We are less than a week away from Election Day. The presidential race and the race for control of the House and Senate remain very close. There is a good chance we won’t know the outcome on Election Day, and it may take many days to count the votes.

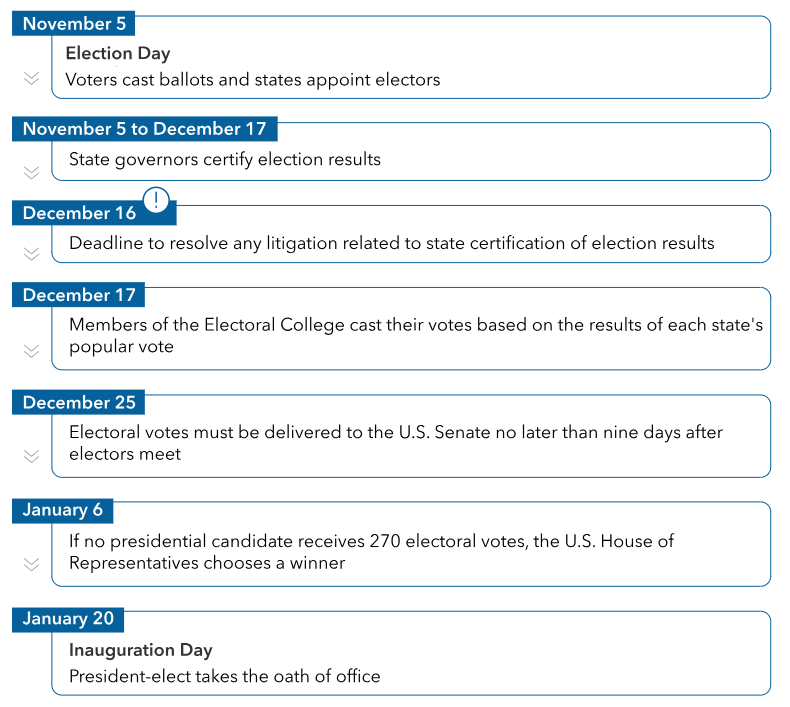

It’s possible that one candidate will gain a sizeable lead so that we will know the outcome sooner, but if not, below is a timeline for how the Presidential Election will play out over the next few months. There could be a lot of uncertainty in the days to come, and that may be reflected in a higher level of market volatility during that time.

What Happens Between Election Day and Inauguration Day

For long-term investors, it is important to keep in mind that the political structure in Washington hasn’t had much of an impact on market returns. From 1933 to 2023, under unified and split governments, the average annual return for the S&P 500 has been between 11% and 14%. Under a split Congress, as we have today, the market has generated an average return of 13.7%.

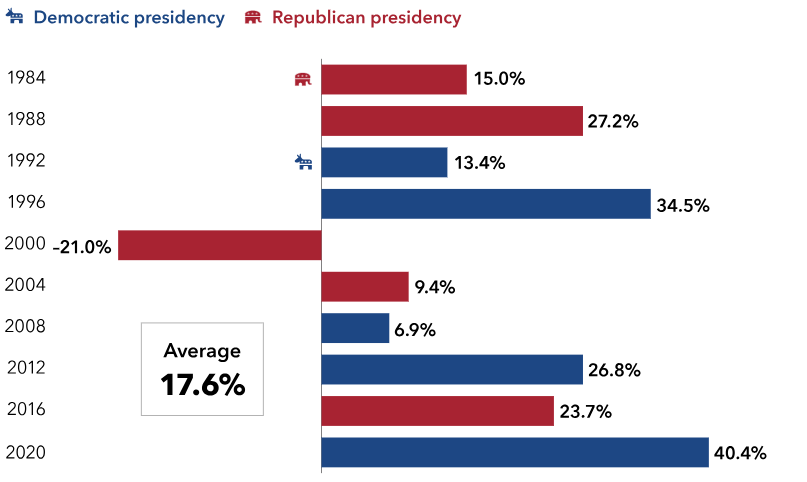

In more recent times, markets have posted even better results one year after Election Day. Since 1984, the average return a year later has been 17.6%, with only one year (2000) being negative. At the end of the day, financial markets appear to care more about the certainty of election outcomes than about who occupies the White House.

S&P 500 Index Total Returns One Year After Election

As the election cycle plays out, the noise and uncertainty can feel overwhelming and anxiety-provoking. In our view, long-term investors should ignore the noise and continue to focus on their financial goals and plan. Presidential elections historically have had very little impact on the stock market.

As we have continued to emphasize, stock markets are more influenced by corporate earnings, monetary policy and economic data than by the election outcome.

The balance of power in Congress may have much more of an effect on issues that matter to investors, such as tax policy, tariffs, the federal debt ceiling and foreign relations.

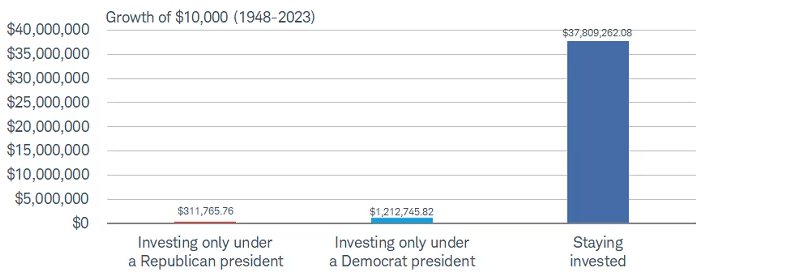

Consider the mythical investor who put $10,000 into the S&P 500 at the beginning of 1948 and did not care who was in the White House. If that investor kept their money in the market, that initial investment would grow to nearly $38 million! Had they invested the $10,000 with Republicans in office only, it would have grown into $310,000, and with Democrats in office only, the total would be $1.2 million.

Stay focused on the long-term goals and the bigger financial picture.

Time IN the Market Matters

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, CNBC, Fidelity, Schwab