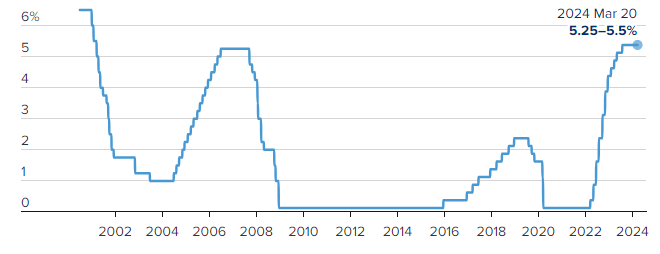

The Federal Reserve held interest rates steady last week and — more importantly to the stock market — is sticking with its forecast of three interest rate cuts this year. This was the fifth meeting in a row that the Fed left rates unchanged, following 11 consecutive meetings with rate increases.

The forecasted rate cuts would be the first reductions since the early days of the pandemic in March 2020. The Fed also raised its projections for GDP growth this year and now sees the economy running at a 2.1% annualized rate. All three major U.S. stock indexes finished at their highest closing levels ever for the first time in more than two years. The last time all three indexes closed at record highs on the same day was Nov. 8, 2021.

Federal Funds Target Rate, July 2000-March 2024

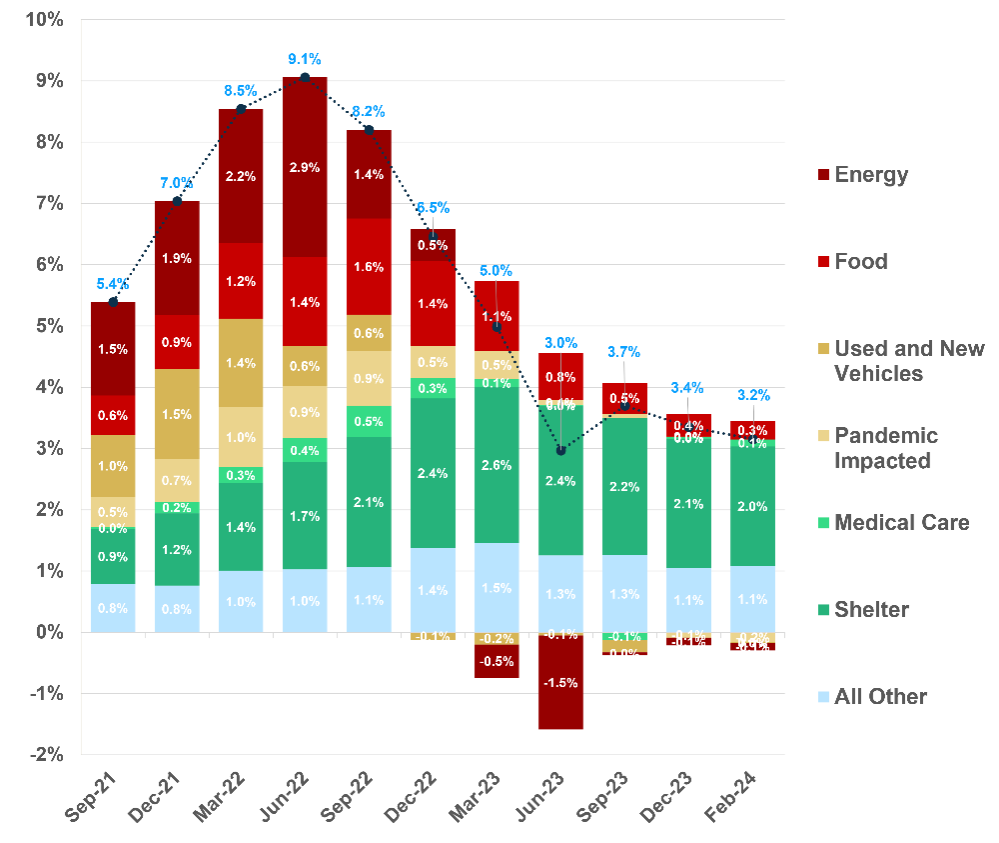

The most recent consumer price index (CPI) data for February came in hotter than expected for the second straight month. Inflation has eased significantly since it hit 9% in 2022. It has stalled at just over 3% in recent months, still well above the Fed’s 2% target rate.

Shelter remains the largest driver of inflation. While energy prices have gone up the last few months (as you’ve seen at the pump), it is nothing compared to what we saw in 2022. Food prices have shrunk significantly, which is a good sign for potential lower inflation going forward.

Overall, inflation’s downtrend from late last year is still intact.

CPI Inflation Has Eased, but Stays High on the Back of Shelter

With stocks trading at all-time highs, now is a good time to review your estate plan. The federal lifetime estate and gift tax exemptions are set to be cut in half unless Congress acts before Jan. 1, 2026. A decrease in the exemption amount could result in significant transfer taxes for families with taxable estates.

In 2017, the Tax Cuts and Job Act increased the exemption. In 2024, the exemption amount increased from $12.92 million to $13.61 million per person (combined $27.22 million for a married couple). Should the provision sunset at the end of 2025, exemptions will revert to 2017 levels, adjusted for inflation, which would be about half of what they are today (roughly $14 million for a married couple).

It is uncertain if Congress will act before 2026. Until this happens, it may be wise to explore options to use the current exemption amount.

The IRS has confirmed that using the larger exemptions amount cannot be “clawed back” after the potential sunset. For example, if a person uses more exemption during their lifetime than is available at death due to a change in the exemption amount, the IRS cannot impose an estate tax on those excess gifts as a part of the taxpayer’s estate when they pass.

Here are a couple of ideas to discuss to plan for a potential change:

Dynasty Trust

A dynasty trust, or perpetual trust, is designed to pass on wealth from one generation to the next without incurring transfer taxes.

Dynasty trusts are irrevocable, and their terms cannot be changed once funded. They allow for potential tax-free transfer of assets to beneficiaries. The trust will define the way each beneficiary receives distributions and what should happen at their passing.

Assets can be held in trust for multiple generations, depending on the state where the trust is established.

Spousal Lifetime Access Trust

A spousal lifetime access trust (SLAT) allows access to assets while keeping them out of your taxable estate. Married taxpayers can consider naming their spouse as the lifetime beneficiary of their trust.

With this type of trust, the taxpayer would gift assets to a trust established for the benefit of their spouse and descendants. The spouse can receive trust income and defined portions of the principal, giving the taxpayer access to trust assets for duration of the marriage.

It is important to note that both trusts are irrevocable, and the taxpayer must be willing to give up control of the assets to obtain the gift of the estate tax benefit of the gift or bequest.

With portfolio values at or near all-time highs, it may make sense to act sooner rather than later. If you have any questions about the best way to potentially navigate changes to the current transfer tax exemption amounts, please do not hesitate to contact our team.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: CNBC, Carson, Kestra

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.