The old saying that markets tend to rally on a wall of worry proved itself at the end of last week and the start of this week. Worries continue to pile up: The U.S. is without a House Speaker, yields continue to rise, a potential government shutdown looms in November, and now there is a war in Israel.

At this time last year, stocks were in a bear market and inflation was soaring. This week marked the bottom of the market in 2022, and as history shows, stocks tend to bottom in October.

Seven of the last 18 bear markets have ended in October, and 18 of the 60 market corrections (a pullback of 10% or more in stocks) have also bottomed in October.

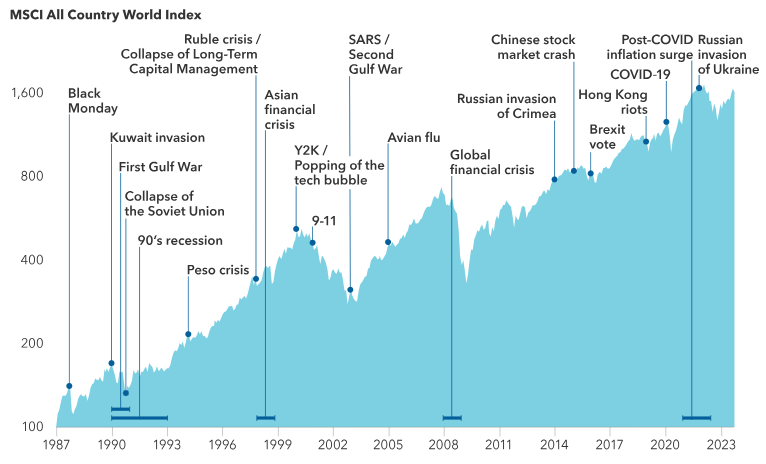

Market shocks and crises are a part of the investing landscape. They are no doubt painful, but we eventually recover, and as we know, there are no guarantees. In moments of crisis or uncertainty, it is easy to wait for clarity before investing, sitting on cash. Since 1987, there have been 23 market shocks, including the 1987 crash, the tech bubble, the global financial crisis, the global pandemic and most recently, the rise of inflation.

The chart below shows that markets have recovered from the shocks to go on and reach new highs, making a long-term perspective critical for investors. Long-term performance tends to be more dependent on the economic cycle than geopolitical developments.

Market Disturbances Are a Fact of Life

So far, the market has taken the war in Israel in stride. Oil prices rose 4% following the news, after having fallen almost 10% last week. If the war remains isolated to Israel and Gaza, the impact to oil and the world economy will be minimal. However, if the war broadens into a regional conflict and Iran is targeted, this could lead to a disruption in the global oil supply of crude oil.

As shown in the chart below, stocks have been mixed following major world events going back to WWII. More than 63% of the time, stocks have been higher one year later, but there have been both major upticks and downturns during that time — with an average return of a little more than 2%. Conflicts may flare up, but they tend not to make investors bearish, outside of a recessionary global economy.

How Do Stocks Do After Major Events?

S&P 500 Index performance after geopolitical and major historical events

The U.S. economy remains strong. The economy relies on the consumer, and consumption comes from income. Income comes from employment growth, wage growth and hours worked. All these factors are up, with the pace of weekly income growth stronger than the current pace of inflation. It was announced last week that the economy created 336,000 jobs in September, almost double the expected number.

Additionally, there was a smaller-than-expected rise in wages, which sparked a market rally. The falling wage pressures indicate that the supply and demand imbalance with workers is normalizing as more people return to the workforce. Wage growth, as measured by average weekly earnings, has eased back to the pre-pandemic pace.

The Fed is unlikely to tighten further if stronger-than-expected wage gains do not accompany stronger-than-expected job gains. Ultimately, corporate profits come from economic growth, and that will eventually play out as earnings season gets under way this week.

As Mark Twain famously said, “October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”

While there is a lot of fear, especially since it is the month of October and the markets have had a rough few months, the market remains oversold. It’s also important to remember that bull markets have dominated bear markets. Since 1950, bear markets have lasted 12 months on average, while bull markets have lasted 67 months and have seen an average return of 265% compared to a decline of 33%.

Market recoveries are rarely straight up, as seen in the first chart, but those investors who can move past the noise and take a long-term view stand a better chance of long-term gains.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Source: Bespoke Investment, Carson, Capital Group, Horizon

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.