We are now a few days from the election, and we are receiving calls and emails from clients who are wondering if they should make changes to their portfolios before the results come in. History suggests election results should not be the primary driver of investment decisions; this is especially true this year, with the pandemic and the fiscal and monetary response from the Federal Reserve driving the markets. While the election certainly will have an impact on the country, we caution against taking drastic action in the world of investing.

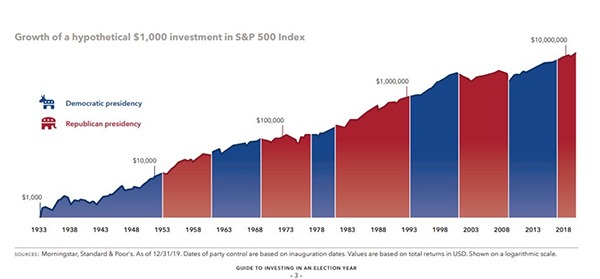

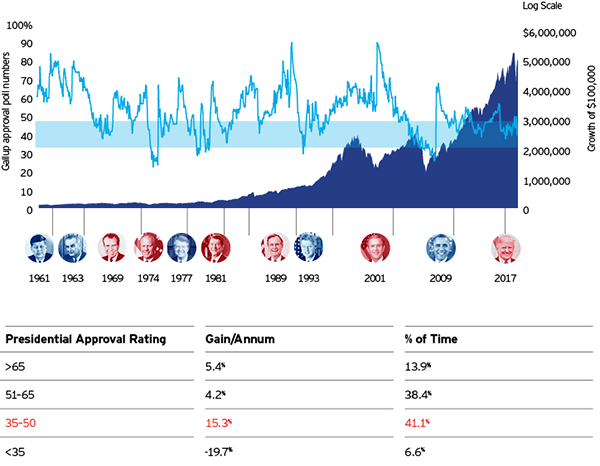

Market commentators — and presidents themselves — have cited the stock market’s performance as a measuring stick of White House policies, but the data doesn’t support this, as seen in the chart below.

Instead, the key drivers of stock market performance are the fundamentals of earnings, interest rates, job growth and productivity. Policy changes do have ramifications for financial plans, tax strategy and estate planning, but not when it comes to day-in, day-out asset allocation.

We want you to keep these thoughts in mind as we enter the home stretch of the election:

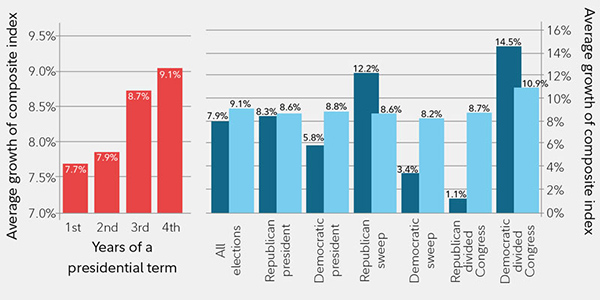

1. Markets have performed well under both parties. As the light blue bars show in the chart below, the markets have yielded positive returns, no matter which party controls the White House or Congress, over a four-year presidential cycle.

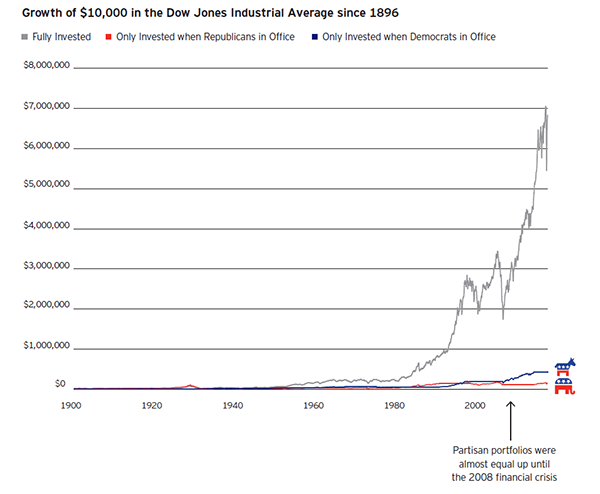

2. Investors are better off staying fully invested. The best-performing portfolio over the past 120 years was one that stayed fully invested through both Democratic and Republican administrations.

3. Monetary policy matters more than who occupies the White House. Historically, presidents have been hurt or helped by monetary policy conditions. Both President Reagan and President Clinton benefited from consistently falling interest rates. Both President George H.W. Bush and President George W. Bush were hurt by Fed tightening, an inverted yield curve and a recession. President Obama benefited from a benign rate environment during his term (minus a brief moment in 2015–2016), and President Trump experienced tighter policy during his first two years, but the last two years have seen rates return to zero. The adage “Don’t fight the Fed” rings true.

4. Don’t confuse politics with market analysis. Some of the best returns in the market came when the presidential approval rating was in the low range of between 36% and 50%.

What does this mean for you?

Investors have prospered in markets during difficult political times. The average return of the S&P 500 since the end of World War II is almost 11%. Staying the course has always made the most sense for investors. Follow your financial plan and ignore the noise.

Remember that market downturns offer the chance to buy stocks at lower prices, which could position a portfolio well for future growth. Again, there are no guarantees that stocks will perform to anyone’s expectations, and decisions could result in losses including a possible loss in principal. However, it may be helpful to remember that some investors use downturns as opportunities to buy stocks that were previously overvalued relative to their perceived earnings potential.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.

Click here for additional investor disclosures.