Tariffs, tariffs, and more tariffs: A new round of tariffs targeting Canada, Mexico and China has whipsawed the stock market in recent days and weeks. The market does not like uncertainty, and that is exactly what we have right now – daily uncertainty regarding the number of tariffs, as well as what countries and which products will have them.

So, what are tariffs?

Tariffs are taxes on imported goods, intended to get a nation’s consumers to buy local products to boost their country’s economy. A company that imports goods pays the tariff — which can be fixed or variable — to the government. The company then has the choice to pass the cost of the tariff to the end consumer or to eat the cost of the tariff and reduce its corporate profits.

The purpose of tariffs is typically to retaliate against other countries for perceived unfair trade practices. At the end of the day, tariffs can increase the cost of production and the cost to the consumer. They also can harm trade and affect a country’s competitiveness in the marketplace.

Last week alone, 25% tariffs on Mexico and Canada went into effect after a monthlong delay. Then, a day later, a month pause was granted for automakers that comply with the United States-Mexico-Canada Agreement (USMCA), a modernized version of NAFTA. Then on Thursday, the pause was extended to include goods that are compliant with the USMCA.

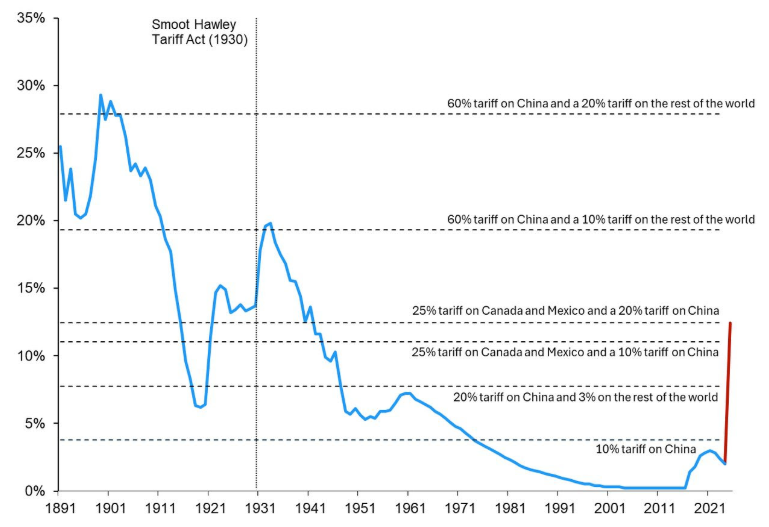

Also, an additional 10% tariff on Chinese imports took effect — on top of the 10% increase that went into effect last month. These tariffs are twice as large as those imposed during President Trump’s first term. The new tariffs will raise the average effective tariff rate that the U.S. imposes on imports from about 2% to 10%, which is something we haven’t seen since the 1930s and 1940s.

Average U.S. Tariff Rates

It’s a challenge to assess the potential damage to economic activity, given the rapidly changing news events from the administration and the differing messages coming from the Secretary of Treasury, Elon Musk, or the president.

The sharp rise in policy uncertainty, combined with recent softening in business and consumer confidence, has led investors and the markets to worry about the dreaded R-word: recession. On-again, off-again tariffs, the reprieve for the auto industry and the likelihood that these tariffs are a negotiating tool to help achieve other policy goals, are causing the markets to take a risk-off approach, as we see money move out of the technology stocks that have worked so well the last two years.

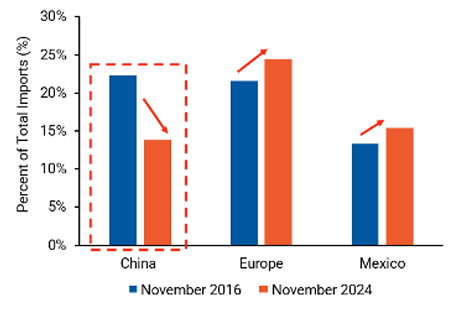

In Trump’s previous administration, we saw that tariffs did have an impact; consumers and business shifted their buying to countries that were not impacted by tariffs. Countries that were targeted by tariffs saw their prices rise more than other goods.

During the first term, the tariffs were more targeted and impacted just a small portion of the country’s imports. This time around, the tariffs that have been announced have a much larger potential impact because they are targeting a wider range of goods.

Trump Tariffs 1.0: Trade Patterns Shifted

Tariffs can be an attractive tool for a president because they can be implemented without Congressional approval. They are easy to put on and to take off. If it becomes clear that tariffs are negatively impacting economic growth, they can be undone easily.

They will continue to be a dominant story for the stock market for the foreseeable future. U.S. trading partners may make trade policy moves of their own, and corporate executives will talk about the potential impact on their companies’ earnings.

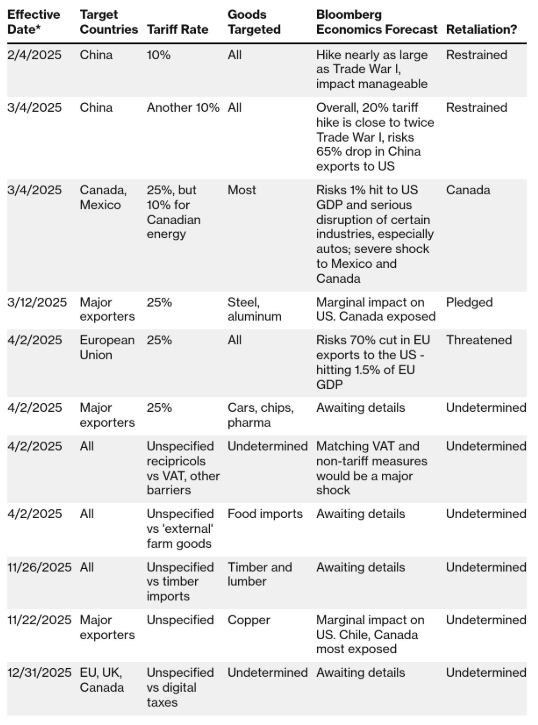

Trump Tariffs So Far

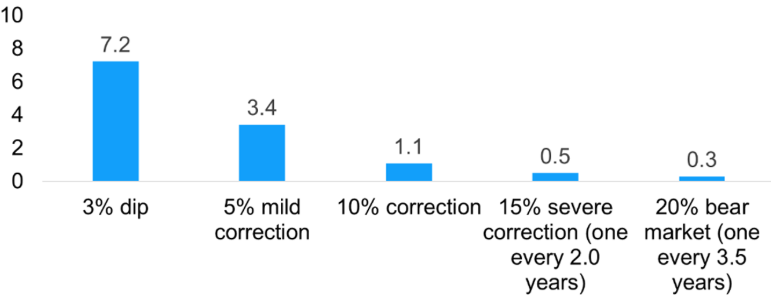

We cannot predict where we go from here. We believe that the bull market is still ongoing — and that it has a ways to go. That doesn’t mean we won’t see significant volatility, like we are seeing now. The S&P 500 is almost in a correction mode (down almost 10% from recent highs), while the NASDAQ is firmly in correction mode.

It is important to remember that even the best years on record have had scary moments. In each of the the last two years, stocks gained more than 20% in the S&P 500, but it wasn’t always easy.

Remember the banking crisis in March 2023? Stocks dropped almost 10%, and then later that year, they dropped another 10%. Last year, we saw two mild corrections, with stocks dropping almost 9% in August. We have referred to this chart before, but now it is a great reminder that stocks drop at least 10% on average almost every year — and so far, 2025 is no different.

Volatility Is the Toll We Pay to Invest

S&P 500 various declines per year (1928-2024)

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, Carson, CNBC, JP Morgan, Kestra Investment Management