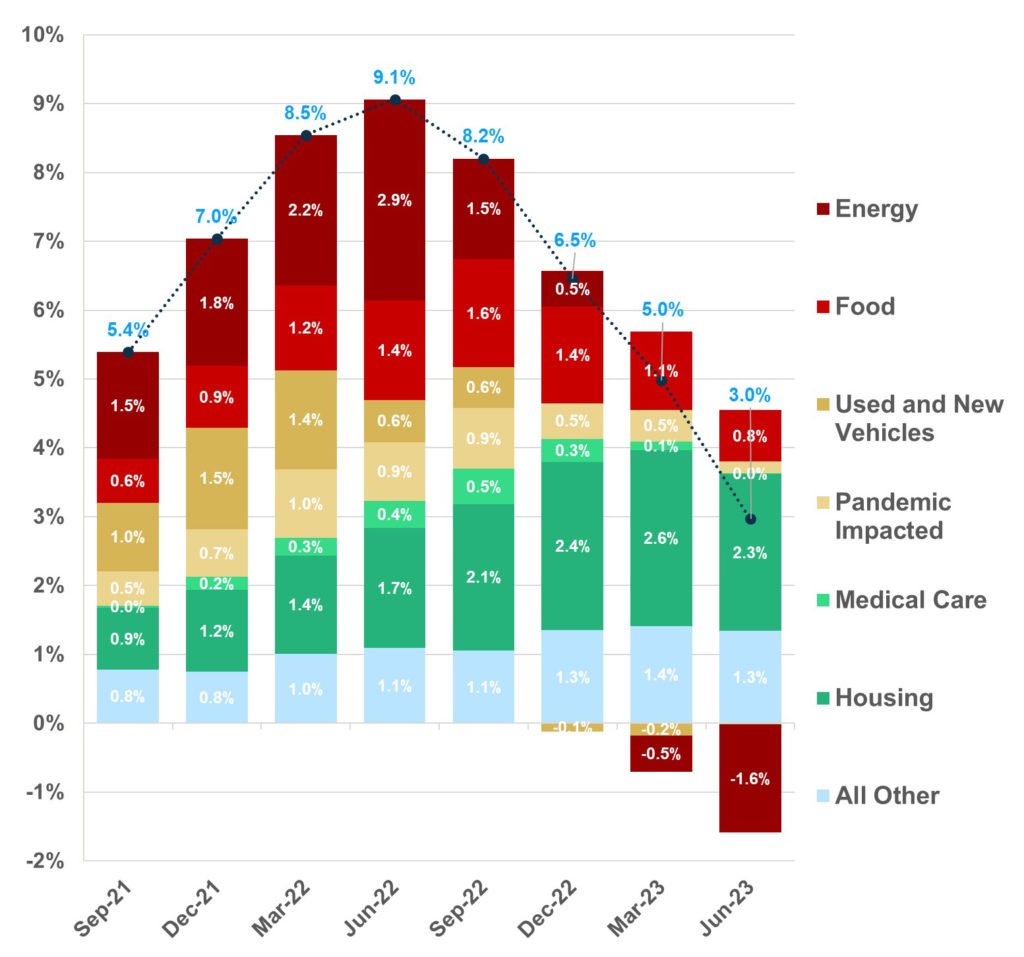

Inflation continues to come down after reaching a peak of 9.1% in June 2022 — a far cry from the high inflation days of the early 1980s, but levels we hadn’t seen in 40 years nonetheless. June’s Consumer Price Index (CPI) came in at an annualized rate of 3%, the lowest level since March 2021 and the 12th consecutive month of price decreases. The CPI remains above the Fed’s target rate of 2%, and while this report is good news for prices and pocketbooks, it is unlikely to stop the Fed from raising rates again later this month. Energy prices also are decreasing; gas was $5 a gallon at this time last year, and price increases were at their highest levels.

Inflation Pulls Back on Lower Energy, Food and Used Car Prices

Contributions to CPI Inflation (Year-Over-Year)

The largest increase in inflation remains healthcare, which is up significantly since the start of the pandemic. For many people, the cost of healthcare is the biggest unknown for retirement planning. How long will I live? What medical needs will I have? Do I need long-term care coverage, and what will that pay for? Do I have enough money to pay for my healthcare needs as I get older, or will I have to depend on my kids or other family members?

Luckily for those who are about to turn 65 — or who are already older than 65 — there is Medicare, which includes several different forms of health care, some provided by the federal government and some by private insurers. Medicare can be complicated to understand, but it is important to know your options.

When do I sign up for Medicare?

The initial enrollment period is a seven-month period around the time you turn 65 and includes the three full months before the month you turn 65, the month you turn 65 and the three full months after the month you turn 65.

There are exceptions to the window for those who are still working and opportunities to enroll later in life. In some cases, though, you can end up paying higher rates by waiting.

What does Medicare entail?

Medicare consists of five major parts:

• Part A covers hospital and skilled nursing care, as well as some home and hospice care. As soon as you turn age 65, you are eligible for Part A, usually at no cost. At age 65, most individuals opt into Part A at a minimum. The main downside is that you are no longer eligible to contribute to a health savings plan if you chose Part A.

• Part B covers outpatient care, such as office visits, diagnostics and some preventative services. If you are on Social Security, you are automatically enrolled in Part B, which has a monthly premium that varies based on your income. If you are still working, you can decline Part B. Once you retire and lose your work insurance, you have an eight-month special enrollment period to sign up for part B.

• Part D is your drug plan that’s offered by private insurers. They require a separate premium that is regulated by the government. There are a wide variety of plans, so shopping to make sure you get the right one is important.

• Part C, also called Medicare Advantage, offers hospital and medical coverage along with benefits you do not get with basic Medicare, like vision, hearing and prescription drugs. Part C is offered through private insurers, and the out-of-pocket expense is capped by the government. If you chose Part C, you will probably not need Part D.

• Medigap Coverage is technically not part of Medicare, but it is commonly purchased as a supplement to Medicare. It is sold by private insurers to cover some costs that Medicare doesn’t, like copayments and deductibles.

What does Medicare not cover?

Medicare does not cover everything, and you will need to pay for or obtain other coverage as mentioned above for services that are not included. Some of the items and services Medicare does not cover are:

• Long-term care

• Most dental care

• Eye exams

• Dentures

• Cosmetic surgery

• Routine physical exams

• Hearing aids

• Concierge services

Medicare & You, the official U.S. government Medicare handbook, contains much more detailed information. (This is a good link to bookmark for future reference.)

If I am not eligible yet, what should I do?

As you approach age 65, mark your calendar for the specific date that you would like to enroll. If you are still working, it may make sense to enroll in Part A only and continue with your company insurance.

Take time to research Medicare plans to match your specific needs. At CD Wealth Management, we think this is an important part of your retirement and should be something you review each year.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Blackrock, Bloomberg, Carson, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.