Are we in a recession — or will we be in a recession soon? Will it be a hard or soft landing? Will the debt ceiling push us into a recession? How bad will it be on the stock market?

These questions weigh on the minds of investors, business owners and decision makers — and the noise seems to grow louder each day. The Federal Reserve has been raising rates aggressively to combat inflation with the hopes of slowing the economy and wage growth. Essentially, the Fed is hoping for an economic slowdown and more layoffs.

Doesn’t that sound like a recession?

Taking a step back, it’s important to understand that an economy is not the same thing as the stock market. The fate of one does not offer a direct read-through to the other.

Economic data is backward-looking by nature, while the stock market is anticipating where companies are headed and what their future valuation should be. Historically, the stock market has anticipated (and therefore priced in) improving economic conditions before they arrive. This makes market timing difficult and reinforces the importance of weathering the downturn.

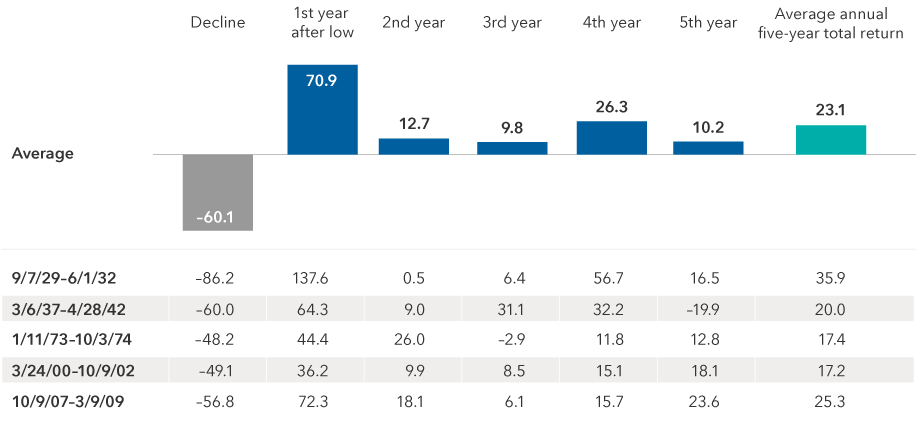

We fully recognize that downturns are not pleasant, but the markets historically have come out the other side much stronger. In the past, the stock market has tended to anticipate recoveries, rebounding ahead of any turn in the economy.

Returns Following the 5 Largest Market Declines Since 1929

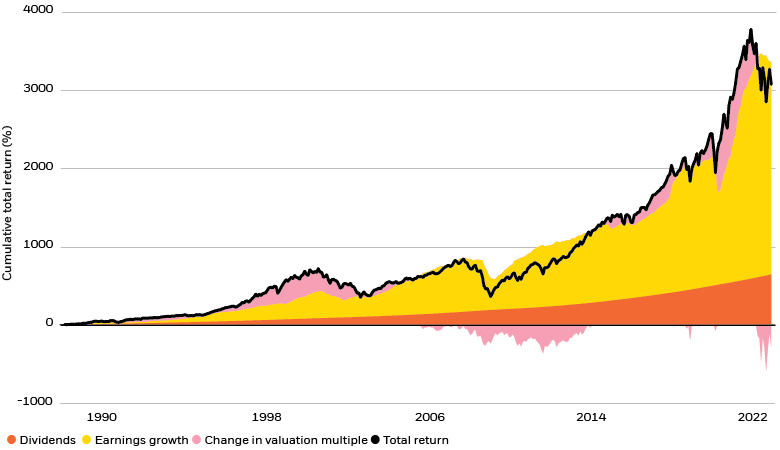

Companies’ underlying fundamentals – revenue, profitability, cash flow, assets and liabilities — are the key determinants of stock returns across time. In other words, earnings are the key contributor to total return. For companies that reinvest earnings into revenue growth, better margins help investors weather the storm of a potential recession and come out stronger. Even as uncertainty clouds the big picture, companies that can maintain earnings growth throughout market cycles will remain prized, and their stock prices rewarded.

Fundamentals Dictate Long-Term Returns

S&P 500 Index sources of total return, 1988-2022

So, if we have a recession, what happens next? The U.S. still has a solid labor market. Household balance sheets remain strong. Inflation is moderating, and the Fed is near the end of the rate-hike cycle. This means strong wages and consumer confidence could boost consumer spending, providing additional help to a range of industries.

Economists already predict that the Federal Reserve will have to begin lowering the Fed Funds rate later this year or next to stimulate the economy. A housing recovery could ensue, as mortgage rates could then begin to drop. Lower mortgage rates could provide a tailwind to construction spending and spending for other durable goods, like household appliances.

This may be the most widely anticipated recession in decades. Many investors remain focused on the timing and severity of the next recession. What if the recession is already priced into the market? Investors may be better served to prepare for what happens after a potential recession — and how we can benefit from the recovery instead of listening to the drumbeat of headlines about when a recession could happen.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Blackrock, S&P

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.