The term “meme stocks” seems to be making a daily appearance in the news: stories of young investors trading on companies that are on the verge of bankruptcy and promoting large gains and losses. BANG stocks, a spoof on the fabled FANG stocks (Facebook, Apple, Netflix and Google), are now Blackberry, AMC Entertainment, Nokia and GameStop. These stocks continue to see excessive trading volume from retail investors who have targeted them on social media.

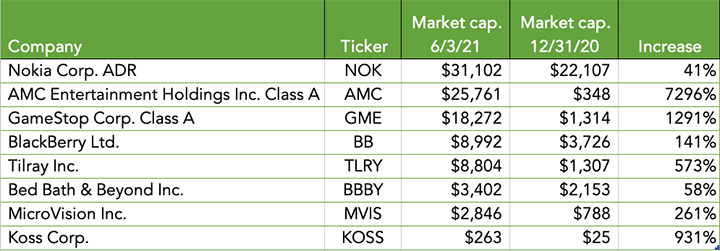

Dogecoin, which started as a cryptocurrency parody, is another example of a meme stock and has seen its value skyrocket on Elon Musk’s tweets. The chart below highlights meme stocks and their growth in market capitalization based on the rise in stock prices year-to-date. AMC has seen its company market capitalization rise an astounding 7,296% in the first five months of the year.

For most investors, the phenomenon of meme stocks has no real impact. If GameStop or AMC were to come crashing back to Earth, it is more than likely that this would have very little impact on the overall market. These stocks were first targeted on a Reddit forum titled “Wall Street Bets,” which looks at the most heavily shorted stocks on Wall Street. The reason institutional investors short a stock is that they believe the stock price is too high and the company is fundamentally flawed and overvalued. Short selling occurs when an investor borrows shares and then immediately sells them, hoping to buy them back later at a lower price. When investors buy the stock back, or “cover the short,” they return the shares to the lender and hope they can profit if the shares have gone down in price.

A short squeeze is when a short seller — someone betting against a stock — is squeezed out of their position by excessive price action to the upside. A group of investors on social media is targeting a company, like AMC, that currently has tremendous, short interest. (This means that many investors are “shorting” the stock in the hopes that the stock price drops.) All the while, retail investors are buying the stock and purchasing call options, pushing the stock price higher and in turn, forcing the investors who are trying to short the stock to sell. This action forces the stock price even higher.

Meme stocks remain a very risky trade, as this group of stocks are not investments — they are gambles. These companies are not trading on underlying financial results and prospects. Regulators, like the Securities and Exchange Commission, are beginning to take a closer look at social media activity and its impact on the financial markets. If rules are implemented on investment content or group coordination, meme stocks could face stiff regulation limiting potential upside and possibly causing these same stocks to crater. Meme stocks carry much higher risk because of their reliance on social media, and while there may be instances of traders making money, you are more than likely to lose.

So, what can we learn from all this? Trading in meme stocks brings a high amount of risk, and those who want to buy the BANG stocks should be prepared to lose their investments. Remember the first rule of gambling: Never gamble what you can’t afford to lose.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. We believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Marketwatch, Yahoo Finance

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures