There have been 13 recessions since World War II — and three of them were in this century. Some say a fourth may be on the way. But what, exactly is a recession?

According to economists, a recession is defined as two consecutive quarters of GDP decline. Last month, the S&P 500 briefly plunged into a bear market as investors digested inflation, rising rates, the war in Ukraine and increased lockdowns in China. On average, recessions since World War II have lasted 11.1 months. The longest was the Great Recession, which lasted 18 months, from December 2007 to June 2009. Conversely, the shortest recession, caused by the global pandemic, lasted two months. Since World War II, we have gone an average of 58 months — nearly five years — between recessions.

Knowing this, it is important to keep the following in perspective:

A recession is not the same as a down stock market.

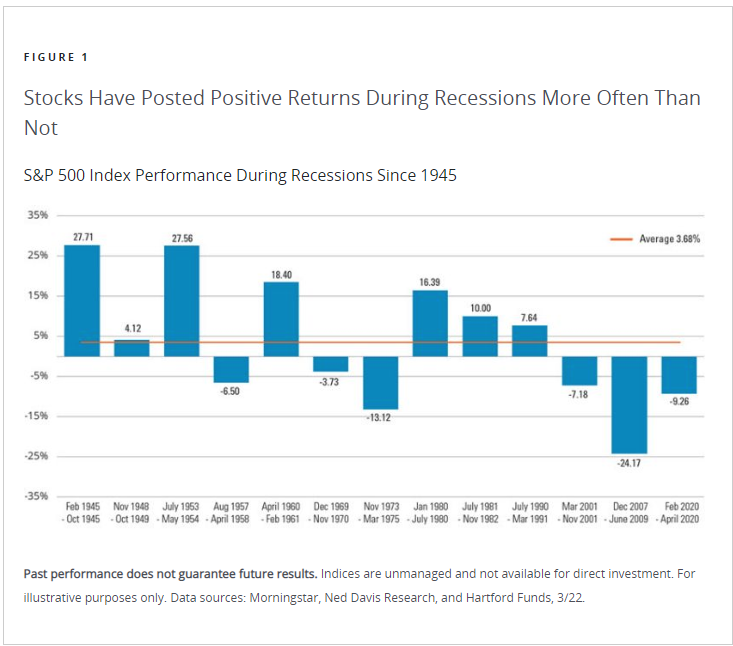

The stock market is based on expectations for the economy looking forward; stocks can move up during a recession or down when the economy is expanding. Economic recessions may not be identified until months after they begin. The chart below shows market returns during the year of the recession, as well as the year following the recession. In all but three of the 13 recession years, the following year posted strong, positive returns.

Recessions can be started by imbalances in the economy, i.e. financial crises.

Recessions can also occur from external shocks, such as a global pandemic or war. For the recession to end, the imbalances must stabilize.

Stocks can grow in a contracting economy.

Although down markets sometimes coincide with recessions, the stock market produced positive returns during seven of the 13 recessions since World War II, and the S&P 500 gained an average of 3.68% during these recessions (see chart below).

Recessions and expansions are normal phases of the economic cycle.

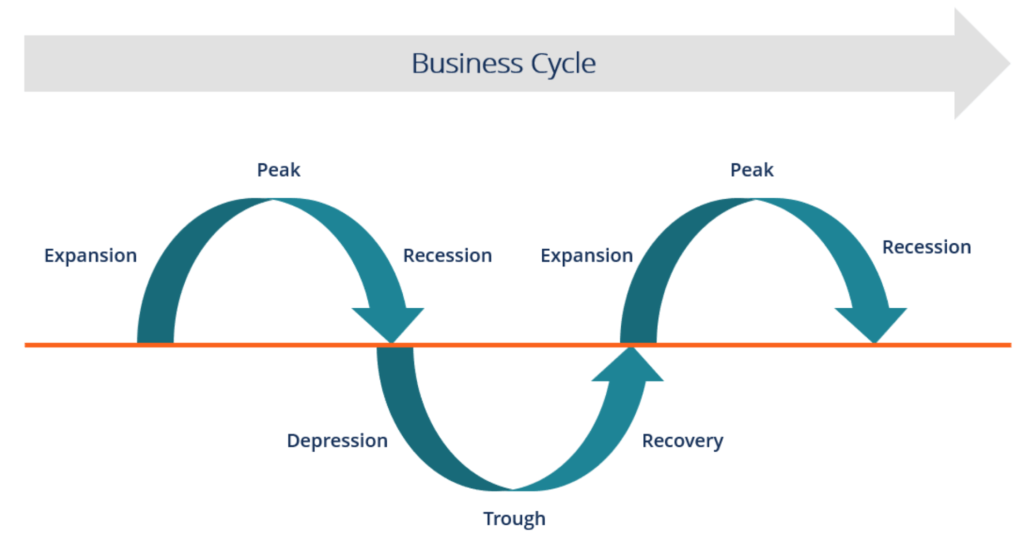

As seen in the chart below, the business cycle flows from expansion in economic activity to a peak, and from that peak to a recession (an economic slowdown), before reaching bottom. The bottom leads to economic recovery, and the cycle repeats itself. Each cycle is different. The period within each phase may also be different, but ultimately, expansions and recessions are normal occurrences.

The U.S. economy grows more than it contracts.

Recessions in the United States have lasted about 11 months on average. The Great Recession, which followed the financial crisis, lasted 18 months. However, the expansion that followed the recession lasted more than 10 years. The Federal Reserve Bank of Cleveland found that the worse a recession, the stronger the expansion that followed it.

Not all stocks are created equal.

Recessions impact various sectors of the economy differently. Cyclical sectors, such as travel and consumer discretionary spending, are more impacted during downtimes, while other sectors, such as utilities, are necessities regardless of where we are in the business cycle.

Individual countries can enter recessions without involving the rest of the world.

According to the World Bank, there have been six global recessions since 1950, compared to the 13 in the U.S. during the same time frame.

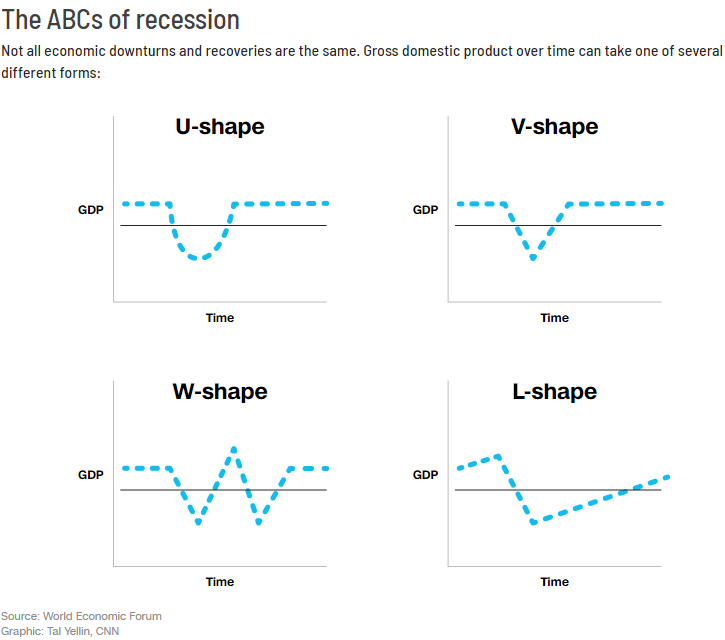

Not all downturns and recoveries are the same.

Recoveries can also take different forms, as shown in the chart below. The recession of 2020 was a strong V-shape, with a quick drop, followed by a quick recovery. This is best case scenario. The U-shaped recession signals a decline that takes a year or two to recover. The W-shape is the dreaded double-dip recession that we witnessed in the early 1980s, while The Great Depression was similar to an L-shaped or hockey stick recession.

So, what can we learn from all this? Recessions are a natural part of the economic cycle. Just because the U.S. economy may have a recession does not mean it will be 2008 all over again and the stock market will experience similar pain. The stock market is a leading economic indicator, but most often it has already started to recover by the time the economy is officially in recession.

During these challenging times, it is important to keep the following in mind:

• Ignore the noise and sensationalist headlines.

• Remember that selling into a panic is not an investment strategy.

• Market declines are a part of economic cycles.

• Don’t try to time the market. Instead invest regularly, even when the market is falling.

It is likely that this recent market drop may be a mere blip in the long-term investment plan. We do not try to time the market. What really matters is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over time, markets tend to rise. During volatile markets, it is it is important to remember that the fear of losing money is stronger than the joy of making money. Investor emotions can have a big impact on retirement outcomes. Market corrections are normal; nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Forbes, Hartford, Kiplinger, NBER, World Economic Forum

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.