Anxiety is rising about the stock market and the economy — and we are still months away from the next election year, when tensions surely will rise. Everywhere we turn, we see negative headlines about a potential government shutdown, inflation ticking back up, a potential recession, the UAW strike, the Fed’s plan for interest rates, student loan payments, a possible real estate crash, bankruptcies rising, and credit card debt surpassing $1 trillion for the first time.

These are legitimate concerns, but we think the chances of them becoming larger issues are smaller than many people expect.

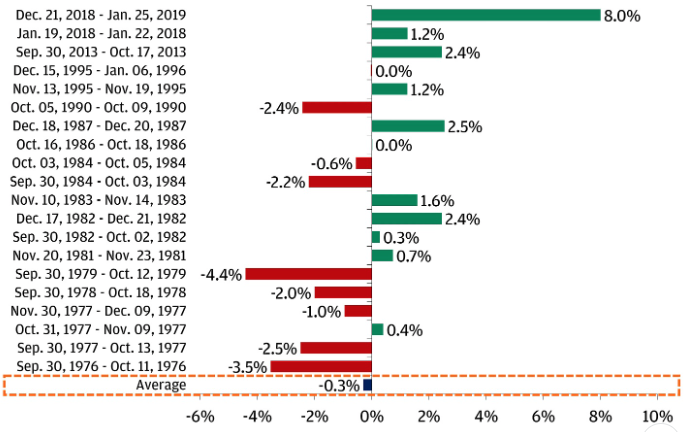

Let’s first address the elephant in the room: the fast-approaching deadline for a potential government shutdown. During the last 20 government shutdowns since 1976, the market has been down only .3% on average, with the largest drawdown being 4.4% and the highest gain being 8%. A potential shutdown may cause only modest losses in economic output — and as is always the case, certain sectors may benefit, such as defense and healthcare.

Stocks Tend To Be Mixed During Shutdowns

S&P 500 returns during prior U.S. government shutdowns, %

Turbulent markets in 2022 and the prospect of higher money market and Treasury yields led investors to flock into money market funds and Treasury bills. Money market funds are at an all-time high of over $5.6 trillion. Cash investments remain attractive to many investors today, but the Fed appears to be nearing a turning point.

No one knows for sure when the Fed will stop raising rates. However, the markets are projecting that we are very near peak rates and that rates may decline starting next year. Sitting in cash may feel very comfortable with rates over 5%, but the benefit of cash is eroded by moderate inflation. Additionally, cash or Treasury bills may see little additional upside once the Fed finishes raising rates.

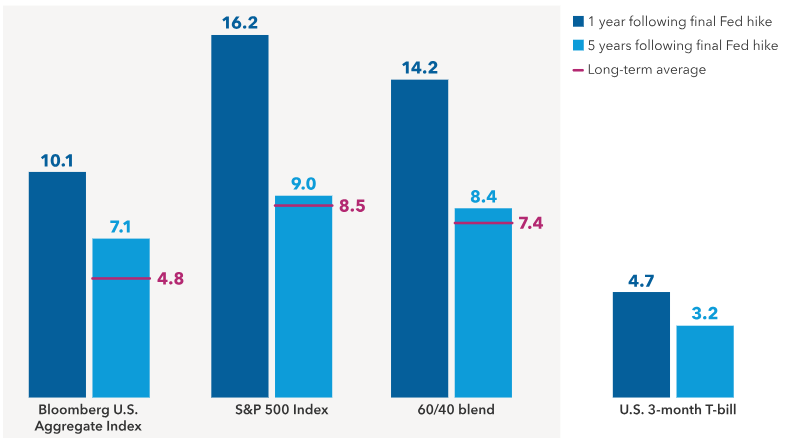

History shows that in the 18 months after when the Fed finishes raising rates, yields on cash-like investments have gone down rapidly. At the same time, both equity and fixed income returns were strong in the year that followed and remained strong for the five years that followed as well.

After Fed Hikes, Long-Term Results Outpaced Cash

Results have been front-loaded following the final Federal Reserve hike in the last four cycles (%)

After student-loan payments were paused in March 2020 because of the pandemic, borrowers will be forced to start payments again in October. Americans paid about $70 billion toward student loans in 2019; it is unlikely we will go right back to this level. Many people continued to pay their loans and didn’t take the government up on its free pass.

The Biden administration recently cancelled $39 billion in loans for 800,000 borrowers. At the same time, a new plan called Saving on a Valuable Education could benefit another 20 million borrowers, forgiving loan balances after 10 years of payments, compared with 20 years previously.

Because of the pandemic, people didn’t spend as much as they typically would have. Much of that excess savings is now gone. Some fear that consumers are tapped and that without excess savings, the economy will not be able to grow. In actuality, the savings rate has grown over the past year, from 3.2% to 4.5%, but that growth not apparent if one is looking only at excess savings.

When the Fed raises rates as sharply as it did over the last 18 months, it often is viewed as a precursor to a recession. Many anticipate a recession because of an anticipated real estate crash and potential bankruptcies from an inability to refinance debt and banks not lending money.

What we have seen so far is that the economy has not slowed down — and if it does slow, it may just lead to slower growth, not necessarily a contraction or recession.

Many mortgages and loans remain at very low rates, as many borrowed aggressively when rates were at historical lows. The economy has remained strong but is not overheating, even with slowing inflation and a tight labor market. With a higher stock market and home values, investors feel comfortable and are not as concerned about savings.

There will always be reasons to worry or wonder if you should try to time the stock market — especially given the concerns we’ve listed above that can seem overwhelming. However, not doing anything can be a very powerful choice, especially when short-term yields are over 5%. Investor emotions are real; and as we have written before, Loss Aversion Theory tells us the fear of losing money is stronger than the joy that comes from making money.

Losses in the past — such as 2008, 2011, 2018, 2020 and most recently last year — can leave scars for investors. However, as we continue to write weekly, we are in this for the long term —and markets don’t idle for long. Investors in cash may end up stuck if they wait too long to get back into the market.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Source: CNBC, Capital Group, Bloomberg

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.