In the financial planning process, clients often ask us if it makes sense to open a Roth IRA or convert a traditional IRA to a Roth IRA. As a refresher: With a Roth IRA, you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½. With a traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are taxed as current income after age 59½. Roth IRAs are best suited for individuals in a lower tax bracket who expect to be in a higher tax bracket when they start taking withdrawals later in life. A traditional IRA may be best suited for those who expect to be in the same or lower tax bracket when they start taking withdrawals in retirement.

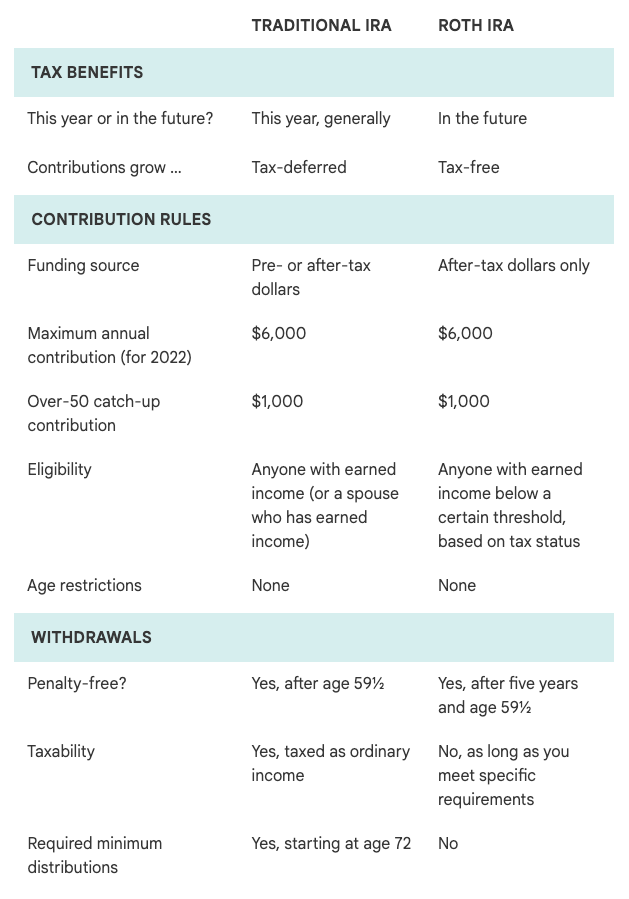

There are three main distinctions between a traditional IRA and a Roth IRA: eligibility, tax treatment and withdrawal requirements. The chart below provides a good summary on the differences.

• Eligibility – With both types of IRAs, the owner must have earned income to be eligible to contribute. For a Roth IRA, you must remain under a total income threshold to be eligible to contribute (income limits can be found here). There are no such limits with a traditional IRA; anyone at any income level can contribute.

• Tax treatments – Contributions to a Roth IRA won’t provide any immediate tax benefit because they are not deductible. Contributions to a traditional IRA may be deductible if you are not a participant in an employee-sponsored plan. Withdrawals from a Roth IRA can be tax-free if requirements are met. Withdrawals from a traditional IRA are typically fully taxable as ordinary income.

• Withdrawal requirements – Both traditional and Roth IRAs allow for withdrawals of any amount once you reach age 59½. Once the owner reaches age 72, traditional IRAs are subject to the required minimum distribution (RMD) rules, forcing money out of the IRA and triggering ordinary income. There are no RMD rules related to Roth IRAs; owners can leave the money in the Roth IRA to grow tax-free as long as they want. A Roth IRA’s beneficiaries generally will need to take RMDs to avoid penalties, although there is an exception for spouses.

For those who are not eligible to contribute to a Roth IRA, there still is a way to take advantage of the tax-free growth. The Roth conversion, also known as a “back door Roth IRA,” allows a taxpayer to withdraw funds from a traditional IRA in a taxable distribution and then roll those monies into a Roth IRA. There are no income thresholds for a Roth conversion. If your tax bracket in retirement may be higher than your current tax rate, it may make sense to convert to a Roth IRA from a traditional IRA. This could happen if you accumulate significant savings in your retirement accounts or achieve top earnings later in your career. Here are five potential reasons to convert to a Roth IRA:

1. Portfolio losses: By converting a traditional IRA to a Roth IRA, the tax will be assessed on the value on the date of the conversion. If you convert to a Roth IRA while the value is lower, the amount of tax owed will be less, and the rebound in value can grow tax free.

2. Anticipating higher tax brackets: If you expect your tax bracket to be higher in retirement, then you may prefer to pay tax on savings now, while you are in a lower tax bracket, and then access those funds tax-free in retirement.

3. Longer growth horizon: Roth IRAs have no RMD obligations, whereas traditional IRAs have RMD after the age of 72. Money in a Roth IRA can stay invested in the stock market longer, giving additional opportunities for growth.

4. Helping your heirs: If your traditional IRA is passed on to your heirs, they will also owe taxes on their withdrawals — and they must be completely withdrawn after 10 years. The Roth IRA withdrawals will be tax free, so you are effectively gifting tax savings to your heirs.

5. Paying for Medicare: If you are enrolled in Medicare Part B or D and your modified adjusted gross income (MAGI) is above a certain threshold, you pay a surcharge on top of your Medicare premium. Withdrawals from a traditional IRA are included in MAGI, while withdrawals from a Roth IRA are not.

Keep in mind the two biggest drawbacks to a Roth IRA conversion are that you must pay income taxes on any pre-tax funds you convert in the year you make it, and you cannot change your mind once you convert. It generally makes sense to use taxable assets rather than proceeds from the converted IRA to pay the tax cost of the Roth IRA conversion. This is because — all things being equal — the rate of return is generally higher for a Roth IRA because no taxes are due for any gains inside the Roth IRA.

Please remember that CD Wealth Management does not offer tax advice, but we work closely with your CPA and attorneys to ensure the right strategy is in place for you and your situation.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Fidelity, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.