On the heels of a record decrease in gross domestic product (GDP) for the second quarter, the U.S. economy rebounded swiftly with a record increase in the third quarter. GDP — the amount spent by U.S. consumers during a given period — climbed 33.1% from July through September after taking a 31.4% tumble from April through June.

While pent-up demand for consumer goods and better manufacturing activity drove that growth, the U.S. economy remains about 4% lower than last year’s levels, and service sectors such as hospitality, restaurants and airlines remain under pressure.

As the economy rebounded in the third quarter, so too did profits. So far, almost 72% of the companies in the S&P 500 have reported earnings for the third quarter. Of those, 87% exceeded earnings estimates, and 77% beat revenue estimates, well above long-term averages.

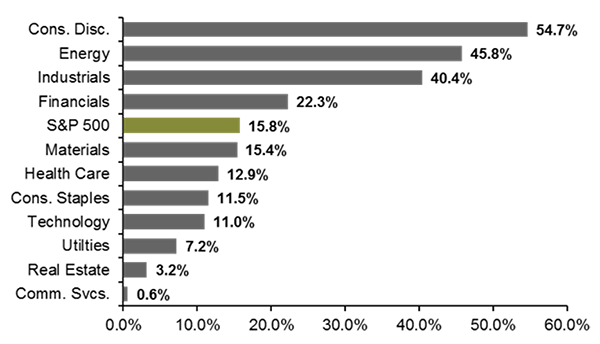

It is possible that analysts set the bar too low for the third quarter, though, as sectors such as energy and financials are seeing positive earnings surprises despite being lower than a year ago. The chart below shows that each sector in the S&P 500 had better than expected earnings for the third quarter.

Although the economy is recovering from the shutdown in March and April, the road to recovery continues to be challenging. Consumer staples, technology and health care are expected to see positive earnings growth on a year-over-year basis. Other sectors, like financials and energy, are expected to decline year over year. However, as the chart above illustrates, banks and energy companies have reported stronger revenues and earnings than anticipated.

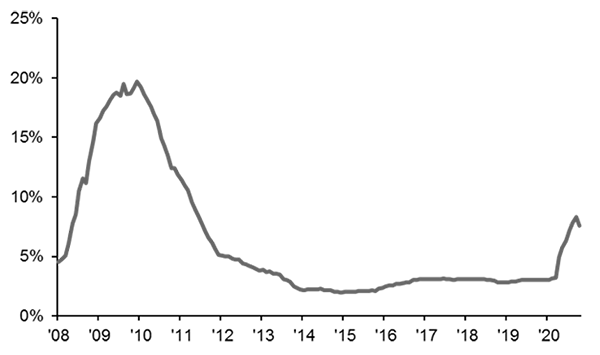

Bank profits have been better than expected with strong trading revenues from asset management as well as lower-than-expected loan-loss provisions. As the chart below shows, current losses stand at 8.3% of sales for banks, compared to 19.7% of sales in aftermath of the Global Financial Crisis. Even with rates at or near zero, the financial companies are able to limit their loan losses and therefore, deliver positive earnings to the bottom line.

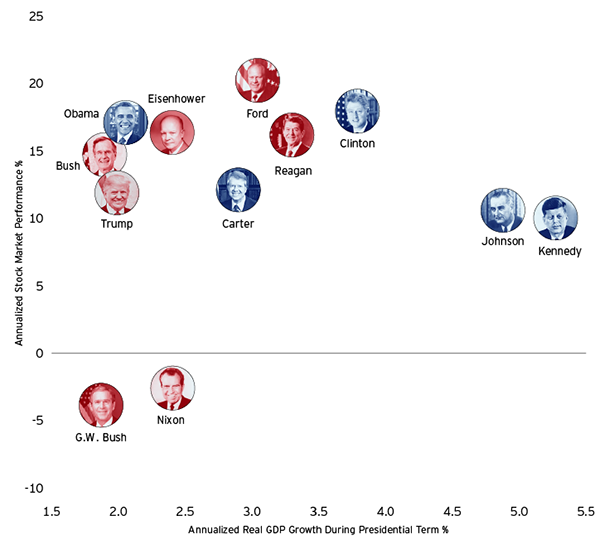

With 2020 earnings generally better than expected and earnings season more than two-thirds complete, where do we go from here? Although the current environment feels more uncertain than normal with the election as well as the COVID-19 pandemic, the best approach to investing in the markets remains one of balance and maintaining asset allocation that meets your individual risk tolerance. As we have written several times over the last few months, the markets do not care about election results; they favor certainty and profits. Historically, markets have performed very similarly regardless of which party controls the White House.

What does this mean for you?

Having a mix of growth and value stocks, large stocks and small stocks, U.S. stocks and international stocks and bonds while staying the course has always made the most sense for investors.

Remember that market downturns offer the chance to buy stocks at lower prices, which could position a portfolio well for future growth. If we experience volatility due to election turmoil, we will follow your financial plan and ignore the noise. There are no guarantees that stocks will perform to anyone’s expectations, and decisions could result in losses including a possible loss in principal. However, it may be helpful to remember that some investors use downturns as opportunities to buy stocks that were previously overvalued relative to their perceived earnings potential.

Data Sources: FactSet, JP Morgan Asset Management, Invesco

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.

Click here for additional investor disclosures.