As we near the end of the year, you may have recently received a letter outlining the required minimum distribution (RMD) that you must take from your retirement accounts if you are of a certain age. Once you reach age 73, you are required to withdraw a certain amount of money from your retirement accounts, such as 401(k), 403(b), 457(b), Traditional IRAs, SEP IRAs and Simple IRAs.

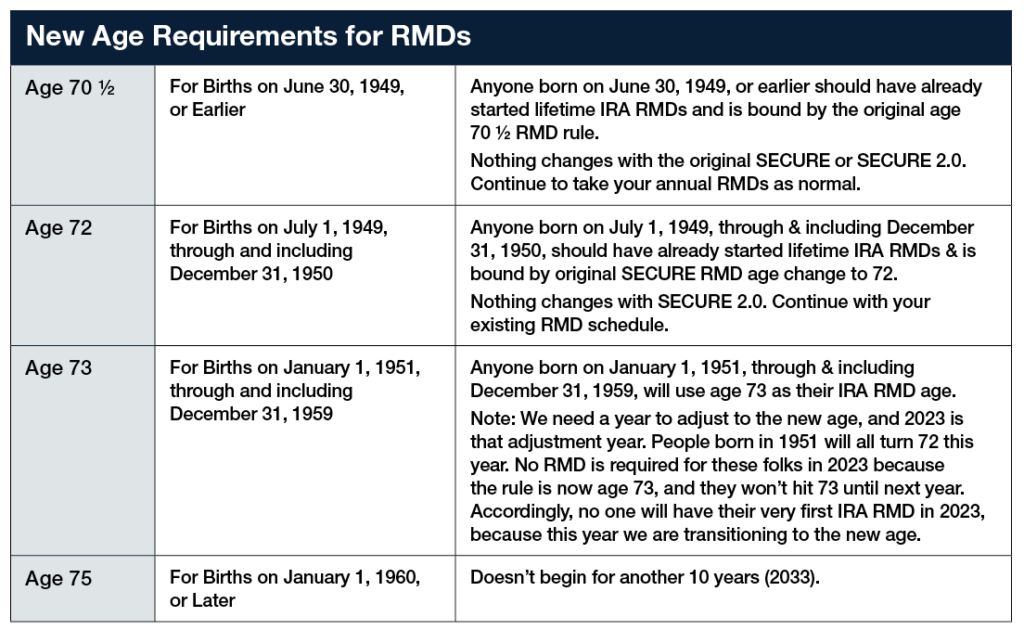

The age at which an RMD is required can be confusing; the rules have gone through several recent changes. An easier way to think of this is that anyone born in 1950 or earlier will have an RMD this year. Anyone born in 1951 or later will not. (The chart below outlines the new age requirements.) As part of the SECURE ACT 2.0, which was enacted at the end of last year, those born after 1960 will be able to delay their RMD until age 75.

What is an RMD?

A required minimum distribution is a yearly mandatory withdrawal from tax-deferred retirement accounts that starts when an account owner reaches the age outlined above. The deadline for taking the RMD is Dec. 31 each year. However, if you are taking your first RMD, you have the option to delay until April 1 in the year following the year you reach age 73.

Why do RMDs exist?

If you have been saving part of your income in a tax-deferred account, you have not paid income tax on those dollars. The government lets you delay paying taxes until you reach a certain age, but it requires you take a distribution (taxed as ordinary income) once you reach that age.

For investors, the benefit of tax deferral is that while we know we will pay income tax eventually on those dollars, we can hopefully pay less tax in retirement than we would during our working years. However, it is not unusual for people to find themselves in the same tax bracket – or even a higher one in retirement.

Income from investments outside retirement accounts, combined with Social Security and RMDs, can add up — and the difference in tax brackets may not be as big as once projected when comparing retirement and non-retirement income.

How much am I required to withdraw?

Your RMD will vary each year; it is based on the account value on Dec. 31 of the previous year. The IRS calculates RMDs by taking the sum of your tax-deferred retirement accounts and dividing it by a number based on life expectancy. The life expectancy factor increases every year, so as you grow older you are required to take out more money. The cost of miscalculating or failing to withdraw the RMD can result in an IRS penalty equal to 25% of the amount not taken on time.

If I have multiple retirement accounts, can I withdraw my total RMD from one of my accounts?

If you have multiple retirement accounts, it is possible to take your RMD from one account, but it also depends on the type of accounts. For example, if you have multiple IRAs (traditional, rollover, SEP and Simple), you must calculate the total amount of RMD for each account separately, but you can withdraw the total RMD from one or any combination of the accounts. For 403(b) and 401(k) accounts, you much calculate the RMD separately for each account, and take the RMD from each account separately. Amounts withdrawn beyond the RMD amount do not reduce RMD in future years.

How are RMDs taxed — and how can I minimize the tax impact?

The RMD amount is taxed as ordinary income — and as a result, it may be subject to both federal and state taxes. If you are 70½ or older, you can contribute up to $100,000 per year in a qualified charitable donation (QCD). For married couples, each spouse can make a QCD up to $100,000. QCDs can be made only to certain charitable organizations — not to donor advised funds.

Depending on your tax bracket, it may make sense to take money out of your retirement account before age 73. Once you reach age 59½, you can take money out of retirement accounts without a 10% penalty for early withdrawal, but you still will owe taxes on the money taken out.

It is important to spend time with your financial team so you understand your options to maximize your income and avoid a costly tax mistake.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Slott Report; IRA RMD Age Made Easy

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.