We are less than 100 days from Election Day. Whenever a presidential election rolls around, it is common to hear it described as “unprecedented.” Presidential elections always add an extra element of uncertainty to investing. On top of assessing the path of the Federal Reserve, the stability of profits and the consumer, investors must grapple with a barrage of headlines about the election.

Uncertainty can create opportunity. Investors often make their worst mistakes during uncertain times, and it can sometimes take years for their portfolios to recover.

As seen in the chart below, many geopolitical events have impacted portfolios in the short term over the last 120 years. Over the long run, however, the market has trended higher.

Investors sometimes get tunnel vision when it comes to the stock market and may only see what is right in front of them: an election, war or a pandemic, for example. When you stretch out your time horizon, the odds move in your favor; roughly 75% of single years have positive returns, nearly 90% of five-year periods are positive, and 100% of 20-year periods are positive!

Even With Bad News, Stocks Tend To Go Higher

Political opinions are best expressed at the polls — not through the portfolio. It is crucial to keep your political feelings from overruling your investing strategy. Investors who allow political opinions to harm their investing discipline may have missed out on above-average returns during political administrations they may not like.

With the intensity of feelings on both sides, it is natural for investors to assume that the news of the day — the election’s eventual outcome — could have major impacts on sentiment and prices in the financial markets.

The stock market is not partisan. Although popular myths suggest that one party or the other is better for market returns, historical data shows otherwise.

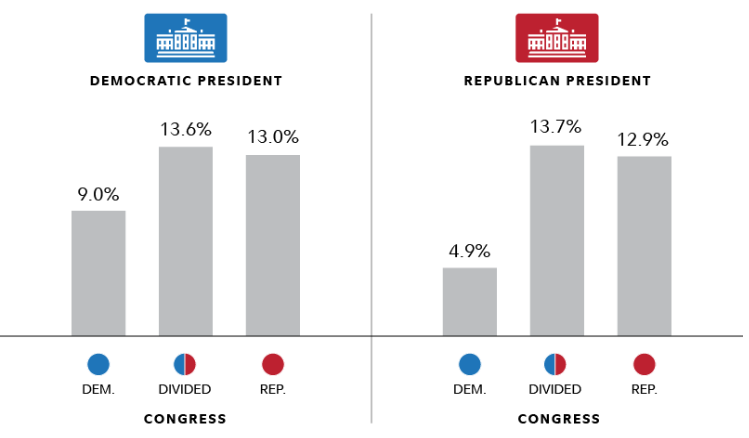

The S&P 500 has averaged positive returns under every partisan combination, as the chart below shows. There also is evidence that a divided government has correlated with stronger market returns — probably because gridlock creates less policy uncertainty, and markets do not like uncertainty.

If you had invested $1,000 in the S&P 500 starting in 1953 and only invested under Republican presidents, you would have just under $30,000 today. If you did the same thing but for only Democrat presidents, you would have just over $60,000. However, if you stayed invested no matter which party was in office, your $1,000 investment would be worth close to $1.7 million today.

No matter which side you sit on, this election cycle is likely to bring more surprising headlines and plenty of emotional ups and downs. It can be tempting to put your money where your convictions are — whether you are optimistic or pessimistic about the November election — but history shows that doing so is not the best economic move for your long-term financial health.

Average Annual S&P 500 Performance

(1933-2022, excluding 2001-2002)

Despite heightened political uncertainty, the economic backdrop remains positive. Market moves are more likely to be driven by market and economic fundamentals like corporate earnings, interest rates and other economic factors. GDP remains strong, the Fed is likely to reduce interest rates, and corporate earnings are expected to grow at double digits in 2024.

Over the past 40 years, there has been only one instance when market returns were negative 12 months after an election — the tech bubble in 2000. This is not to downplay the importance of an election, but instead to remind us that the economy does not change course based on an election result.

Through good times and bad, economic progress and the ingenuity of American companies have led to innovation, increased productivity and earnings growth — ultimately driving markets higher. Once political uncertainty is out of the way, markets tend to return to focusing on fundamentals, and right now, the fundamentals look pretty good.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, JP Morgan, Strategas Research

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.