The overall market sentiment feels very negative as the market has declined five consecutive weeks and began this week in similar fashion. Consumer confidence, a leading economic indicator, is negative. Market volatility remains elevated, as the VIX index closed at 35, more than double the historical value. Inflation is on everyone’s mind these days, especially at the grocery store or the gas pump.

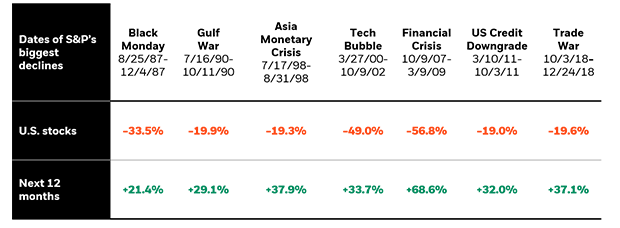

All market corrections feel similar: The sky is falling — how will the market ever come back or turn around? While we recognize that these times are painful from a portfolio perspective, we also realize that market corrections are healthy for the long-term performance of the market. It is important to remember that stock market downturns often are followed by a period of positive market performance. Since 1987, every major decline in U.S. equities has reversed itself between 21% and 68% within the following year, as seen in the chart below. And those who dollar-cost average in their portfolios — whether in taxable or tax-deferred accounts — have the potential to take advantage of the market recoveries by adding more monies into the portfolio.

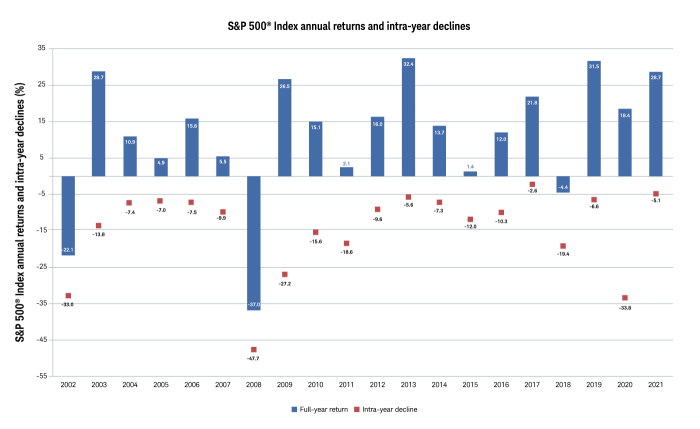

Here’s another way of looking at the volatile nature of markets and corrections: The chart below shows intra-year declines over the 20-year period from 2002 to 2021, which includes the pandemic. A decline of at least 10% occurred in 10 out of 20 years (50% of the time), with an average pullback of 15%.* Despite these pullbacks, stocks rose in most years, with positive returns in all but three years and an average gain of 7%.

We want to share with you a few frequently asked questions that we are receiving during the market sell-off in hopes that they answer questions you may have:

I’m hearing a lot about I-bonds. What are they — and should we invest in them?

Series I Savings Bonds are a type of U.S. savings bond designed to protect the value of cash from inflation. Interest rates on I bonds are adjusted regularly to keep pace with inflation. Investors can purchase up to $10,000 of I bonds annually per person through the government’s Treasury Direct website. I bonds earn interest monthly, though you don’t get access to interest until you cash out the bond. You must own the bond for at least five years to receive all the interest that is due. You cannot sell the I bond before holding for one year. If you sell after one year and before the five-year holding requirement, you forfeit three months of interest that has been earned. These bonds have an actual maturity of 30 years. Keep in mind that these bonds cannot be purchased through our office and can only be purchased online through the Treasury Direct website.

Are there any changes to the portfolio that we need to make, and should we continue to purchase bonds?

As we communicate each week, we are constantly analyzing the market, the economy and the portfolios. To use the old hockey adage, we are skating to where the puck is going, not where it is. We are not going to make changes to the portfolio to time the market, but rather we are being strategic and thoughtful. We understand that market volatility is unsettling, but historically, this is not unusual. The portfolios are diversified and invested per each client’s risk tolerance.

We tweaked the fixed-income portion of the portfolio late last year to shorten the maturity and duration of the bonds. Bonds have had their worst start to the year in history, but we do not believe that it is in our clients’ best interest to abandon fixed income and move to cash or to increase risk tolerance and move to equities. While both stocks and bonds are down to start the year as inflation peaks and the Fed slows down interest rate hikes, we believe bonds will provide the necessary diversification and income to help the portfolio during market volatility.

Bonds can be used for three primary purposes: income, capital preservation and equity diversification. As is the case with equities, being diversified within fixed income may help reduce portfolio risk. As always, we will communicate any portfolio changes as they occur.

Where does the market go from here?

Four main factors continue to be at play with this market: inflation, the war in the Ukraine, China and its continued lockdowns, and the Federal Reserve. Last week, the Fed raised rates by 50 basis points. Chairman Powell commented that the Fed is “strongly committed to restoring price stability” and that a 75-basis point hike is “not something the committee is actively considering.” Stocks are likely to remain volatile as the Fed pushes interest rates higher.

The possibility of a recession later this year or next year remains in play, but strong earnings growth and record low unemployment are not recessionary indications. Remember that the stock market is a leading economic indicator, and often, the market sells off before the recession or the economic bottom of the cycle. By the time the economy feels worse, the stock market is already starting to recover. We do not know when the market will hit bottom, but we remain strong believers in the long-term fundamentals of the market.

So, what can we learn from all this? Selling into a panic is not an investment strategy. Understanding that people fear losing money more than they enjoy making money is important during volatile markets. Investor emotions can have a big impact on retirement outcomes.

It is likely that this recent market drop may be a mere blip in the long-term investment plan. We are not going to try to time the market; what really matters is time in the market, not out of the market. That means staying the course and continuing to invest — even when the markets dip — to take advantage of potential market upturns.

We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over a longer time horizon, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Blackrock, Forbes, Schwab

*As of Tuesday, May 10, the S&P 500 is down more than 15% year-to-date

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.