their economies for five years after the recession.

Today’s borrowing is largely appropriate and necessary in order to reduce the economic pain caused by the COVID-19 pandemic. Once the pandemic ends and the economy is on its way to recovery, policymakers will turn their focus to long-term debt and deficit reduction to get the country on solid fiscal ground. Even as the level of debts rise, the cost of carrying the debt, reflected with low interest rates, has tumbled. Financial markets have maintained confidence in the ability for the U.S. to carry the financial burdens. As The New York Times put it, “The economy has not drowned in the flood of red ink – and there’s a growing sense that the country could take on even more without any serious consequence.”1

What does this mean for you?

Follow your financial plan and ignore the noise. Remember that market downturns offer the chance to buy stocks at lower prices, which could position a portfolio well for future growth. Again, there are no guarantees that stocks will perform to anyone’s expectations, and decisions could result in losses including a possible loss in principal. But it may be helpful to remember that some investors use downturns as opportunities to buy stocks that were previously overvalued relative to their perceived earnings potential.

Data Sources: Pew Research Center, UsgovernmentSpending.com, FS Investments

1 New York Times – August 21, 2020 – We have crossed the line Debt Hawks Warned Us about for Decades

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.