What’s driving interest rates higher? What is inflation — and is it transitory or here to stay? What is stagflation? What are real rates versus nominal rates? Why does everyone keep talking about inflation and interest rates? Why are energy prices so high?

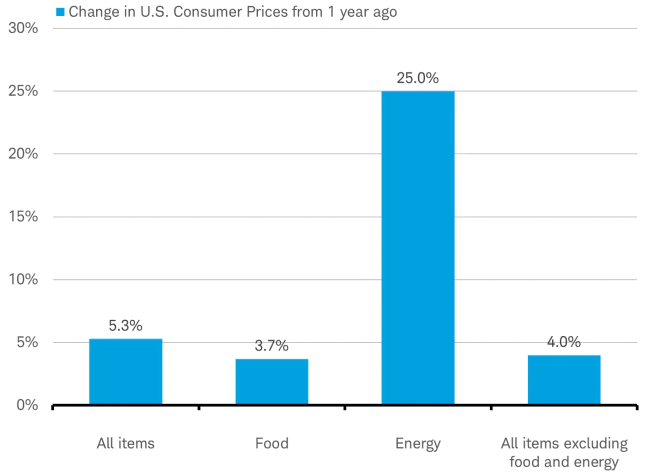

With so many unanswered questions, the noise in the financial markets remains at a high level. The energy world has changed drastically since April 2020, when we wrote about the negative price of a barrel of oil! West Texas Crude oil prices are now over $80 a barrel. Energy prices, as measured by the CPI index, are up 25% over the last year, as seen in the chart below. If you remove food and energy from the CPI calculation, the year-over-year change in consumer prices is only 4%, not the reported 5.3%. A perfect storm of energy shortages and high demand has made the outlook uncertain for energy prices globally. Prices are surging for oil, natural gas and coal, along with other commodities such as lumber, used cars and shipping costs — and there are supply chain disruptions as well. The demand for energy is outpacing the supply, and when that happens, prices will rise to meet the demand.

For those who want to compare this oil surge to the 1970s, there are several critical differences:

* The energy intensity of gross domestic product (GDP) is half of what it was in the 1970s.

* Fracking wasn’t available in the 1970s, and now, it can rapidly increase production.

* The U.S. is now an exporter of oil versus being a major importer 50 years ago.

All these factors are making economists question how transitory inflation is. What if we have inflation with lower growth, which we call stagflation? Stagflation refers to an economy that is experiencing a simultaneous increase in inflation and stagnation of economic output (slow or negative economic growth). Investors have had little experience with stagflation in recent decades. Only 41 quarters since 1960 (17% of the time) have been in a stagflation environment, and most of those occurred in the 1970s. We believe the equity market should continue to be strong as investors gain confidence that the current pace of inflation is transitory and not permanent.

As shipping costs come down, the supply of goods increases, prices will drop and some of the inflationary pressures that we feel today will dissipate. Eventually, the boats that are floating at sea full of goods will be offloaded, and those goods will make their way into the economy. Therefore, the Fed continues to say that the inflation we are experiencing today is transitory and expected to level off — even if it takes a year or two to do so.

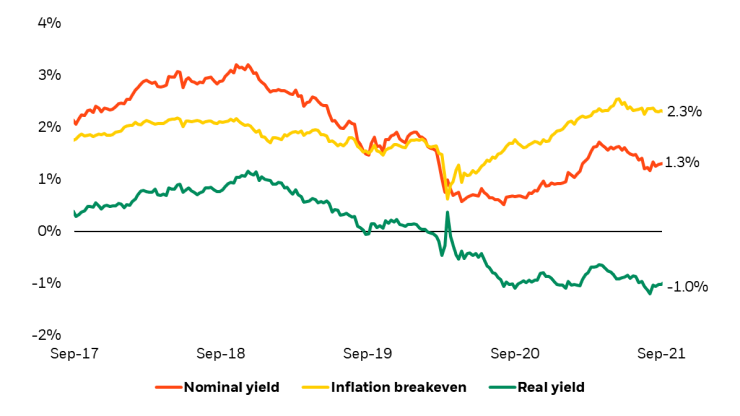

So what’s driving interest rates higher? Interest rates are largely impacted by two factors: policy decisions made by the Fed and investor expectations of those decisions over the long run. The Fed would like to moderate the speed at which Treasury yields rise through its tapering of asset purchases. The Fed is maintaining a dual mandate of price stability and maximum employment before it considers raising short-term rates. The chart below reflects the difference between nominal rates and real rates.

Nominal rates are the rates we commonly discuss and read about — the 10-year Treasury rate, for example. Real rates are the interest rates that an investor receives after adjusting for inflation – the real yield you receive from owning an asset. If a Treasury bond were to pay you 5% nominal yield per year, but inflation is 3% per year, you would have a real rate of only 2%. As seen in the chart below, if the 10-year Treasury rate is 1.3% and inflation is running around 2.3%, then the real yield is now a -1%. This means investors who are buying Treasuries now are essentially expected to earn a negative 1% in real yield annually.

So, what can we learn from all this? More and more noise is creeping into the markets today: worries about inflation, higher energy prices, slower growth and possible stagflation. The amount of liquidity in the markets remain at record levels. There still exists a chance that we will see additional stimulus into the economy through an infrastructure package. While questions exist about the state of the economy, there remain many reasons to be optimistic. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or one indicator.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Blackrock, CNBC, Horizon, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures