November was a big month for stocks! The Dow closed above 45,000 for the first time, and the S&P 500 hit 6,000 for the first time. Small-cap stocks rose almost 11% during the month.

Optimism over lower taxes, a stronger economy and strong earnings were the likely reasons for the month’s great showing. So far in 2024, the S&P has made 56 new all-time highs. The S&P is up more than 25% for the year — and for the first time since 1998, it’s up more than 20% in back-to-back years.

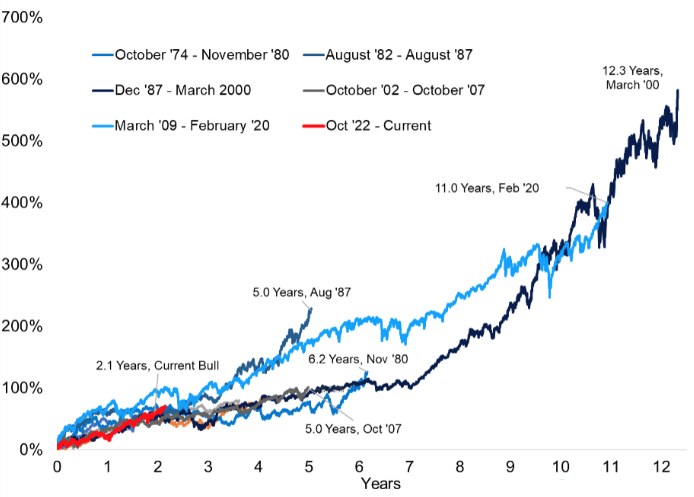

The current bull market is 26 months old and up more than 70% from lows in mid-October 2022. The good news is that once previous bull markets get to this point, there can still be additional room to go higher. Over the past 50 years, five other bull markets have lasted more than two years. The shortest lasted five years, and the longest lasted more than 12 years.

Bull Markets Beyond Their Second Birthday

Here are some fun market tidbits to end the year:

1. The “Santa Claus rally” is the typically encouraging period that includes the last five trading days of December and the first two trading days of the new year.

2. December typically is the S&P 500’s second-best month in an average election year, trailing only November.

3. On average, December is the third-best month, behind April and November.

4. Going back to 1950, December has been positive 75% of the time.

Santa brings gifts — and not always in the form of market returns. The IRS recently released its inflation adjustments for 2025 related to personal income tax, retirement contributions, estate taxes and Social Security benefits. While these changes won’t affect tax returns due in April, they will be very helpful in planning for 2025.

Personal Income Tax

The standard deduction is increasing in 2025, which could mean a bigger tax break for you. The new standard deduction for 2025 is:

• Married filing jointly: $30,000, an increase of $800

• Single taxpayers and married individuals filing separately: $15,000, up $400

• Heads of Households: $22,500, an increase of $600

• In addition, retired married couples (both age 65+) filing jointly, will receive an additional standard deduction of $3,200 ($1,600 each)! This may make it more difficult to itemize deductions in 2025. We will want to keep this in mind with charitable giving to consider a bunching strategy.

For tax year 2025, the top tax rate remains 37% with income greater than $751,600 for married filing jointly ($626,350 for single taxpayers). The other tax brackets are:

• Incomes over $501,050 for married filing jointly ($250,525 for single): 35%

• Incomes over $394,600 for married filing jointly ($197,300 for single): 32%

• Incomes over $206,700 for married filing jointly ($103,350 for single): 24%

• Incomes over $96,950 for married filing jointly ($48,475 for single): 22%

• Incomes over $23,850 for married filing jointly ($11,925 for single): 12%

• Incomes less than $23,850 for married filing jointly ($11,925 or less for single): 10%

Retirement Savings Contributions

The 401(k)-contribution limit is increasing by another $500 to $23,500. The maximum contribution for certain profit-sharing plans is increasing to $70,000.

Traditional and Roth IRA contribution limits are staying the same at $7,000. In 2025, for those under the age of 50, the cap will remain at $7,000. Married couples with income below $236,000 will be able to make a full Roth contribution in 2025 ($150,000 for those who are single). Phaseout ranges are changed for 2025; couples with income over $246,000 will not be eligible to contribute to a Roth IRA.

While catch-up contributions for participants 50 and older will remain at $7,500, the IRS is introducing a new super catch-up contribution limit for older employees. Beginning in 2025, individuals age 60-63 can contribute an additional $3,750 to their employer-sponsored retirement plans, for a total catch-up amount of $11,250.

The backdoor Roth IRA option remains a viable choice. The first step is to contribute to a Traditional IRA; this is a non-deductible contribution. After the traditional IRA contribution is completed, you can convert those funds to a Roth IRA.

If the original contribution to a traditional IRA was not deductible, then the conversion of that amount is non-taxable. However, any growth on that amount between the contribution and the conversion dates would be taxable. Completing the backdoor Roth transaction can be a tricky process, and you will want to consult your financial advisor and CPA.

Please make sure you adjust your 401(k) plan to account for the increased contribution limit.

Social Security

Social Security benefits will increase 2.5% in 2025, an average increase of almost $48 per month. This adjustment is smaller when compared to the 5%-8% increases that were in response to higher inflation in recent years.

Estate Taxes and Gifting

The gift tax annual exclusion is increasing from $18,000 to $19,000 for 2025, the fourth consecutive year that the gift limit has increased. Individuals can gift up to this amount to any number of individuals in 2025 without incurring gift tax or using any of the taxpayer’s lifetime exemption. Married couples can use this exemption, allowing them to gift up to $38,000 annually to each recipient in 2025.

In addition, the lifetime exemption amount increased about $380,000 per person, to $13.99 million per individual. This increase means that a married couple can shield a total of $27.98 million from federal estate or gift tax. This exemption is still set to sunset by about 50% at the beginning of 2026. Remember, however, that certain kinds of planning strategies can take months or even years to implement.

The end of the year is a perfect time to review your financial planning needs. This includes reviewing the investment portfolio, assessing year-end tax planning opportunities, reviewing retirement goals, and managing your legacy plans. The above changes for 2025 may apply to you and your family. We are happy to meet to discuss any of the above to ensure that you remain on track with your financial goals.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, Carson, Fidelity, Schwab