The drumbeat of negative news and noise remains constant. For some investors, it may be hard to remain optimistic with all the headlines about high inflation, higher interest rates, political discourse and a potential government shutdown — not to mention the upcoming election.

These feelings are valid — but they are only feelings. Feelings are not necessarily based on data and do not necessarily reflect how the stock market views the world. Feelings can be influenced by which political party you favor, but the market doesn’t care which party you like. It cares only about where the market is headed.

Here Comes the Worst Month of the Year

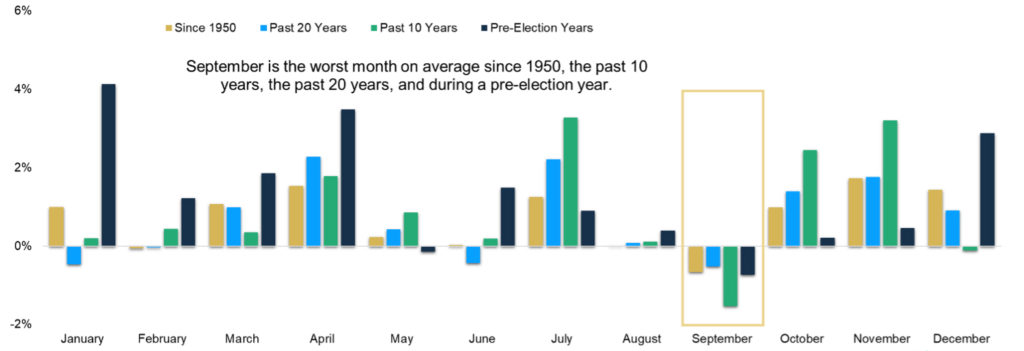

S&P 500 Index Average Monthly Returns (1950-2022)

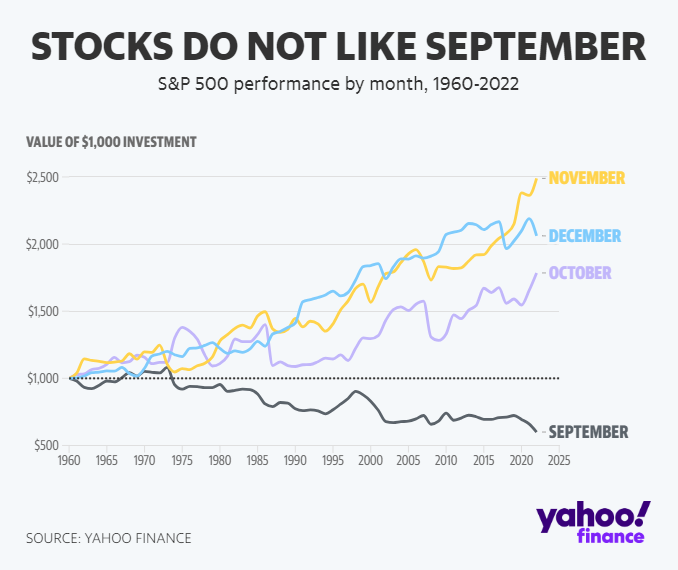

Historically, September has been the worst month for stocks and is one of two months that have been negative in a pre-election year cycle. Going back to 1945, the S&P 500 declined more than half of the time, with an average return of -0.73%. Going back to 1960, however, the last three months of the year have seen positive returns following a negative September. So while the immediate forecast for September may seem ominous, it is important to see the entire forest and not just the one tree in front of you.

If September is historically the stock market’s worst month, why would this September be any different? There are always silver linings to be found in the market if you look for them.

• Artificial intelligence: AI has fueled much of the rally for the year. Even outside of the technology sector, companies have jumped on the bandwagon and are embracing how AI can transform their businesses.

• Cash, cash, cash: Investors are holding more than $5.5 trillion of cash that is waiting to be invested into the market. Excess cash could help the market drive further gains.

• Apple: Wall Street is expecting the company to debut the next iPhone as well as new watches next week. Apple is the largest component of the S&P 500 at 7.35% of the overall index, and as Apple tends to move, the market follows.

• ARM IPO: British chip design firm ARM Holdings is set to go public next week in the largest technology IPO for the year, with an estimated value at $52 billion. Investors are hoping that this breathes new life into the IPO market that has seen very little action since 2002. Mega cap tech companies are publicly talking about wanting to own stock in ARM.

• Credit spreads: A credit spread tells us how much extra interest over Treasury bonds investors are demanding from corporations that want to borrow money. If investors are worried about a recession, they may expect lending to companies to be riskier and, therefore, demand higher interest rates to compensate for the additional risk. As of today, spreads remain tight, and as seen in the chart below, they are not showing signs of stress compared to the recessionary periods in gray.

Credit Markets Show No Stress

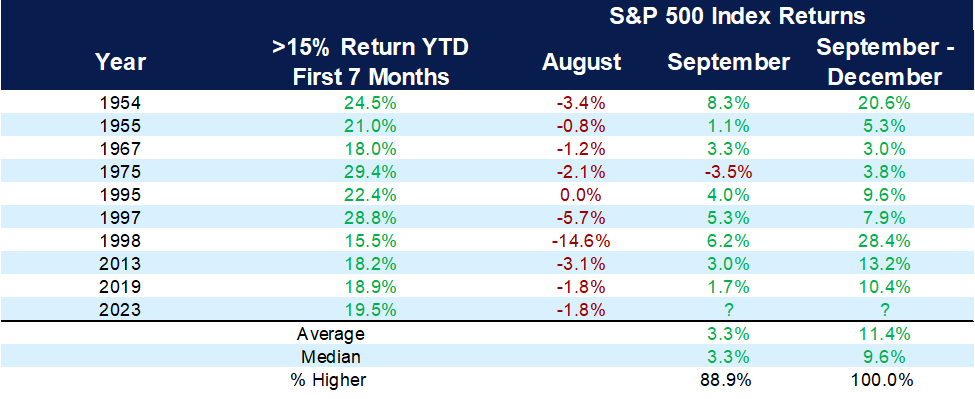

The last nine times that the market has been up more than 15% for the first seven months of the year and then had a negative August, the market averaged an 11.4% return over the final four months of the year. Will 2023 experience similar returns? Only time will tell, but as seen in the numbers below, the results have been positive 100% of the time.

Clues September Could Surprise Higher

S&P 500 Performance After a Big First 7 Months and Negative August

The month of September remains a mystery. With the Federal Reserve meeting later this month, the possibility of higher rates remains — along with a potential government shutdown on Oct. 1. There are always silver linings to find in the market, as we outlined above, and we are looking forward to the remaining four months of the year. One thing that we can count on is that the markets are never dull. The markets remain forward-looking and focused on earnings over the long run — not on a day-to-day basis.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, CNBC, Yahoo

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.