The S&P 500 closed higher for the fifth consecutive month; the odds favor a down month relatively soon. Historically, August has been a poor-performing month, ranking worse than only February and September going back to 1950.

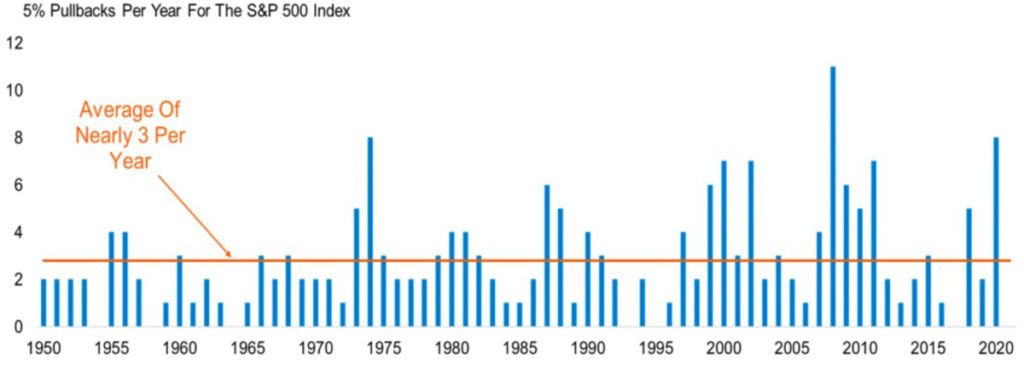

If the markets do experience weakness in the coming months, investors may be surprised — and talking heads may say that they are finally right for saying that the market is due for a pullback. It may present buying opportunities for those with cash on hand, or it may be a challenge to refrain from panicking for those who get nervous when the market drops. Remember, most years see a temporary decline of 5% or more at least three times.

Pullbacks are common, and they should be expected. When they happen, many people tend to go straight to the worst-case scenario — that the sky is falling, and the market will never recover. Often, this can happen because of what people read or hear on the television. Many people may get in trouble because they extrapolate strength or weakness into perpetuity. They don’t believe that the trend will turn in a different direction.

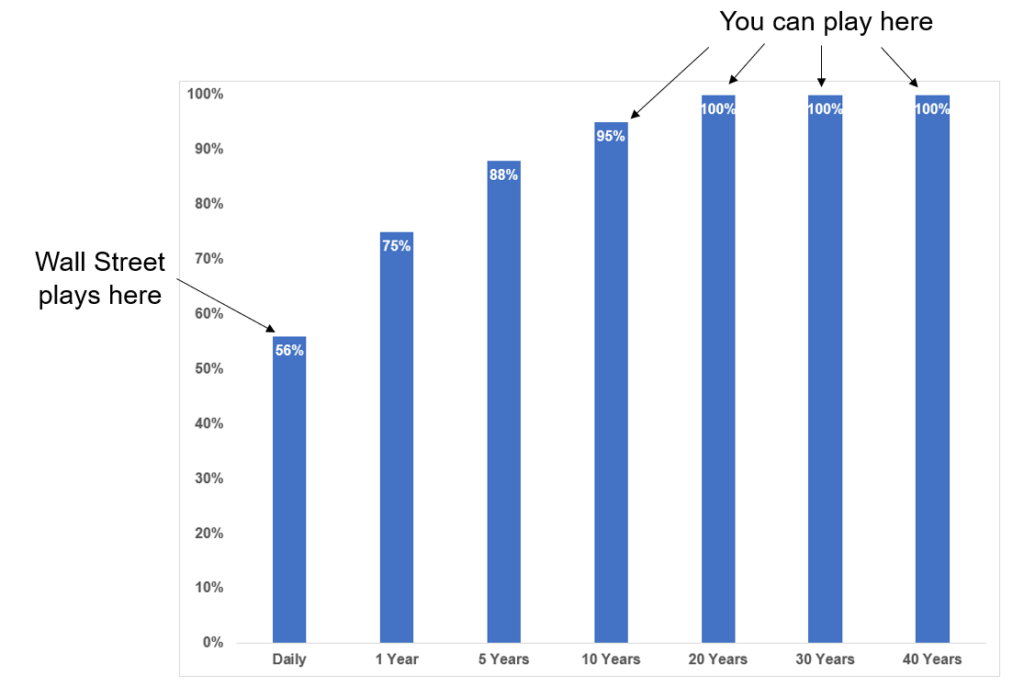

The news can sway your outlook. Remember, most analysts or stock market predictors have an angle. They are not playing the long game and are focused on the short term. With our clients, we are focused on the long term, typically 10 years or longer. We are focused on whether you achieve your financial goals; the longer your time horizon, the higher the probability of success in the markets.

Time Horizon Matters

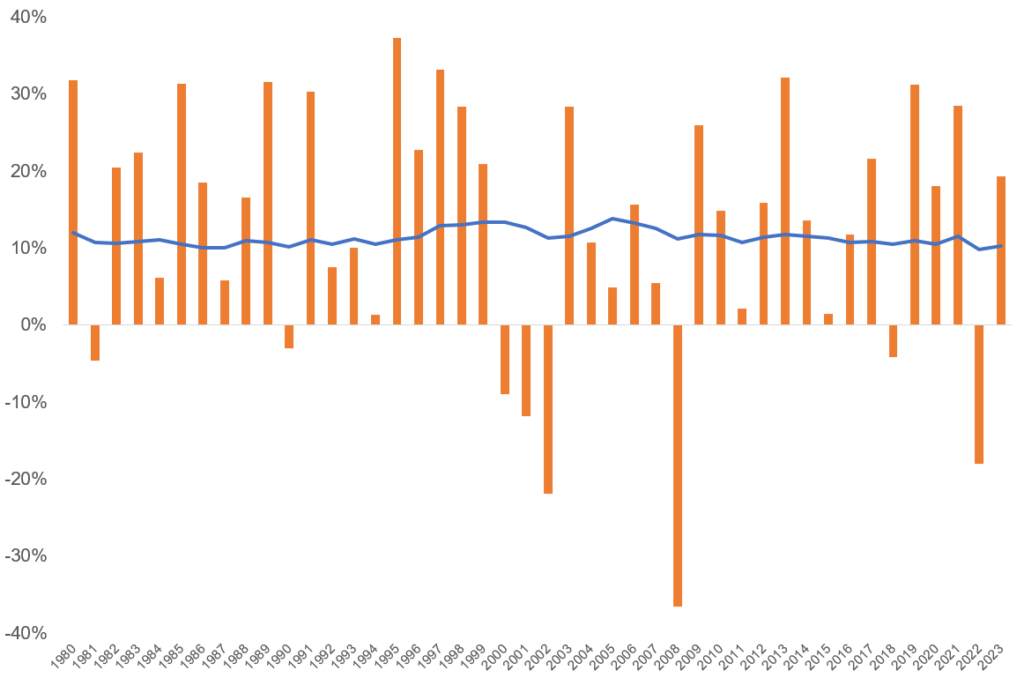

The chart below shows us another good way to look at the long-term picture: a rolling 30-year return of the S&P 500 (the blue line), compared to the latest one-year returns (the orange bars) for each 30-year period.

Returns in any one year are all over the map. As we wrote recently, returns for any one year can vary from the average — but over the long run, the average return doesn’t change much from year to year. A one-year return can make you feel good or bad, but if you stay invested over the long term — and don’t sell out of the portfolio in a down year — it shouldn’t have much bearing on long-term results.

30-Year Returns vs. 1-Year Returns

The narrative of this year’s rally has changed over the last two months. This is no longer just a “Magnificent Seven” rally by the top tech giants. Resilient economic data in the U.S., receding inflation pressures and expectations for the Fed ending the rate-hiking cycle have led to a broader market rally since early June.

If we can avoid a hard-landing recession, the overall market valuation appears reasonable. The long-term average over the past 100 years for stocks has been about 10% per year. After the three and half years of this decade, we have experienced two bear markets and world-changing events, and the market is averaging slightly over 10% per year. We will continue to preach against making investment decisions based on one-year returns!

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: LPL, Carson, American Funds, A Common Sense Guide to Investing

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.