U.S. stock markets rallied to record highs last week, and bond yields rose after the Democrats won two Senate runoff elections in Georgia, providing a narrow majority in Congress. Even in the face of what we witnessed in Washington last week, the equity markets pushed higher.

As we have written in previous articles, the stock market looks forward, not backward. The market’s climb is based in part on the expectation of additional fiscal stimulus being passed in the first quarter of 2021 to help those most hurt by the pandemic, spending on green initiatives and limited tax increases.

The vaccine rollout has been slower than hoped, and a new, more infectious coronavirus strain is spreading. The pace of the rollout will be a major factor in how quickly the economy can return to pre-pandemic levels. Once the vaccine becomes more widespread, we believe we will see a restart to the economy — and the pent-up demand for goods and services and for travel will bring a return to normalcy.

The prospects of more fiscal spending under a Democrat-led government could further fuel stocks. Many fear that this could push inflation higher over time. We do expect additional spending to drive deficits higher; as we wrote recently, with interest rates close to zero, additional debt can be more easily digested by the economy than when interest rates are higher. The Federal Reserve’s resolve to keep rates low will help fight inflation and make additional debt payments more modest. Corporate and personal tax increases are possible, but large-scale changes appear unlikely in our view.

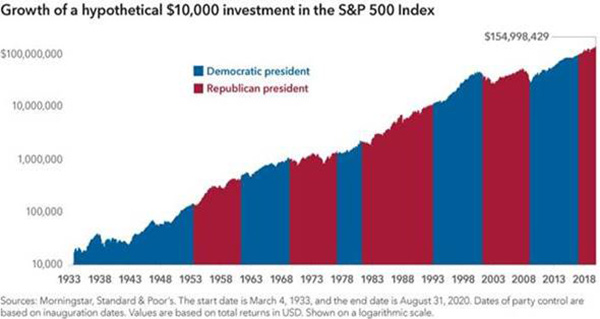

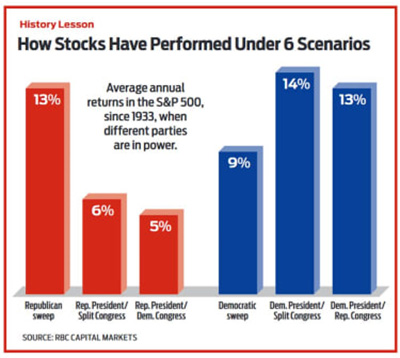

Regardless of who is president or which party controls Congress, the best course of action is to stay invested. The charts below confirm this strategy in different ways. The first chart shows how a hypothetical investment has increased since 1933, through a series of presidents from both parties. The second chart below shows the average annual returns under six different sets of election results, each reflecting positive returns.

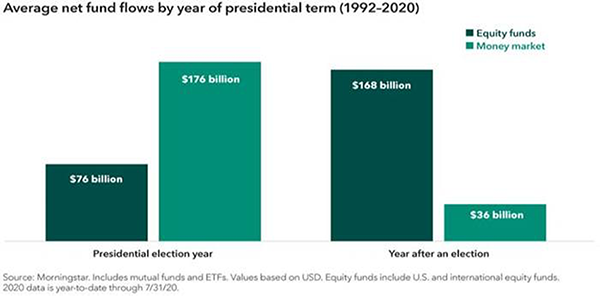

The final chart below shows the average net flows into equities during each presidential election year and each following year. The amount of money on average flowing into equities after an election is significantly greater than the prior year, another positive for equities.

So, what can we learn from all this? No matter what the election outcome was, whether you agree with the political views of the president or the majority of Congress, it is important to stay invested for the long term. We will experience volatility, and the first half of 2021 may be a choppy ride. If you do not stay invested, you will miss the ride — and the long-term growth.

From an investment perspective, we use the above insights to help with strategic and tactical asset allocation based on where we see the portfolio heading over the next five to seven years, with short-term adjustments along the way. We are not trying to time the market, but we will try to take advantage when we see where the market is heading. Having a well-balanced, diversified portfolio and a financial plan are keys to successful investing. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Sources: Morningstar, RBC Capital

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The Dow Jones Industrial Average is a popular indicator of the stock market based on the average closing prices of 30 active U.S. stocks representative of the overall economy. S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It is not possible to invest directly in an index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.