For now, the S&P 500 has narrowly avoided entering a bear market, defined as a sustainable period of declining stock values, with a drop of 20% or more from recent market highs.

Trade policy is shifting rapidly, often changing daily. With recent tariff announcements, the stock market has been experiencing large levels of uncertainty.

Every period of market volatility feels different. We hear that a lot from clients: It feels different this time.

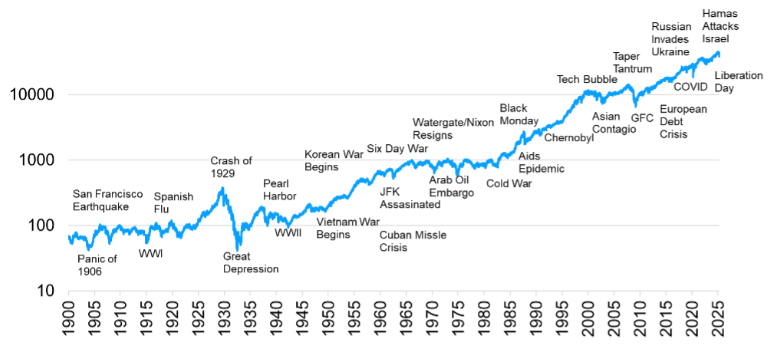

This is a very normal response to market uncertainty. As the chart below shows, though, stocks have moved higher and higher over the last 120-plus years, even with plenty of bad news. Each time, it felt different.

Stocks Tend To Go Higher Over Time — Even With Bad News

Dow Jones with major geopolitical events since 1900

What’s the Proper Course of Action?

History shows that selling in periods of extreme market volatility and bearishness has been a mistake. We don’t know what the rest of the year will bring, but smart investing can overcome the power of emotion.

Below are some solid investment principles that can help investors help fight the emotional urges in volatile and uncertain times.

1. Time in the market is what matters.

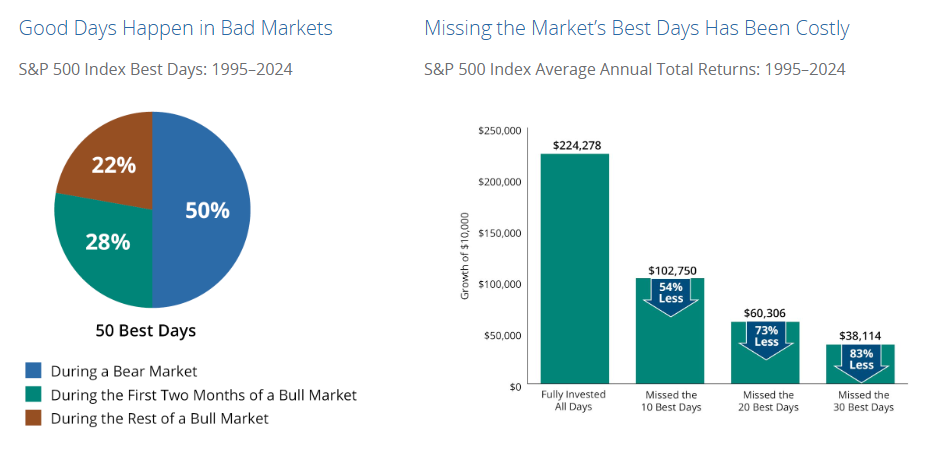

Every week, we write that timing the market is impossible and can lead to costly mistakes. Avoiding the market’s downs may mean missing out on the ups as well.

This week has been a perfect example. Stocks skyrocketed on Wednesday, with the S&P 500 rising almost 10% while the NASDAQ rose more than 12% in one day. On a percentage basis, this was the best day for the S&P since 2008 and for the NASDAQ since 2001. The vast majority (78 percent) of the stock market’s best days have occurred during a bear market or during the first two months of a bull market.

If you missed these days, your returns would be cut in half. If you missed the best 30 days, your return would be about 83% lower. These outcomes would create a very different long-term scenario.

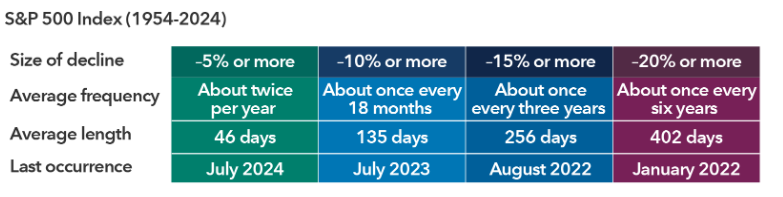

2. Market declines are part of investing.

Over long periods of time, stocks move higher — but market declines are inevitable.

Downturns Happen Frequently But Don’t Last Forever

3. Stick to the plan.

We have created thoughtful and well-constructed plans for our clients that take into account the market’s ups and downs, risk tolerance and long and short-term goals.

4. Buy more on dips.

This is known as dollar-cost averaging — systematically investing at regular intervals, regardless of the price. If you have excess cash, now is the time to maintain your strategy, not to change it. (This does not ensure a profit, nor protect against a loss.)

5. Diversification matters.

Spreading investments across a variety of asset classes can help buffer the effects of volatility in the portfolio. This includes equities and fixed income. Bonds can help soften the impact of market losses on the overall portfolio.

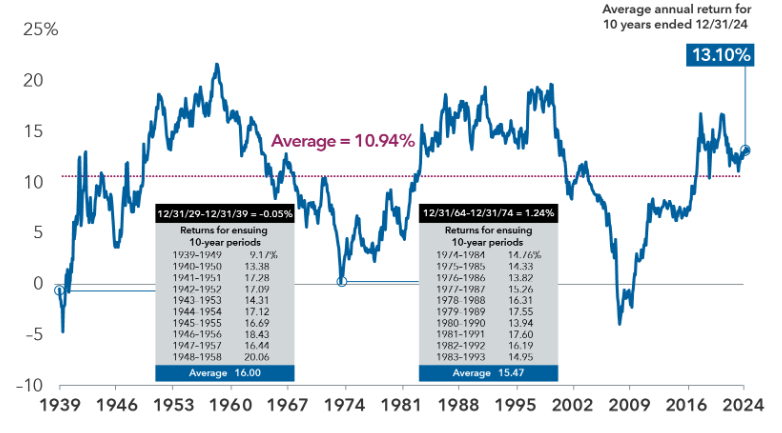

6. The market rewards long-term investors.

It is always important to maintain a long-term perspective, especially when markets are volatile and declining. Including market downturns, the S&P average annual return over all 10-year periods from 1939 to 2024 was 10.94%.

S&P 500 Rolling 10-Year Average Annual Total Returns

It’s natural for emotions to arise during periods of volatility. Those who can tune out the noise and focus on long-term goals are better positioned for a better financial future.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: KIM, Carson, Hartford, Fidelity