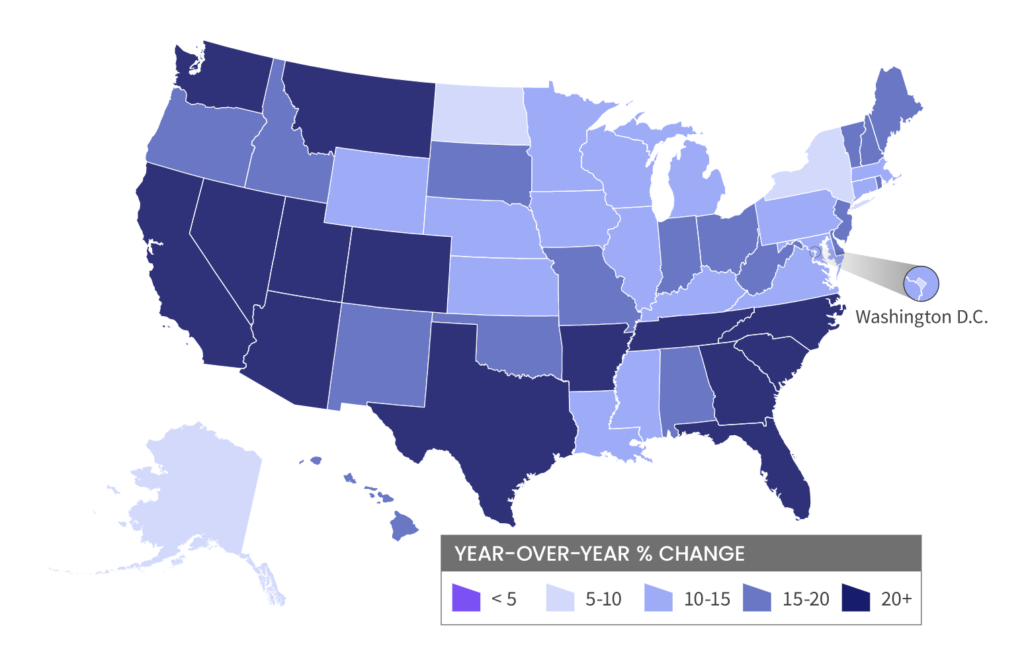

For homeowners, the increase in home prices over the last 16 months has been impressive. Nationally, home prices increased more than 20% year over year through April, with Florida leading the pack at more than 30%. It’s not a surprise for those of us who live in Texas to see that home prices have surged more than 20% during the last year.

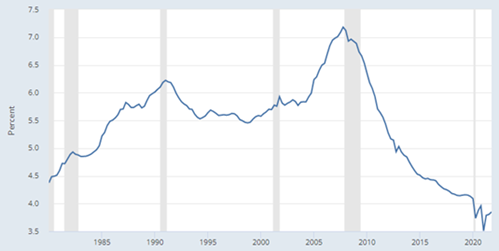

Rising interest rates have led to a drastic increase in the 30-year fixed mortgage loan rate. Last week, that rate hit 5.8%. By comparison, the rate at the start of 2022 was slightly higher than 3%. The low mortgage rates that we experienced over the last several years had been a real boon to the housing market and a big cause of the increase in home prices.

With the drastic increase in home prices, many are starting to wonder if this is setting up to be a repeat of the Great Financial Crisis (GFC) that we witnessed in 2008. The underlying drivers for this housing market appear dramatically different. Here are several reasons that we feel the housing market today will not experience a repeat of 2008:

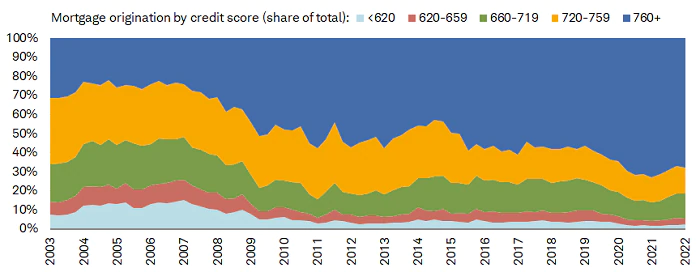

• The housing market today is in better health thanks to new lending regulations that resulted from the GFC. The chart below shows the credit quality of loans today compared with the time leading up to the GFC. Today, more than 70% of home loans go to those with credit scores over 720. The average borrower’s FICO score today is 751, a record high.

The higher score wins

• Home prices soared during the last two years as demand rocketed during the pandemic. Homeowners today have record levels of home equity due to the increase in prices. The amount of equity that homeowners can access is over $11 trillion, a 34% increase compared to last year.

• The amount of leverage — how much debt the homeowner has against the home’s value — has fallen dramatically. Total mortgage debt is less than 43% of total home values, the lowest on record. Negative equity is basically non-existent. (In 2011, one in four borrowers were underwater.) Today, mortgage payments as a percentage of consumer’s disposable income are just 3.8%, about half of what it was before 2008.

Mortgage Debt Service Payments as % of Disposable Income

• There are 2.5 million adjustable-rate mortgages (ARMs), accounting for about 8% of all active mortgages and the lowest volume on record. In 2007, there were 13.1 million ARMS, representing 36% of all mortgages. More than 80% of today’s ARMs operate under a fixed rate for the first seven to 10 years.

• Mortgage delinquencies are at a record low, with about 3% of mortgages past due. There are fewer past-due mortgages than there were before the pandemic.

• Following the Great Financial Crisis, a decade of underbuilding of homes ensued. As the millennial population is reaching peak home-buying age, there are millions of first-time home buyers waiting for the opportunity to purchase their first home.

Higher mortgage rates are already having the intended effect of slowing down housing prices. Existing home sales fell for the fourth straight month in May, and “further sales declines should be expected in the upcoming months given housing affordability challenges from the sharp rise in mortgage rates this year,” said Lawrence Yun, chief economist for the National Association of Realtors.

Existing buyers are still competing for a low supply of houses as builders face issues with supply chain, labor shortages and a decade of underbuilding. Higher rates taking some of the momentum from the housing market is not necessarily a bad thing for the economy and may help the Federal Reserve soft-land the economy (instead of a feared crash landing).

So, what can we learn from all this? We understand the concern that investors have comparing today’s housing market to that of the pre–GFC market crash. We take comfort in the fact that the amount of leverage and types of loans today are nowhere near what we witnessed during the GFC bubble. Lending has been in favor of those with much higher credit scores. Household balance sheets are in much better shape, and the percentage of one’s disposable income spent on mortgages is at an all-time low. We do not believe that the housing market will see a similar relapse to what we experienced in 2008. We will continue to closely monitor the housing market and its effect on the economy.

We will continue to harp on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator.

In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over time, markets tend to rise. During volatile markets, it is important to remember that the fear of losing money is stronger than the joy of making money. Investor emotions can have a big impact on retirement outcomes. Market corrections and bear markets are normal; nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: CoreLogic, Federal Reserve Board, Kestra Investment Management, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.